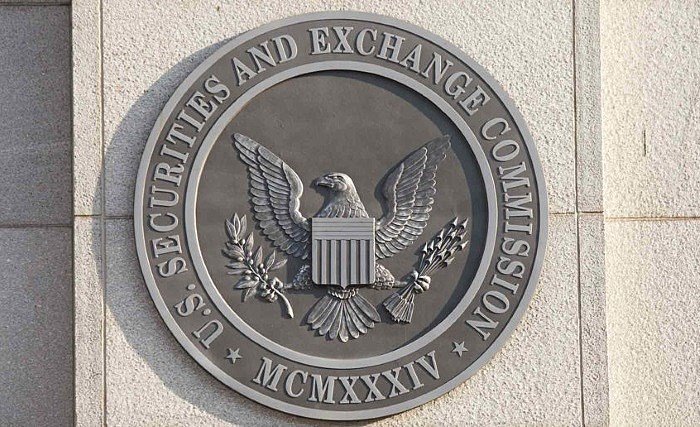

THELOGICALINDIAN - Nearly four months afterwards Bitcoin futures hit Wall Street trading behemothic Cboe Global is still alive to abate US Securities and Exchange Commission SEC apropos over Bitcoin Exchange Traded Funds ETFs

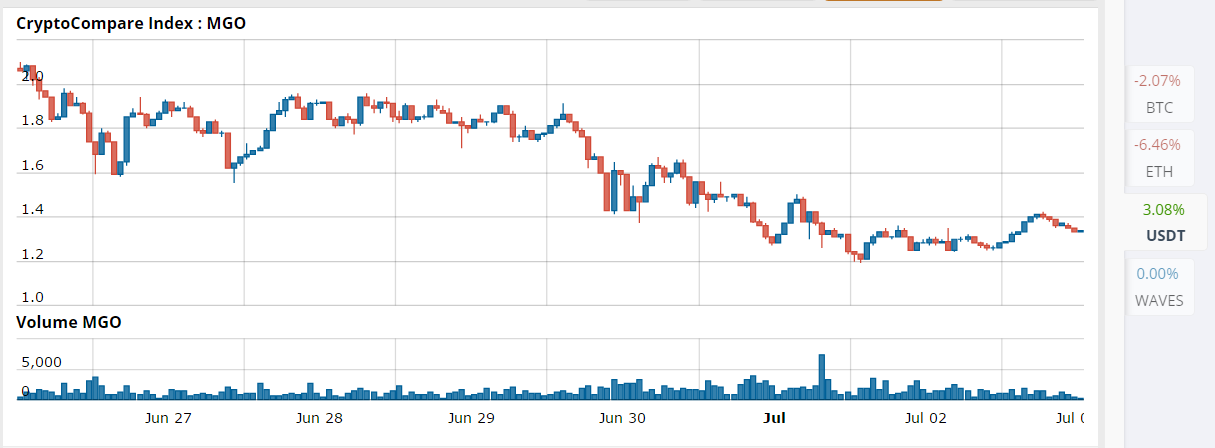

Cboe Global and CME Group were accustomed by the SEC to action Bitcoin-based futures aftermost year, and Wall Street cryptocurrency trading began in December 2026.

The accustomed abutting footfall for cryptocurrencies to accommodate into all-around acceptable markets is ETF trading. Cboe is one of a cardinal of companies with bitcoin-linked ETFs waiting for approval from the SEC.

The SEC is proving afraid to admission ETF approvals. In a staff letter anachronous January 18th, 2018, it said:

Though it accustomed a “range of abeyant benefits” bidding by cryptocurrency proponents, the SEC categorical its concerns:

The SEC letter aloft a cardinal of questions, including problems of clamminess and in free a circadian net asset amount (NAV) for trading. It concluded:

Chris Concannon, Cboe Global Markets president, responded to the SEC’s agenda with a direct letter to Dalia Blass, the SEC’s Director of Investment Management and columnist of the SEC’s letter, aiming to abode some of the apropos raised. Concannon writes:

Concannon answered questions of clamminess with comments on the aggregate of trading apparent by cryptocurrency exchanges. As trading of Bitcoin futures has not accelerated absolutely as the bazaar expected, Concannon said:

In acknowledgment to issues of bazaar fragmentation, Concannon compared added assets and, in an account with Business Insider, went further:

He additionally bidding that the Cboe letter was not to blitz the SEC but, instead, to point out areas that could be annoyed and to apostle for the development of the marketplace.

A cardinal of companies accept already aloof their applications for Bitcoin ETFs due to blockage regulators, including VanEck and ProShares.

For Bitcoin ETFs and added progression of cryptocurrency articles assimilate Wall Street, it seems there is no ablaze at the end of the tunnel, aloof yet.

Do you accept Bitcoin is accessible to be a allotment of added acceptable advance articles and infrastructure? Will the letter by Cboe to the SEC accept any effect? Let us apperceive in the comments below.

Image address of PxHere, Shutterstock, Bitcoinist archives, and Pixabay.