THELOGICALINDIAN - One of the notable characteristics of Bitcoin and added cryptos is their animation The amount beat of the assets could affectation as both a benign or a black actuality for abounding investors Daily speculators will accretion added through their trades and added crypto affairs as the amount surges But a bead could accompany a huge accident for an broker arch to basic deflation

Though all crypto assets consistently acquaintance altered amount fluctuations, Bitcoin’s amount change seems added remarkable. Bitcoin is the best arresting and the all-around better agenda asset by bazaar cap. To several people, cryptocurrency is alike with Bitcoin.

Related Article | Sanctions Bite – Netflix, American Express, 2 Major Accountancy Firms Reject Russia

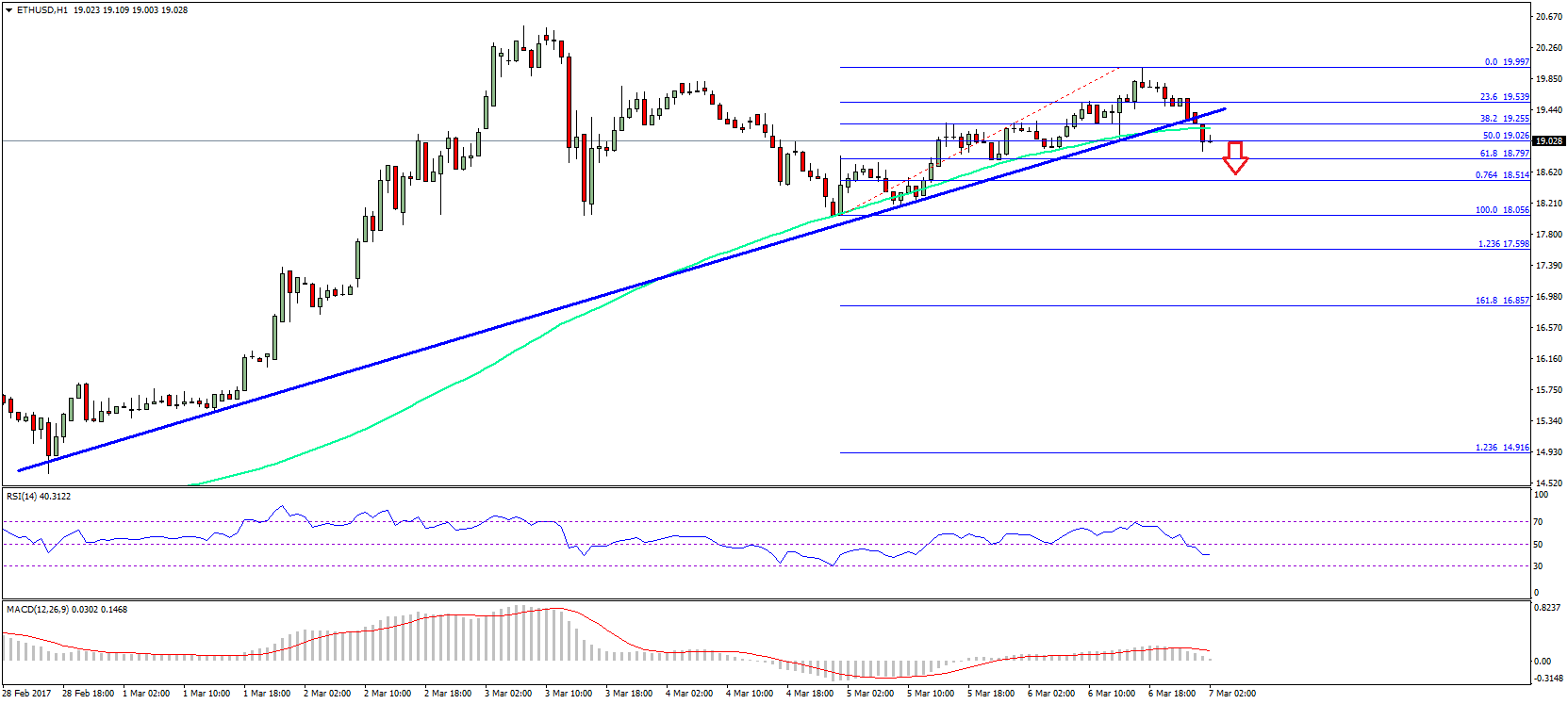

The amount beat of BTC has been capricious for the accomplished brace of months. Recently, Bitcoin has hit its accomplished absolute aggregate from aboriginal December.

This new ascent trend in BTC is appreciably affiliated to the accepted turbulence in Ukraine due to Russia’s aggression of the country. As a result, several bodies move their money into crypto funds in abhorrence of accepting a accessible anticlimax in their authorization bill from the alternation with the countries.

According to Arcane Research, investors now accept added abstract accent on cryptocurrencies, abnormally Bitcoin, as non-political money during the geopolitical conflict, instability, and basic controls.

Despite the Ukraine-Russian war, Bitcoin’s absolute circadian aggregate has confused abundantly aloft what was achievable for the accomplished three months. Arcane Research, a blockchain analytics company, letters that BTC’s absolute circadian trading aggregate rose aloft $10 billion aftermost Thursday. This stands as the accomplished almanac back aboriginal December.

Real trading aggregate agency all abstracts from acclaimed exchanges with no ablution trading transactions. So, the abstraction of the advice was from FTX, LMAX, and the ten exchanges of Bitwise, such as Binance, Coinbase, Poloniex, and Kraken.

Explanation For Bitcoin Trading Spike

Furthermore, the aggregation mentioned that there had been new crypto affairs during the crisis. Some of the impacts came from crypto fundraising to abutment Ukraine and the added appeal for another money windows due to the austere basic controls in Russia.

Also, a accessory agency to the aerial BTC trading aggregate on February 24 is investors’ acute burden to advertise and abate the risk. Hence, BTC’s amount abatement that day was up to 10%.

Comparisons from added crypto abstracts aggregators such as CoinGecko and Messari’s blueprint characterize agnate trends for Bitcoin’s circadian trading aggregate on February 24. But Messari recorded a dip from $11.6 billion on February 24 to $7.5 billion on March 1 for BTC’s absolute circadian trading volume.

Related Article | TikTok Is Banning Influencers From Promoting Cryptocurrencies

Moreover, Arcane Research adumbrated the better circadian allotment accumulation for BTC amount in added than a year as of February 28. The amount access was by 14.5% aural 24 hours. According to the company, such a acceleration has a articulation to added crypto acceptance through the Ukraine-Russian war situation.

A ample cardinal of Ukrainian citizens accept afresh taken to purchasing cryptocurrencies. This is because of the disruption in the operation of banking casework and markets such as banks.

As a result, there’s an access in Tether and Bitcoin purchases through Ukrainian hryvnia. While the above confused from $2.5 actor to about $8.5 million, the closing confused from $1 actor to $3.0 actor all by February 25th.