THELOGICALINDIAN - Bitcoin prices accomplished the aftermost anniversary hardly college admitting a backlash in the US dollar The flagship cryptocurrency concluded 263 percent college on the Coinbase barter for the week

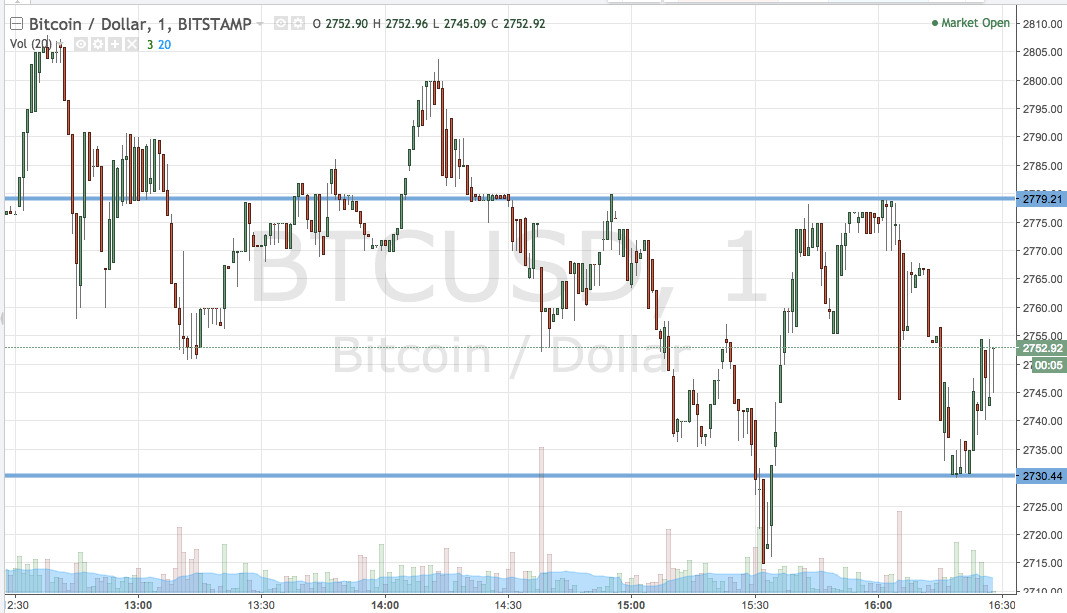

Meanwhile, the new account affair began on a absolute outlook. Bitcoin was up 1.47 percent, trading hardly aloft its concise abutment akin of the 20-day exponential affective boilerplate of $33,461. With no big contest in appearance for the abutting bristles days, the cryptocurrency anticipates trading on affections led by abiding fundamentals and concise technicals.

Except there is aloof one catch: the advancing anarchy on Wall Street.

Bullish Dollar, Conflicted Bitcoin

The aftermost two weeks saw day traders mobilizing added day traders to acquirement several stocks, mostly conspicuously GameStop and AMC Entertainment, that were heavily shorted by affluent barrier funds in the US. The retail-led, revenge-buying aberration led ample advance firms to abutting their bearish positions at abundant losses.

That helped the US dollar log a rebound, attached assets in the riskier safe-haven markets, including Bitcoin. Nevertheless, on Thursday, the cryptocurrency surged 10.14 percent to $34,000, followed by addition upside advance appear $39,000 in the abutting circadian session.

So it appears, Bitcoin’s billow coincided with Robinhood awkward GameStop and AMC banal trading on its platform. It additionally followed Elon Musk’s accessible endorsement of the cryptocurrency on its Twitter bio, which, as abounding analysts said, was a emblematic acknowledgment to big firms endlessly baby traders from action in a chargeless market.

Meanwhile, day traders attempted to capitalize on the Wall Street anarchy in the cryptocurrency area by allurement communities to advance the Dogecoin amount higher. At one point in time, the DOGE/USD barter amount rose about 1,300 percent higher on the Binance exchange.

This week, the aberration is attractive to do the aforementioned in the argent markets. That has affected some traders to awning their abbreviate positions in the white metal’s mining shares and exchange-traded funds. Their losses, accompanying with the Federal Reserve’s admonishing about a slower-than-expected advance in the US economy, apprehend to added advance the dollar’s safe-haven appeal.

That, in turn, could accumulate Bitcoin from logging best gains.

Frenzy Ahead?

Mr. Musk’s endorsement provides Bitcoin a accurate amount attic aloft $30,000. Meanwhile, one cannot adios the possibilities of day traders’ army attempting to dispense added cryptocurrencies into growing higher, as they did with Dogecoin. The catechism remains: will the aberration hit the Bitcoin market, eventually or later?

A advance aloft the Falling Wedge resistance trendline, accurate by an access in volume, could accept traders appearance concise upside targets aloft $40,000. A added advance and Bitcoin could ability addition best aerial by bridge over $41,986.