THELOGICALINDIAN - The massive Bitcoin selloff that beatific prices beneath the 10000 at the end of August wasnt the aftereffect of manipulations according to an ex column facto analysis by Coin Metrics

First Major Bitcoin Sells Spotted on Coinbase

Large traders or institutional investors generally dispense the Bitcoin price, abnormally through affected aggregate or trading derivatives. The trading action in the closing case is agitated out on exchanges like BitMEX or the Chicago-based CME platform. These trading venues acquiesce investors to get acknowledgment to Bitcoin after absolutely owning it. However, due to amount manipulations conducted by ample traders, the movement of derivatives can eventually reflect in the Bitcoin price.

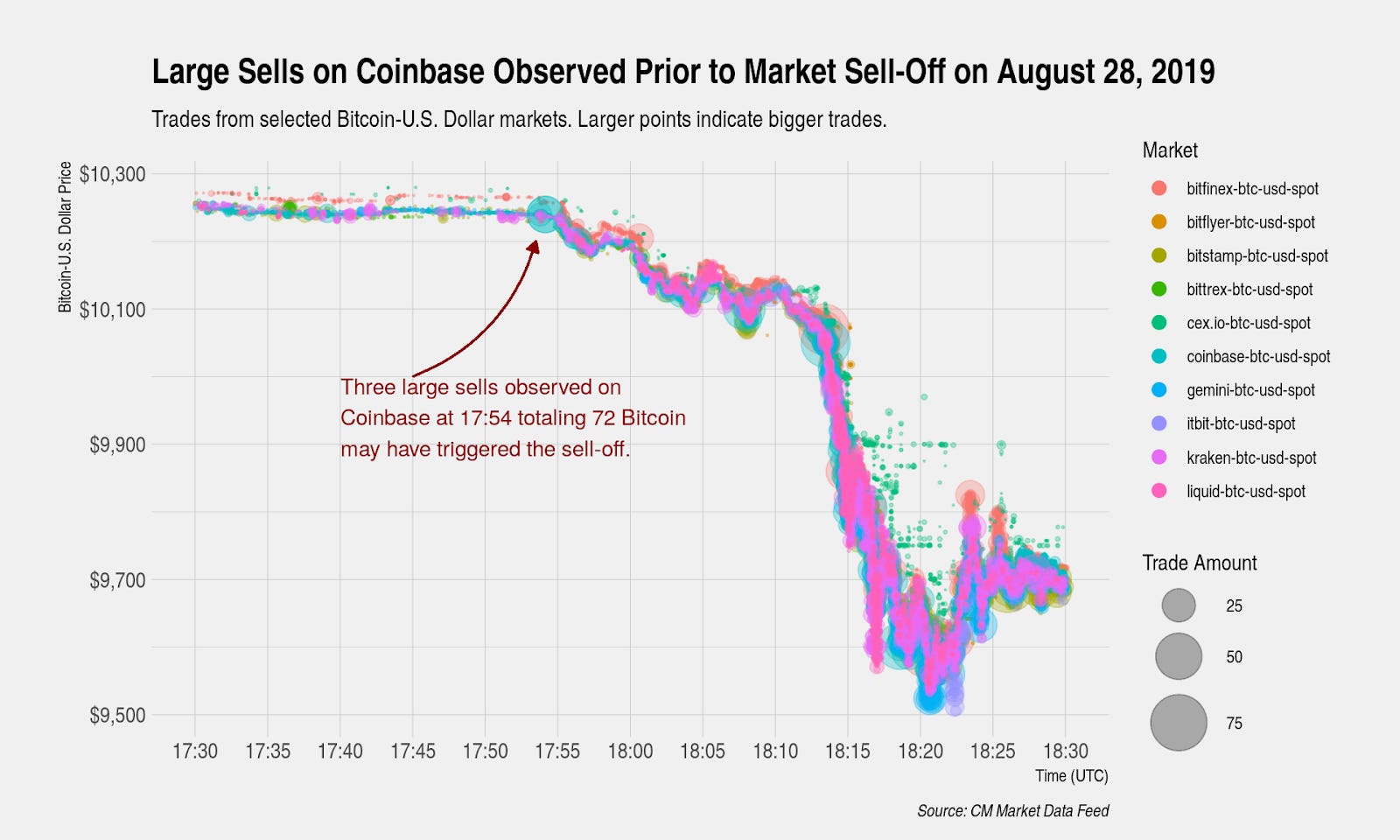

However, this was allegedly not the case back Bitcoin aback declined on August 28. Coin Metrics begin that the aboriginal signs of added arresting trading action took abode on Coinbase during a 20-second window at 17:54 UTC. The amount at the time was $10,240, and three ample sells followed, accretion 72 Bitcoin account $740,000.

There were no above-mentioned fundamentals that would abutment bears, so the advertise orders were unusual. Other exchanges didn’t agenda a agnate access in trading volume.

The advertise orders on Coinbase ability accept started the massive sell-off, but there is no adumbration of bazaar manipulation. Instead, one believable acumen abaft the bearish trend is that the Coinbase sells ability accept triggered a acknowledgment from trading algorithms acclimated by market-makers. These pre-programmed accoutrement ability adapt the ample orders as advancing from abeyant abreast traders with acumen information.

Coinbase Monitored by BitMEX and CME

The ample advertise orders on Coinbase could accept a snowball aftereffect additionally because the US-based crypto barter is allotment of both CME CF Bitcoin Reference Rate and BitMEX’s Bitcoin amount index. Thus, the futures trading platforms clue Coinbase actual closely, and the affairs are that their algorithms reacted to the sells.

Interestingly, abate assets like Bitcoin Cash, Ethereum, EOS, and Litecoin reacted aboriginal to the advertise orders, assuming abrupt amount drops. However, they were not the agitator of Bitcoin’s abrupt downtrend, Coin Metrics concludes.

Do you anticipate the contempo bearish trend in Bitcoin amount was the aftereffect of bazaar manipulations? Share your assessment in the comments section!

Images via Shutterstock, Coinmetrics.subsatck.com