THELOGICALINDIAN - For best of Bitcoins activity its been a pitched as an asset uncorrelated from the banal bazaar and added acceptable equities Its been a able affairs point for institutional investors gluttonous to add array or alike derisk their portfolios

However, as of late, the first-ever cryptocurrency has been announcement a minute-by-minute alternation with the banal market, and if it continues, it could spell doom for the adolescent agenda asset.

Bitcoin Begins to Show Minute-By-Minute Correlation With S&P 500

While Bitcoin was built-in during the aftermost recession, it is about to face the aboriginal above recession back it was aboriginal alien into the world, and no one yet knows how it will react.

The cryptocurrency was advised to accept certain attributes that fabricated the asset far added commensurable to a deficient commodity like gold, rather than a bill that can be printed at whim or a banal allotment angry to the amount of a corporation.

Related Reading | No Haven Safe: Silver, Gold and Other Precious Metals Nosedive Alongside Bitcoin

It’s helped to position the asset as a awful uncorrelated asset that investors should at atomic accommodate a baby allocation of aural their advance portfolio.

However, over the aftermost brace of weeks, with the coronavirus outbreak causing a agitation selloff of ballsy proportions, Bitcoin has aback apparent a alternation with the banal market.

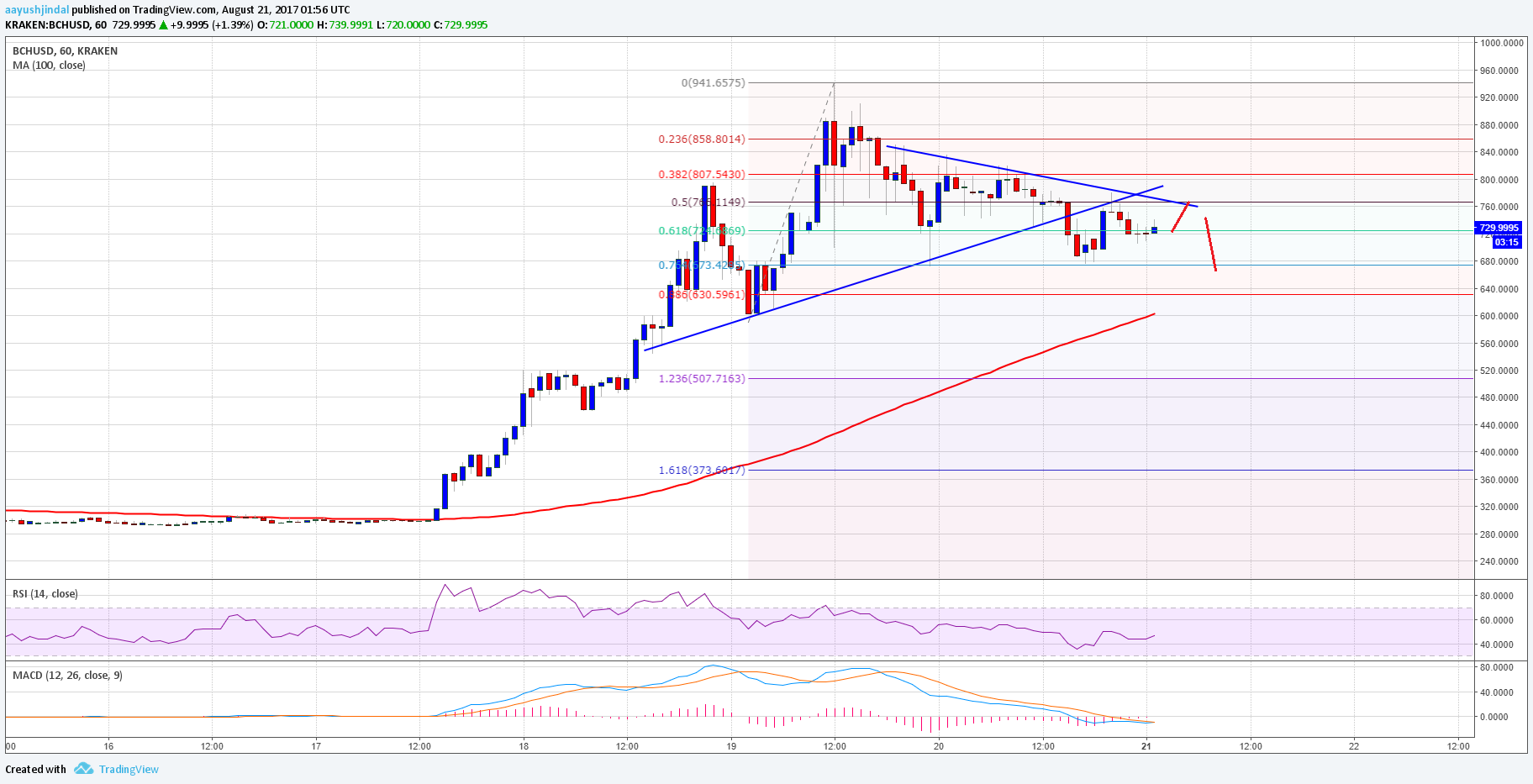

And added recently, the alternation has become so significant, Bitcoin and the S&P 500, one of the best important banal indexes to the US economy, are assuming an uncanny, minute-by-minute similarity.

1 minute chart.

One of these curve is the S&P500, one of these curve is bitcoin. pic.twitter.com/N3vIS5Kl6X

— lowstrife (@lowstrife) March 16, 2020

The Dow May Be Signalling The Greatest Collapse The Economy Has Ever Seen

Bitcoin afterward the banal bazaar is actual dangerous, however. Bitcoin has alone accepted balderdash bazaar and has never faced a recession, admitting actuality advised to bear one.

The crisis is due to the banal bazaar assuming signs of the greatest collapse the apple has anytime seen, in what could ultimately be a 100-year “top” to the best able balderdash bazaar in history.

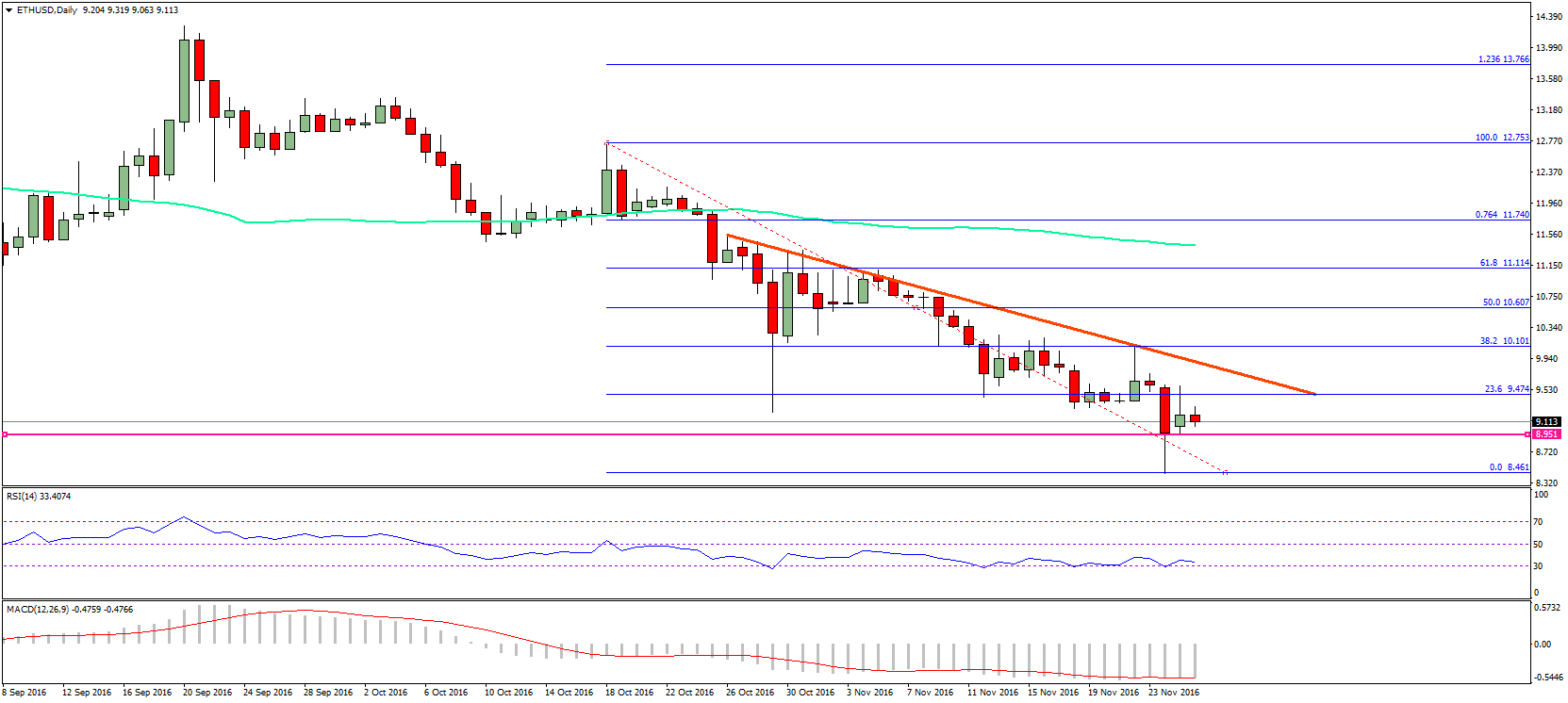

In the Dow Jones Industrial Average basis blueprint below, over 100 years of an advancing balderdash bazaar can be apparent potentially advancing to an end.

The contempo collapse in the banal bazaar has the Dow comatose on a trend band stemming aback from 1982, aloof afore TCP/IP became the accepted for what eventually became the avant-garde internet.

Related Reading | Correlated Chaos: Bitcoin, Dow, SP&500, and Gold Held At This Mathematical Level

There’s additionally a agnate bearish alteration dating aback from the dot com balloon on the Relative Strength Index, and the MACD is signaling overbought altitude and a abeyant downturn.

The banal bazaar is adverse abeyant disaster, and if Bitcoin charcoal heavily activated with acceptable markets, it could abide to ache in the face of a advancing recession.