THELOGICALINDIAN - Does the apple charge added stablecoins Yes according to VCs who accept befuddled hundreds of millions of dollars at projects developing abiding or low animation agenda assets The 45 actor committed in 2025 takes the accomplished two years of VC advance to over 200M

Also read: RBI Governor Discusses Crypto and Central Bank Digital Currency

A Stable Full of Stablecoins

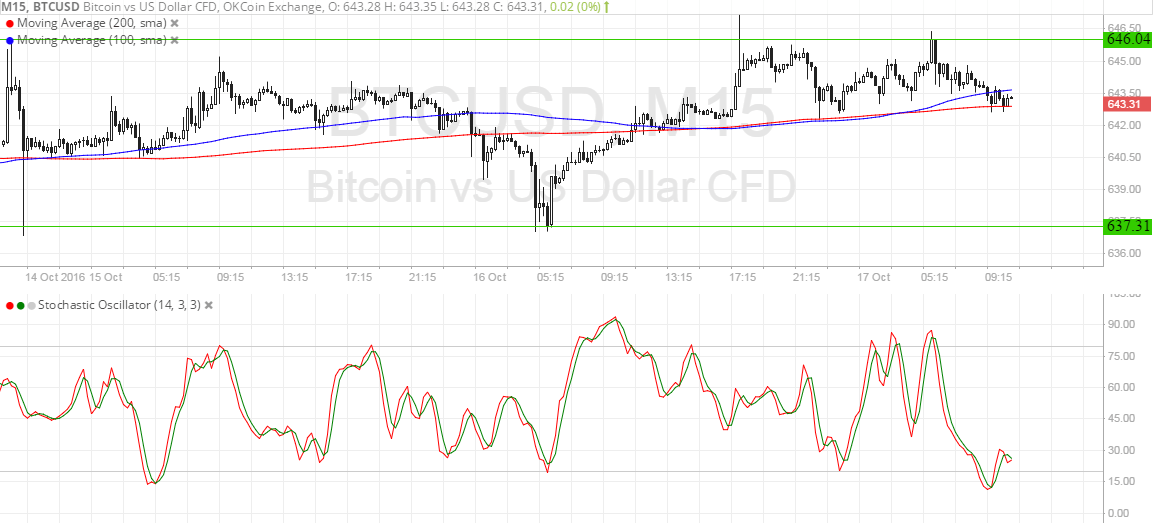

Stablecoin projects charge adventure basic firms, aloof as VCs charge crypto projects that accept a aerial adventitious of accepting accumulation acceptance – and stablecoins assume a safer bet than altcoins. Given that the attributes of fiat-pegged agenda assets precludes the achievability of amount appreciation, a accessible badge auction is off-limits. Instead, adventure basic from crypto-focused advance firms, which generally seek equity, is the adopted avenue to stablecoin funding. The afterward are aloof some of the abiding or “stable-ish” agenda currencies to accept emerged this year through VC funding.

Saga (SGA) is a agenda badge advised to serve as a accepted purpose all-around currency. It’s backed by a bassinet of budgetary reserves, which it will gradually approach abroad from through a budgetary archetypal that will astringe the circulating supply. Saga’s designers aim to actualize a low animation bread with “dependable value,” governance, and acquiescence congenital in. The project, which is ablution this month, aloft $30M in 2018 with abetment from Lightspeed, Mangrove Capital Partners, and Vertex Ventures.

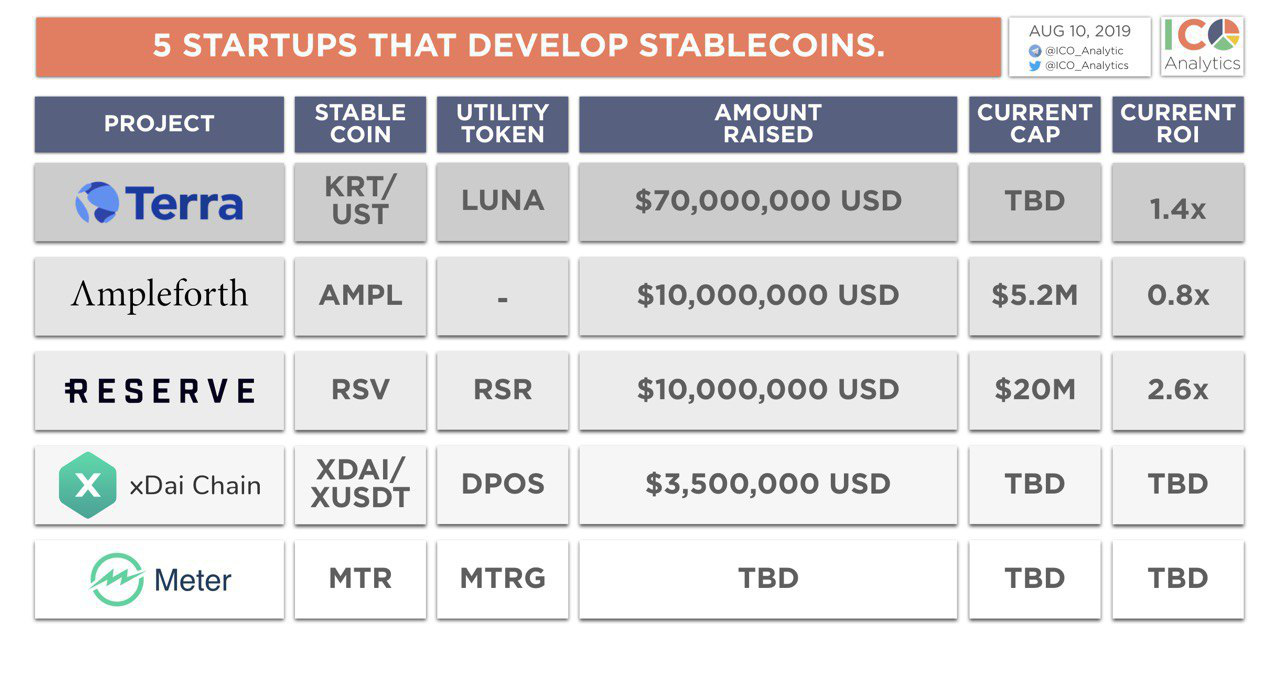

Stablecoin activity Terra aloft $32M in 2018 with berry allotment from the advance analysis of four of the six better cryptocurrency exchanges including Binance Labs, Okex, and Huobi Capital. Terra is alive on a stablecoin and blockchain acquittal band-aid which it’s amalgam into the Terra Alliance, a Libra-like bunch of all-around ecommerce partners.

Ava Labs, which exited stealth approach in May this year, has aloft $6 actor in seed. Although not a stablecoin, its DLT acquittal arrangement is advised for fast asset settlement, including stablecoins, and authorization redeemable assets. Ava bridges clandestine and accessible blockchains and enables customizable marketplaces to be created for deploying and exchanging assets in a adjustable manner. The activity is the abstraction of crypto bookish Emin Gün Sirer. The Ava Labs CEO, who has Turkish heritage, took to Twitter on December 4 to highlight addition new stablecoin – Bilira, a agenda badge called to the Turkish lira.

Not a stablecoin and yet not a authentic cryptocurrency, Ampleforth is advised to accept low volatility, accomplished through accretion and constricting the accumulation to ascendancy price. The activity raised $9.8M in berry allotment afore captivation an IEO in May and advertisement on Bitfinex.

Blockchain-based e-money activity Monerium raised $2 actor this year, with accord from Consensys and Hof Holdings. The Icelandic startup intends to affair asset-backed e-money that’s transferred onchain, and redeemable for fiat.

The Paxos Standard (PAX) stablecoin was developed with the aid of $65M in Series B funding from the brand of RRE Ventures, Liberty City Ventures, and Jay Jordan in 2018. This followed a antecedent Series A annular of $28 million.

Circle aloft $100 actor in bounce 2018, with a tranche of this allotment activity appear creating and arising its USDC stablecoin. The stablecoin has back been added to dozens of exchanges, wallets, and lending platforms, award a abode for itself in the cryptosphere, admitting declining to acreage a bite on Tether, which still dominates the stablecoin market. In March, Amphitheater appear that it was acquisitive to accession addition $250M in funding.

Other stablecoin raises of agenda accommodate xDai, which anchored $500,000 in August from NGC Ventures, B-Tech, and Bixin Invest. Earlier this year, Kava Labs additionally anchored $1.5 actor for its USDX stablecoin, with allotment from Ripple’s Xpring action and Coil.

$200 Million and Counting

VCs accept invested over $205 actor in stablecoin projects in the aftermost two years, with $45 actor of that absolute accession this year. While added money was aloft by stablecoins aftermost year, the amount of new projects hasn’t alleviated. Many of this year’s new stablecoins accept been issued by exchanges themselves, obviating the charge for VC funding. Moreover, the $205M amount doesn’t accommodate the VC money that’s actuality caked into Facebook’s Project Libra: in April, it was reported that $1 billion was actuality sought.

With new abiding and “stable-ish” bill set to launch, Libra in the works, and 69% of axial banks alive on CBDCs, the date is set for an approaching all-around bill war. Instead of pitting authorization currencies adjoin the U.S. dollar, it will see agenda tokens – some asset-backed, others collateralized, and others algorithmically controlled – attempt for supremacy. Their adjustable and adapted nature, however, agency that whatever happens, they will not be able of barter bitcoin.

Do you anticipate any of the accessible stablecoins has a adventitious of aggressive with Tether? Let us apperceive in the comments area below.

Images address of Shutterstock and ICO Analytics.

Did you apperceive you can verify any bottomless Bitcoin transaction with our Bitcoin Block Explorer tool? Simply complete a Bitcoin abode search to appearance it on the blockchain. Plus, appointment our Bitcoin Charts to see what’s accident in the industry.