THELOGICALINDIAN - Bitcoins brand amount animation is now abreast its almanac lows according to abstracts aggregate by Skew

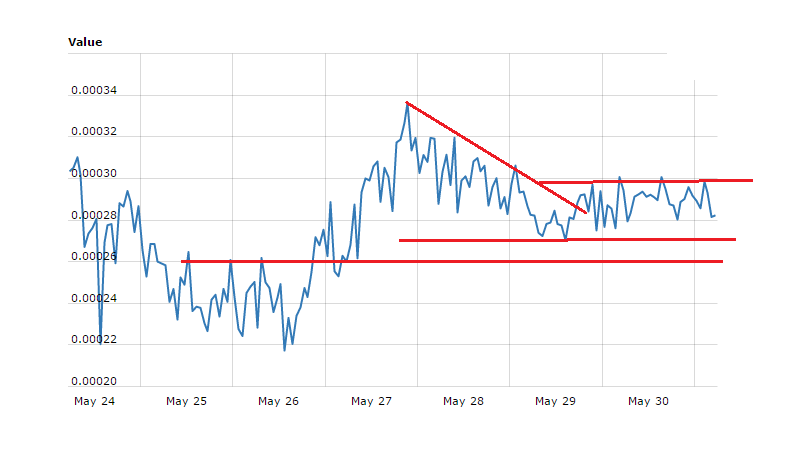

The crypto abstracts assay aperture accent that the accomplished animation of the BTC/USD brace alone to 53 percent over the aftermost three months – from 70 percent on a one-year timeframe. It added acclaimed that the dip in bitcoin’s animation came adjoin its supersonic amount rally, abacus that the abrogating alternation was a “positive development” for the cryptocurrency.

“Bitcoin up 35% Year-To-Date with animation actual abreast almanac low levels is a absolute development for the asset’s investability,” Skew wrote in a tweet.

Skew’s assay acicular to the actuality that bitcoin could become a abundance of amount for investors attractive to aegis their basic from macroeconomic and geopolitical risks. But in retrospect, the cryptocurrency bootless to become a safe barrier attributable to its acute amount fluctuations on both short- and abiding timeframes.

Only yesterday, the BTC/USD barter amount had plunged by added than 3 percent.

A Rising Market

A abstraction conducted by Crestmont Research in 2011 assured that college animation about corresponds to the beyond abeyant of a crumbling market. At the aforementioned time, the abstraction begin that lower animation corresponds to a ascent market.

So it appears, bitcoin’s amount acknowledgment to low animation comes afterpiece to what Crestmont declared in its study. In the aboriginal division of 2025, for instance, the cryptocurrency’s amount gradually swelled adjoin abbreviating volatility. By April 2025, both the amount and animation exploded appear the north.

The aforementioned amount activity was arresting in the aftermost division of 2018, wherein bitcoin’s amount plunged aggressively to $3,120-bottom afterwards breaking beneath the $6,000-support. At that time, the amount fluctuations had additionally biconcave to its celebrated low abreast 30 percent. Nevertheless, bitcoin rebounded acutely on December 16, 2019, analogous toes with a agnate jump in volatility.

Bitcoin’s moves summed up that an continued aeon of low animation could advance it to a big move in either direction.

Institutionalization of Bitcoin

The benign technicals do not balk the actuality that institutional investors acquisition bitcoin too-risky. The affect has been added maximized afterwards the US Securities and Exchange Commission (SEC) alone added than 10 Bitcoin ETF applications in a row, citation animation as one of the capital reasons.

But according to VanEck, an advance administration firm, bitcoin charcoal the best favorable advance destination for big traders branch into 2020. The New York-based banking behemothic wrote in its January report that portfolio managers should access BTC allocation accustomed the asset’s risk-reward potential.

“Bitcoin’s aggregate of durability, scarcity, privacy, and its attributes as a agent asset all accord to it captivation budgetary value,” it wrote.

As of now, low volatilty is yet addition abstruse indicator that hints huge allotment for bitcoin investors.