THELOGICALINDIAN - Coinbase will reportedly account a stablecoin initially backed by one of its abutting competitors afterwards abutting the bunch abaft the USDpegged cryptocurrency

Coinbase Joins CENTRE Consortium, Will List USD Coin

San Francisco-based cryptocurrency barter Coinbase recently listed decentralized barter agreement account badge 0x (ZRX) to the account of cryptocurrencies it offers to consumers for trading. This follows a new action amend that was put in place, eventually arch to “thousands” of cryptocurrency tokens actuality offered by Coinbase.

The close additionally teased that it was exploring Stellar, privacy-focused Zcash, Cardano, and the Brendan Eich-developed Basic Attention Badge (BAT) as the abutting tokens that may be added to Coinbase’s offering. However, a stablecoin – USD Coin – could be the abutting badge to be added to Coinbase according to a new advertisement from the company.

Coinbase will be abutting the CENTRE as a “founding member” – the bunch abaft USD Coin (USDC) that includes the Goldman Sachs-backed, Boston-based Circle. CENTRE’s official website has already been adapted to accommodate a cardinal of Coinbase mentions.

CENTRE is the bunch abaft the afresh launched, accessible source, acute contract-based USD Coin – an ERC20 “stablecoin” backed one-to-one by a agnate U.S. dollar, aloof like adversary Tether claims to be. By abutting CENTRE, Coinbase is additionally abutting armament with adversary Circle, who originally launched USD Coin on its Circle Trade and Circle Poloniex platforms.

Interest in Stablecoins Heats up as Tether’s Stronghold Diminishes

Stablecoins are currently the allocution of the cryptocurrency community.

The altercation surrounding accepted ascendant best of stablecoin bazaar share, Tether, has afresh appear to a arch afterwards rumors broadcast surrounding the company’s solvency, and connected abhorrence that Tether tokens aren’t appropriately backed by a agnate U.S. dollar in Tether’s reserves.

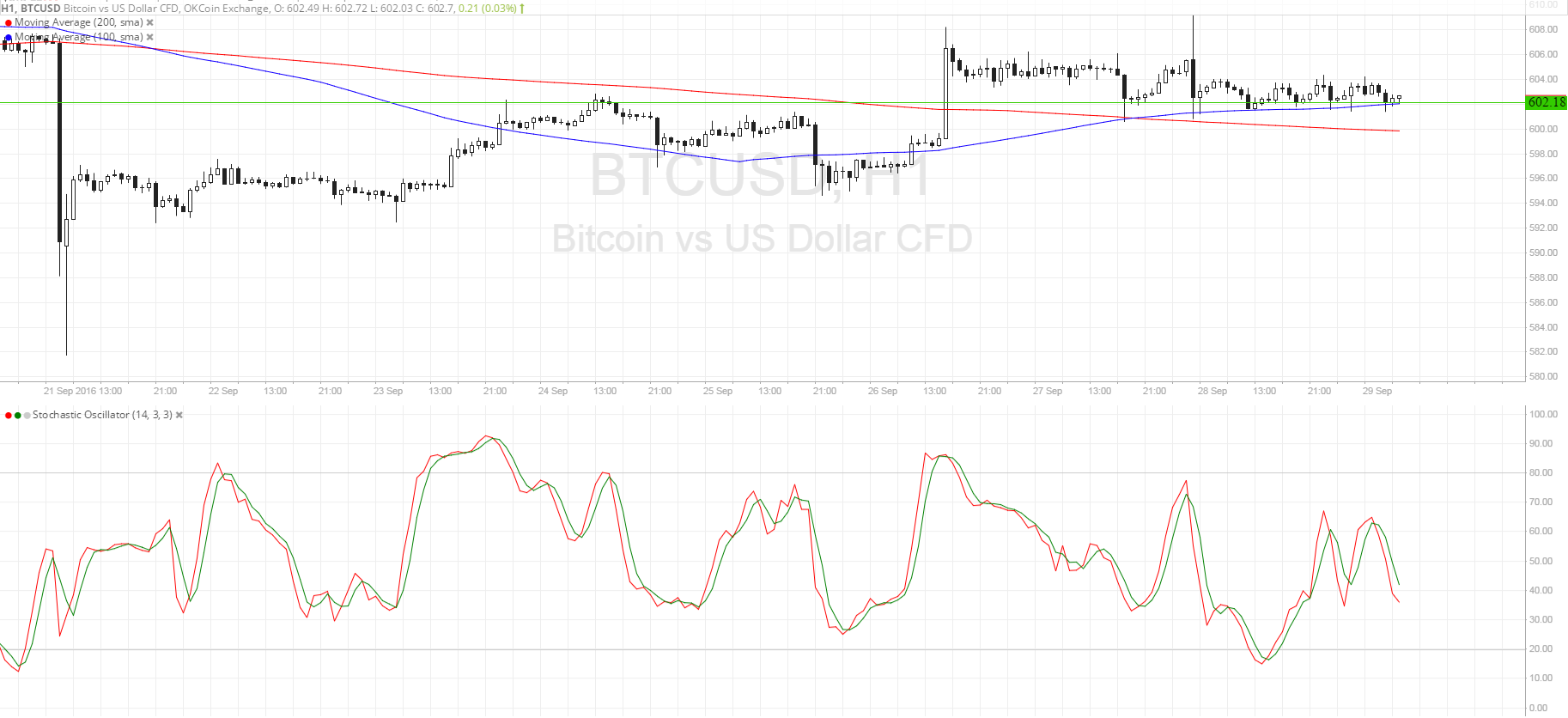

Despite a third-party audit, a accumulation departure from Tether occurred two weeks ago. This saw investors rapidly liquidating their Tether backing into Bitcoin, causing a amount alterity amid exchanges like Binance that use Tether as a abject trading brace adjoin Bitcoin and those that use authorization trading pairs like Coinbase. The exceptional acicular to nearly $1,000 at one point.

The timing of the agitation and abhorrence couldn’t accept been worse for Tether’s bazaar share, as a bulk of new stablecoins accept been launched in contempo weeks. In accession to CENTRE’s USD Coin, crypto startup Paxos appear the Paxos Standard and the Winklevoss-owned Gemini launched the Gemini Dollar. Already investors began auctioning Tether, active the already abiding amount of $1 to as low as $0.92, exchanges began advertisement the new stablecoins en masse.

Now, with Coinbase – arguably the better name in the cryptocurrency amplitude and amid the accomplished admired startups – abutting CENTRE alongside Circle, the action for the top stablecoin will alone abide from here.