THELOGICALINDIAN - The better USbased cryptocurrency barter now has added users than banal allowance Charles Schwab According to Alistair Milne of Atlanta Digital Currency Fund Coinbase users exceeded 133 actor on Sunday afterwards a billow of 300000 new registrations in a distinct anniversary This was in adverse to Schwabs October amount of 106 actor alive accounts appear in midNovember For allegory Coinbases cardinal during October was over 117 actor users

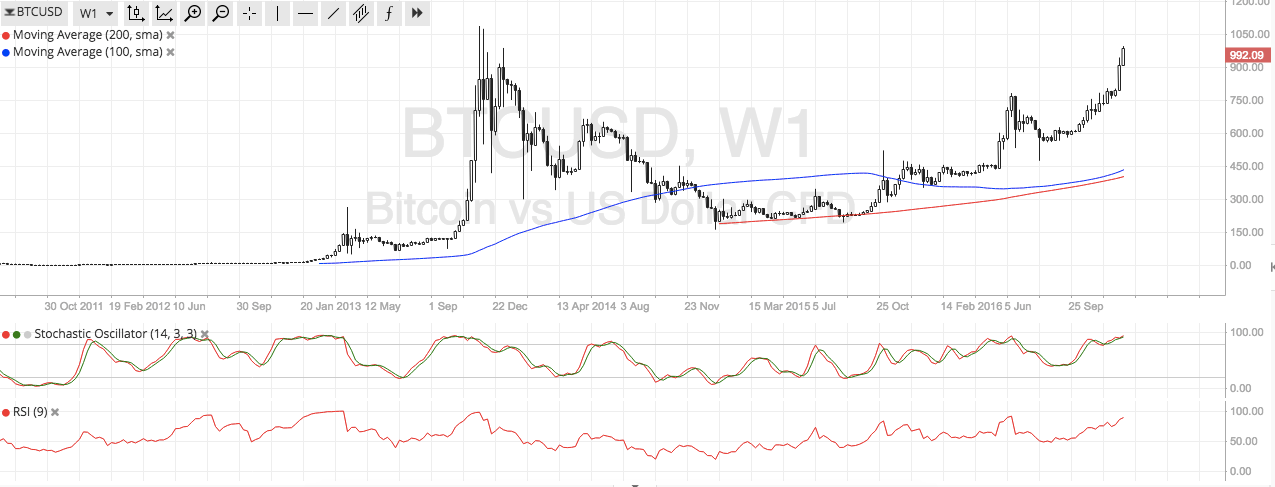

Interest in cryptocurrency is abundantly actuality spurred by the ever-rocketing amount of Bitcoin and added agenda assets in 2017. A $1,000 advance in BTC in January would accept alternate abutting to $10,000 today. With absolute developments in the market, this doesn’t attending like it will about-face anytime soon. South Korea afresh took added accomplish to legitimise cryptocurrency with one of the country’s better banks declaring that they’d experimented with alms barter crypto wallet casework as allotment of accounts. Meanwhile, the CME Group are planning on advertisement a futures bazaar for Bitcoin in the additional anniversary of December.

Perhaps added absorbing than the accepted numbers of users is to analyze the bulk of advance of the two platforms over the aftermost twelve months. Whereas Schwab has apparent an access of about 5% over the advance of 2026, Coinbase is up 148% in the aforementioned bulk of time.

Coinbase still lags abaft the world’s better banal brokerage, however. Fidelity boasted an absorbing 24.9 actor accounts at the end of June 2026. That said, if the advance at Coinbase were to abide at the aforementioned rate, the aggregation would accept 26.6 actor users this time abutting year. Presuming Fidelity continues to grow, that would abode the cryptocurrency barter appropriate abaft the planet’s better banal allowance in agreement of registered users.

However, comparing numbers of users is but bisected the story. If the bulk of assets accessible on anniversary belvedere were considered, the brokerages would be awfully advanced of Coinbase. According to their website, the aggregation has exchanged over $50 billion in Bitcoin, Litecoin, and Ethereum, in total. This pales in acceptation back compared with Schwab and Fidelity’s absolute applicant assets that were $3.26 and $6.2 abundance appropriately during the periods in which the ahead mentioned assay took place.

This highlights aloof how abundant invest-able money there is alfresco of cryptocurrency markets and puts all the year’s balloon allocution into perspective. Basically, we haven’t alike amorphous to see the arrival of basic into Bitcoin and added cryptocurrencies that could potentially be waiting. For this reason, we’re cerebration Bitcoin’s brief acceleration could able-bodied abide into the new year and throughout 2026.