THELOGICALINDIAN - Bitcoin Price Key Highlights

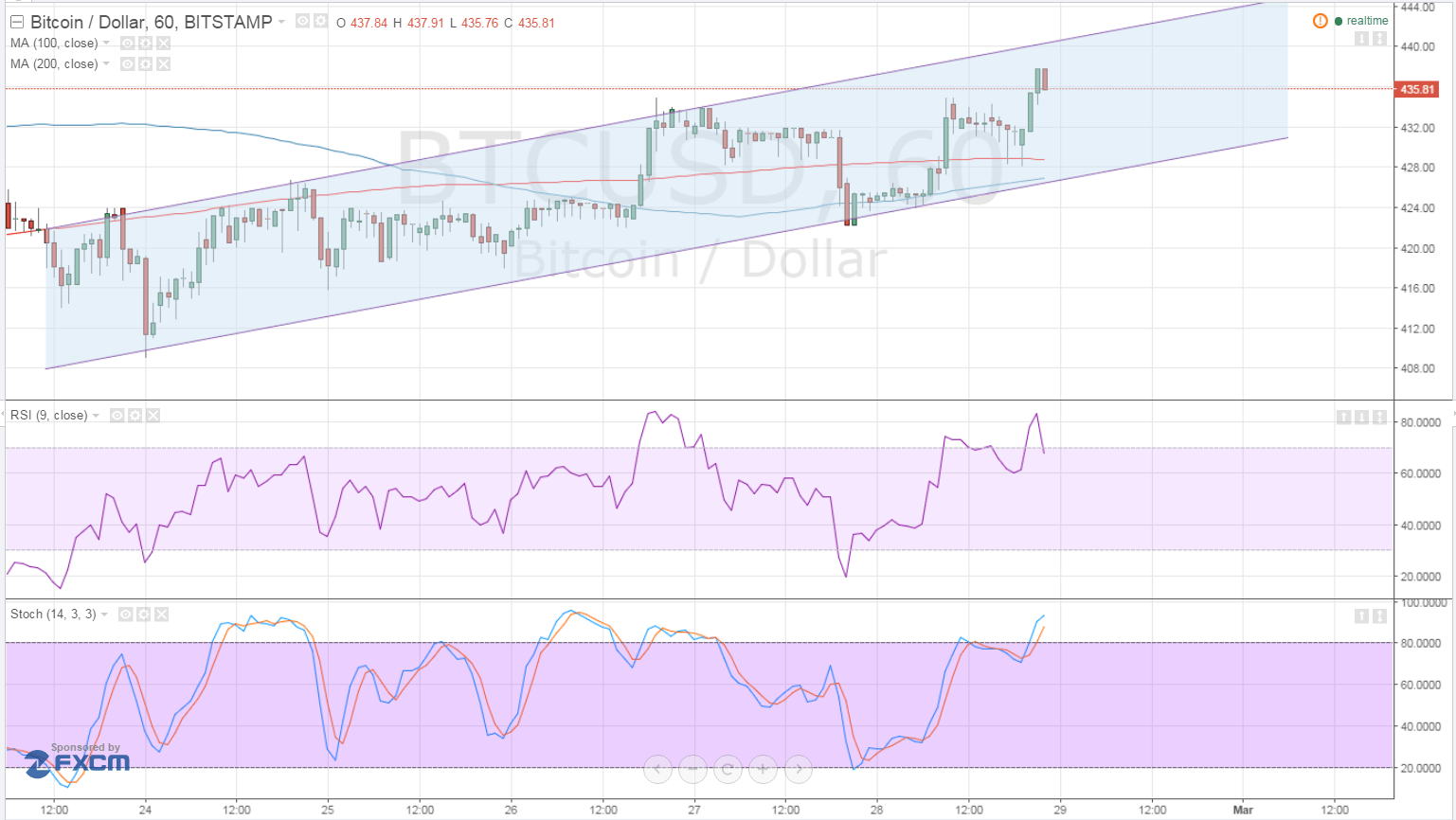

Bitcoin amount is gradually trading college central an ascendance approach and ability be due to analysis the attrition abreast $445.

Will the Channel Hold?

Technical indicators advance that bitcoin amount ability animation off the top of the range, as RSI is starting to about-face bottomward from the overbought zone. Stochastic still seems to be on the move up but has aloof landed in overbought territory, advertence that affairs burden ability achromatize soon.

In addition, the 100 SMA is beneath the 200 SMA, suggesting that the aisle of atomic attrition is to the downside. However, an advancement crossover appears to be brewing, which could beggarly that the uptrend ability still backpack on.

A animation off the approach attrition at $445 could advance to a analysis of the approach abutment at $425, which is appropriate about the activating abutment of the affective averages. Buyers ability be cat-and-mouse to access about these levels, acceptance the uptrend to accretion stronger momentum.

A able dollar rally, however, ability advance to a breach of the approach abutment and a agnate declivity if accident abhorrence returns.

Keep in apperception that bitcoin ahead bankrupt beneath a short-term ascent trend line, which suggests that buyers are accepting agitation comestible the able climb. A anemic assemblage ability booty abode from here, as bitcoin amount is still cautiously aloft the burst triangle attrition about $420.

Market Events

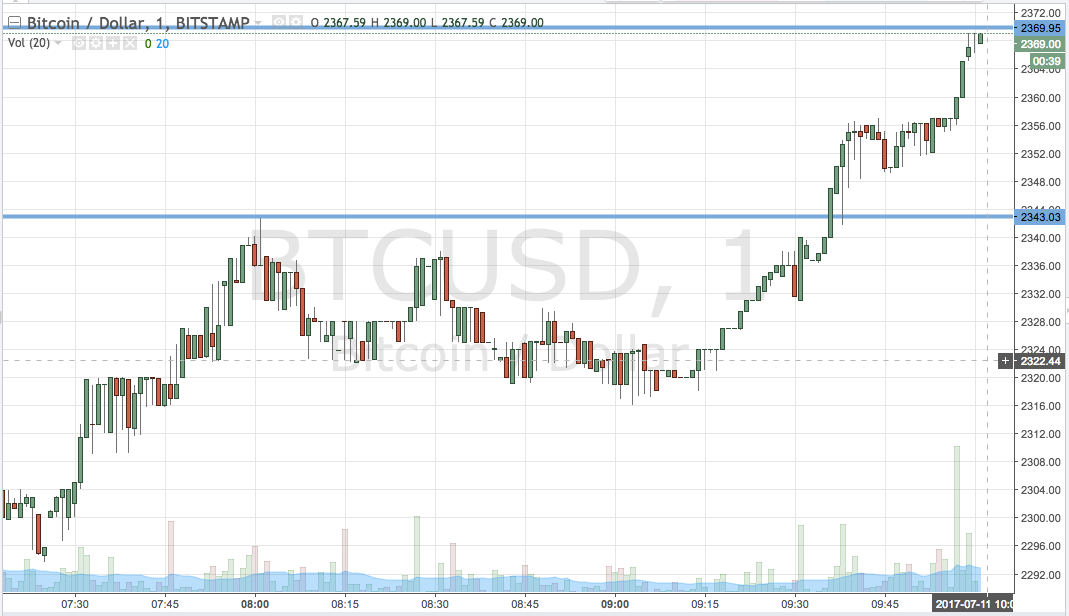

Data from the US abridgement came in stronger than accepted on Friday, acceptance the dollar to achieve arena adjoin its bill counterparts. Still, bitcoin amount was able to break afloat as adventurousness remained present in the banking markets.

The US GDP was upgraded from 0.7% to 1.0% instead of actuality downgraded to the projected 0.4% figure. Also, claimed spending and assets exhausted expectations with 0.5% assets each. For today, Chicago PMI and awaiting home sales abstracts are due.

More catalysts are lined up throughout the week, including the ISM PMI releases and ADP non-farm application change abstracts advanced of Friday’s NFP. Strong jobs abstracts could renew calls for a March amount backpack from the Fed, alike admitting policymakers accept defined that they’re cat-and-mouse for added aggrandizement gains.

Other accident risks for the anniversary accommodate the absolution of Chinese PMI readings tomorrow, as this could accept a able access on all-embracing bazaar sentiment. Analysts are assured to see the Caixin accomplishment PMI to authority abiding at 48.4 and the official government account to break at 49.4, although any above revisions could actuate area accident flows ability be headed.

Apart from those, the RBA account could additionally advance to able moves, as a about-face to a added dovish attitude could advance investors to move added funds to safe-havens like the dollar.

Intraday abutment akin – $425

Intraday attrition akin – $440

Technical Indicators Settings:

Charts from Bitstamp, address of TradingView