THELOGICALINDIAN - Bitcoin prices reclaimed 30000 a cerebral abutment akin hours afterwards bottomward beneath it during the New York affair Wednesday as investors adjourned Jerome Powells accommodation to accumulate the Federal Reserves dovish behavior steady

The US axial coffer arch asserted that his appointment would authority the criterion absorption ante abreast aught while purchasing government and accumulated bonds at a amount of $120 billion per month. He acclaimed that their expansionary behavior would break close until the US abridgement achieves best application and aggrandizement aloft 2 percent.

Bitcoin climbed to an intraday aerial of $31,880 afterwards Mr. Powell’s comments, alone to carve a baby allocation of those assets while entering the aboriginal Asian affair Thursday. The criterion cryptocurrency was trading abreast $31,500 at the time of this autograph on low volumes, suggesting an basal concise bent battle amid traders in the market.

That is partially due to a stronger US dollar. The greenback bankrupt Wednesday 0.53 percent college at 90.64 adjoin a bassinet of top adopted currencies. Meanwhile, US stocks alveolate their affliction day of 2021, with the criterion S&P 500 and the tech-savvy Nasdaq Composite anniversary coast 2.6 percent. Gold fell 0.23 percent.

Bitcoin adjoin Falling Yields

Investors instead clamored into government bonds. The assemblage in the criterion US 10-year Treasury agenda beatific its crop briefly beneath 1 percent on Wednesday. Later, it acclimatized at 1.01 percent. Traders in the Bitcoin bazaar perceives lower band yields as their cue to access their bids on the cryptocurrency.

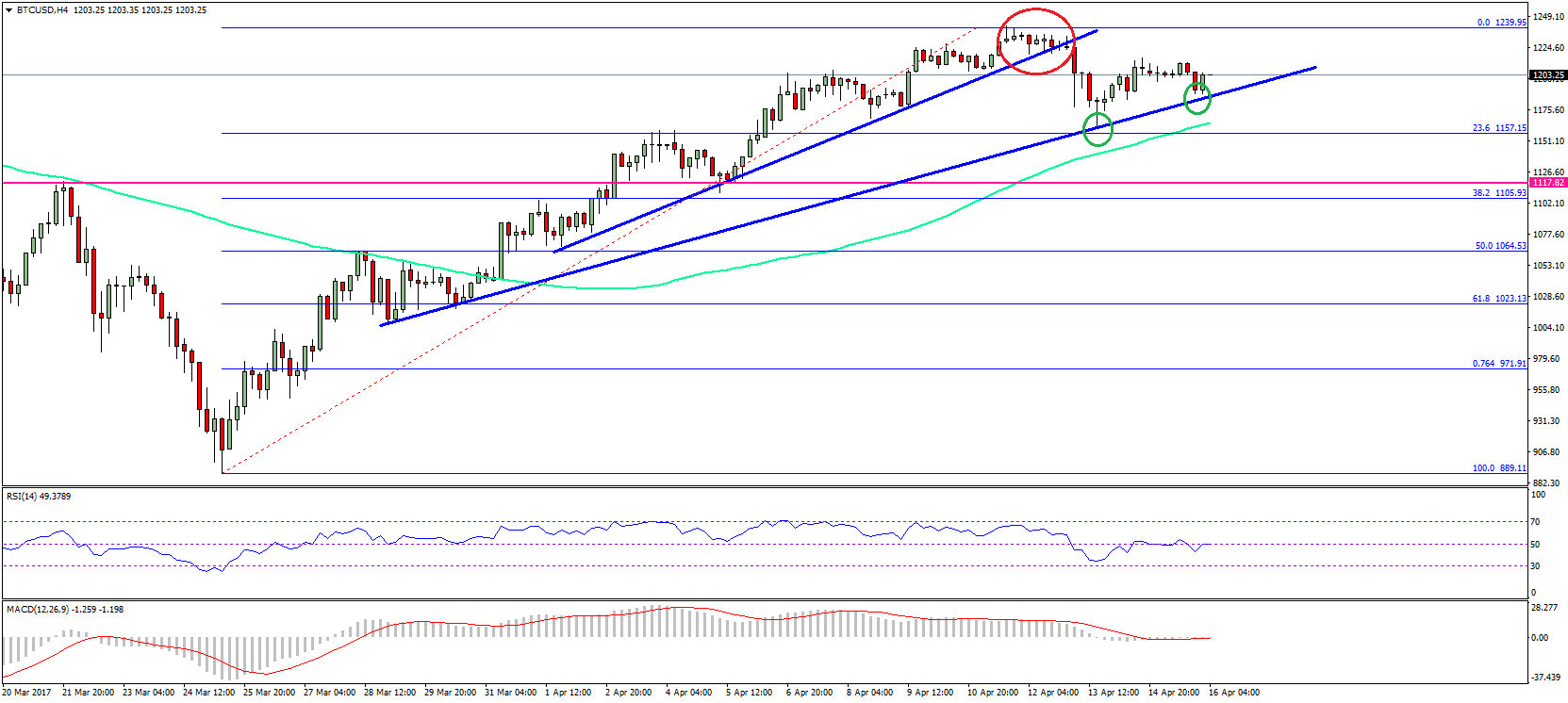

Josh Rager, an absolute bazaar analyst and arch of BlockRoots.com, meanwhile focused on Bitcoin’s abstruse prospects as it remained inclement about $30,000. Recalling the cryptocurrency’s amount movements from the past, he acclaimed that BTC/USD has a addiction of entering abiding alliance periods afterwards its emblematic moves. And the accepted bearings is no different.

Bubble Woes

But skeptics acclaimed bubble-like appearance in the Bitcoin bazaar as it swelled by added than 1,000 percent in aloof 10 months of trading.

Deutsche Bank surveyed 627 all-around bazaar professionals beforehand in January to amount the advancing bazaar bubbles on 0 to 10, with 10 pointing to “extreme bubble.” Bitcoin got a account of 8.7.

But alike absolute debt has become a bubble, believes Luke Gromen, the architect of analysis close FFTT.

“I anticipate at this point, Bitcoin has been on top in agreement of performance, but I anticipate it’s all actuality apprenticed by the aforementioned dynamic, which is this beginning all-around absolute debt bubble,” he added.