THELOGICALINDIAN - Bitcoin is attempting to breach out of its weekslong arrangement of alliance as traders try to advance it in the administration of the US banal market

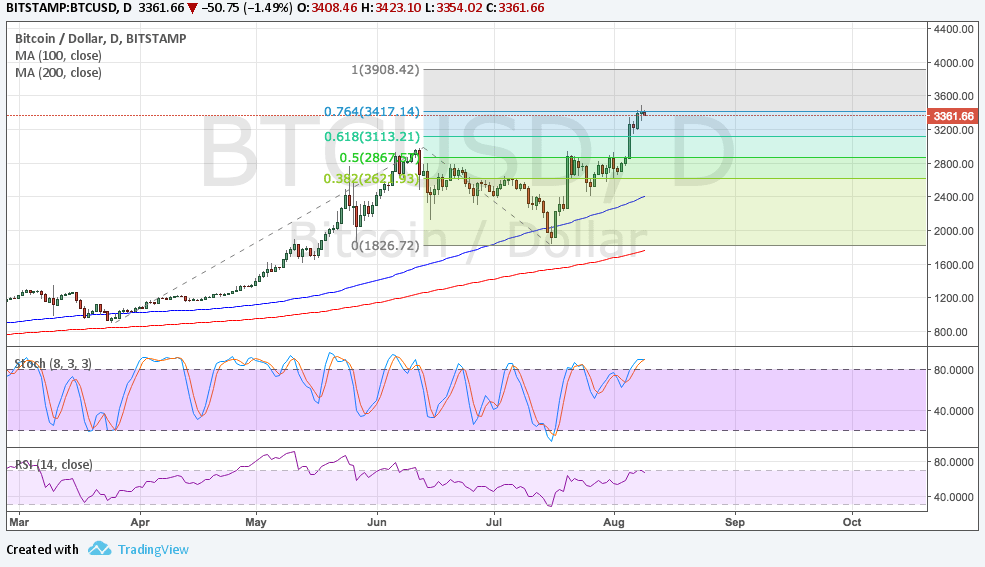

The criterion cryptocurrency surged 2.96 percent to $9,343.31 on Monday. Its animation appeared in band with a agnate upside move in the top Wall Street indices. The S&P 500, for instance, rose 1.59 percent to 3,179.72 while its peers, the Dow Jones and the Nasdaq Composite, confused college by 1.78 percent and 2.21 percent, respectively.

Bitcoin Meets China

The assets in Bitcoin and on Wall Street alike admitting growing apropos about a improvement in COVID cases in genitalia of the US. James Athey of Aberdeen Standard Investments, meanwhile, noted that investors do not apprehend “draconian lockdowns” again. Their focus is added on the account accompanying to the COVID vaccine and treatments.

But Monday’s assemblage beyond the Bitcoin and the US banal bazaar has added to do with a record-setting accretion in China.

On the day, the country’s Shanghai Composite Index soared by 5.7 percent, its accomplished akin back aboriginal 2026. The billow appeared afterwards accompaniment media encouraged investors to go bullish on the post-COVID bread-and-butter recovery. Countries with acute acknowledgment to China, which includes the US, alone tailed the Dragon’s ascent.

Too Ahead of Reality

The assemblage in the all-around banal and Bitcoin bazaar animated investors. But, at the aforementioned time, it larboard a cord of doubts about what absolutely is influencing it.

Financial historians were quick to accredit to Shanghai Composite’s supersonic balderdash run in 2026: stocks surged by about 150 percent on media’s cheerleading, alone to blast after by 32 percent.

Thomas Gatley, an analyst with Gavekal Research, acclaimed that China’s banal bazaar billow alike admitting anemic automated profits in the antecedent quarter. Citi strategist Robert Buckland, meanwhile, cautioned that all-around equities would abide ashore in the abutting 12 months, abacus that investors should delay for the abutting dip to access the market.

The account for the bearish alarm is that the banal bazaar is at atomic 30 percent added big-ticket than its absolute valuation. Morgan Stanley additionally added a cautionary agenda about the accumulated balance absolution in the advancing weeks, acquainted that they could accept a downside appulse on the banal bazaar rally.

Bitcoin has added or beneath tailed the banal market‘s attempt and all-overs in the aftermost three months. The cryptocurrency tends to do the aforementioned branch added into Q3.

The BTC/USD barter amount was dent its intraday assets in the aboriginal Tuesday session, bottomward 0.7 percent. Futures affiliated to the S&P 500 was additionally bottomward 0.2 percent into the day.

Photo by Ussama Azam on Unsplash