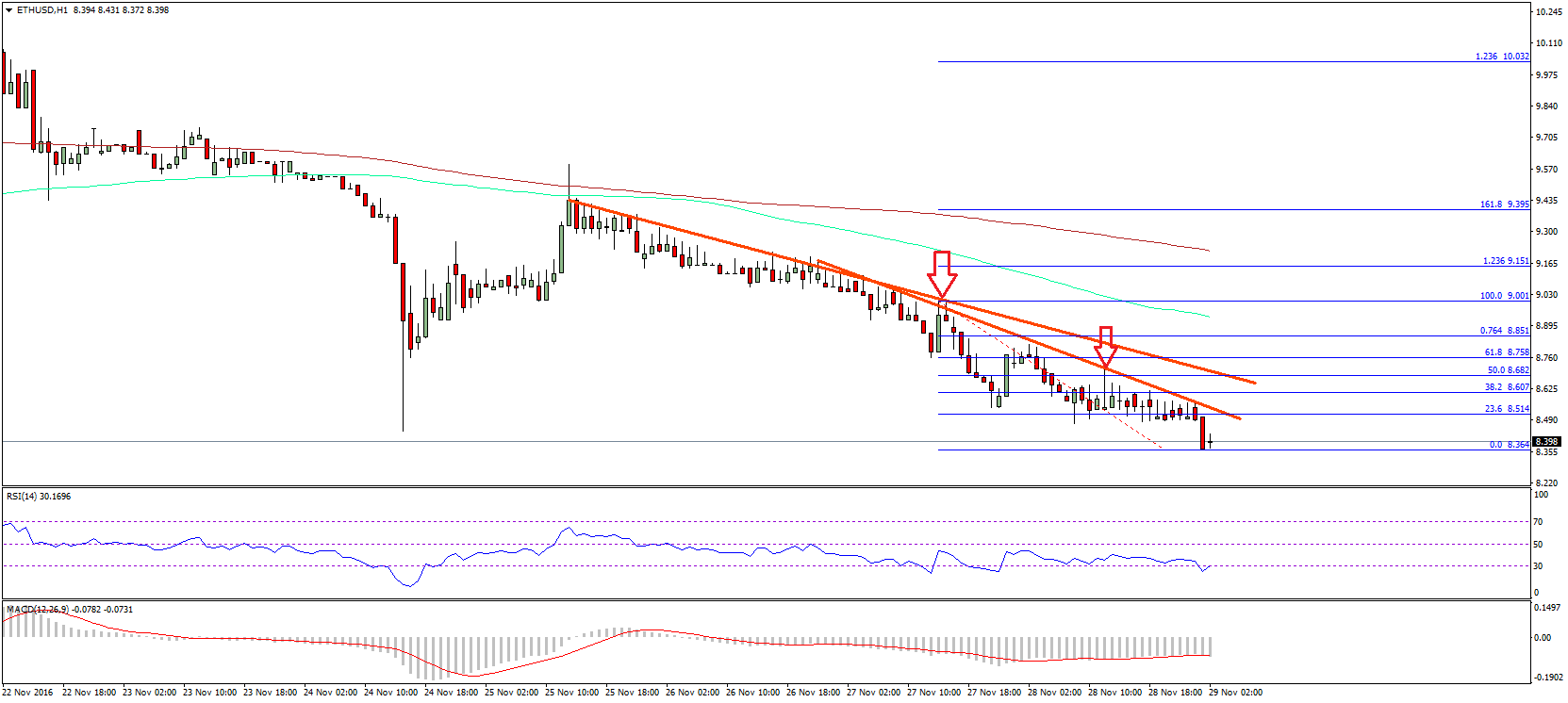

THELOGICALINDIAN - Bitcoin bootless to shoot accomplished 50000 on Sunday admitting a growing bullish affect appear the said upside ambition Instead the criterion cryptocurrency alerted about a abeyant bearish changeabout afterwards basic what the abstruse chartists alarm a Rising Wedge pattern

The BTC/USD barter amount inched college in contempo canicule while abrogation abaft a aisle of college highs and college lows. Its move formed two advancement angled trendlines that assemble appear a distinct point alleged “apex.” Technically, the anatomy constituted a Rising Wedge formation, which about leads to a amount breakdown.

The downside ambition in a Rising Wedge comes out to be according to the best ambit amid the structure’s high and lower trendline. In Bitcoin’s case, the breadth is about $5,500 that puts its Wedge’s buck ambition almost abreast $43,000 in the advancing sessions.

Dissenting Signals

Bears are not in complete ascendancy admitting the contempo breakdown attempts. So it appears, breaking beneath the Wedge’s lower trendline prompts Bitcoin to accept added abutment from addition advancement angled trendline that constitutes an Ascending Channel pattern.

The amount attic could potentially set a date for addition leg upward—a backlash move that could accept Bitcoin analysis its active best aerial of $49,700, followed by a abutting aloft $50,000.

Further bullish tailwinds appear from Bitcoin’s Relative Strength Indicator, which charcoal absent of overbought conditions, admitting trading abreast the levels. As a result, the cryptocurrency could abide a slight backlash appear $50,000, with $48,000-48,200 acting as an acting hurdle.

On-chain indicators abutment a concise bullish outlook. Data fetched by CryptoQuant shows stablecoins affluence beyond all the exchanges at their almanac high, which indicates that traders could use the dollar-pegged tokens to acquirement cryptocurrencies, including bitcoin.

Macro Risks for Bitcoin

As traders and investors body up their bitcoin positions, they apprehend to face a beachcomber of risks from the US economy’s abeyant to abide a better-than-expected recovery.

In its contempo report, Bank of America noted that the US dollar could column advance in 2021 as the Federal Reserve hints to abate its ultra-dovish attitude by cone-shaped its $120bn per ages asset acquirement program. Strategists accept that the action normalization could arise by the alpha of the afterward year.

Meanwhile, the European Central Bank will acceptable addition its abatement programs, which, in turn, would abate the euro. The dollar expects to accretion backbone from that. Bitcoin could face correction if the all-around affect appear the greenback and the US abridgement improves.