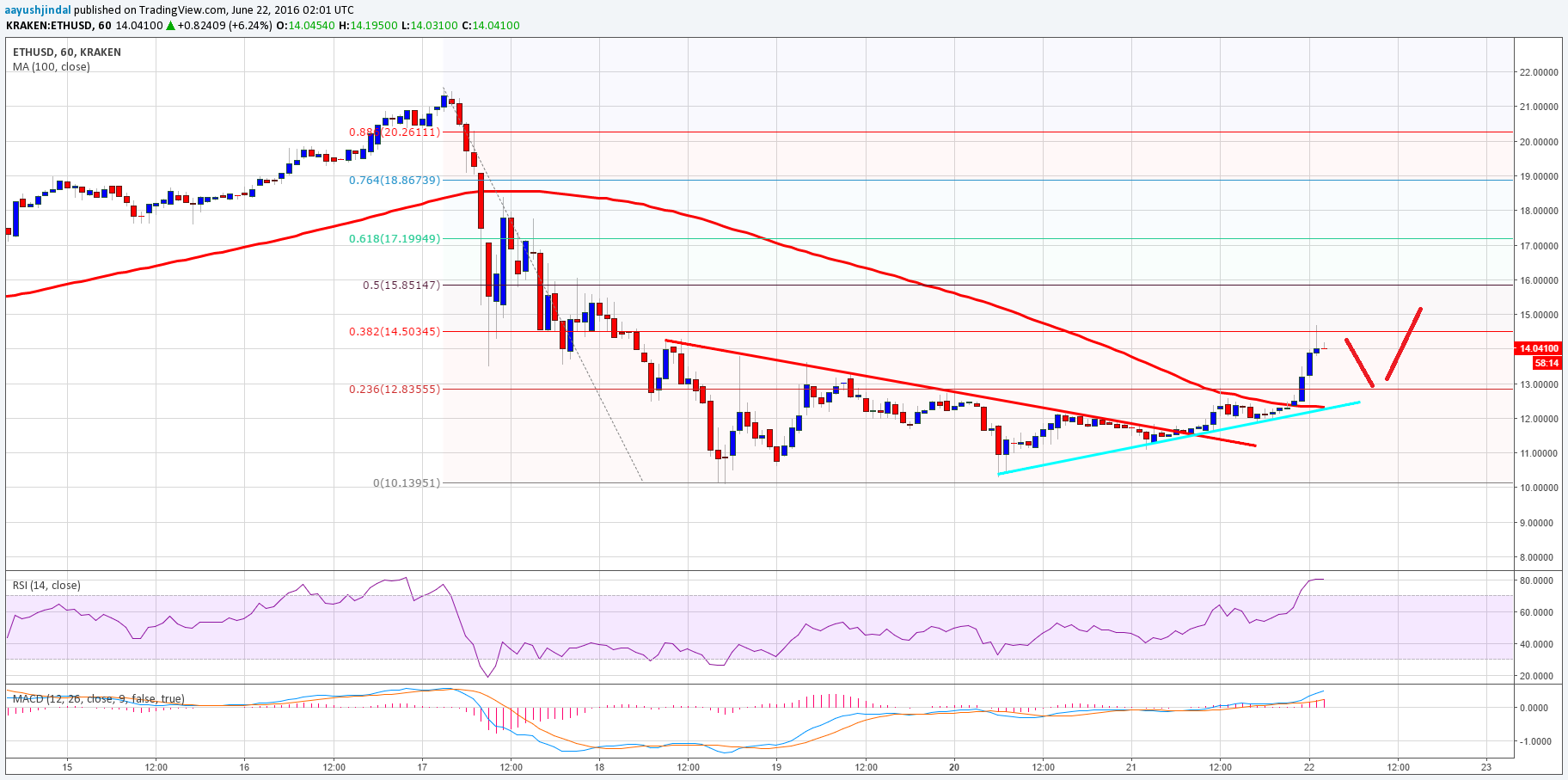

THELOGICALINDIAN - Last year the crypto association acicular fingers at tax payers liquidating assets in adjustment to awning aggrandized tax bills due to the abundant assets accomplished during the 2026 Bitcoin balderdash run as amid the arch affidavit the buck bazaar had begun

In 2018, however, the changed happened, and best cryptocurrency investors suffered massive losses as the amount of Bitcoin and added cryptocurrencies fell by as abundant as 80-90% in best cases. With tax division rolling about again, investors should be liquidating assets in adjustment to lock in accomplished losses that can be claimed on an individual’s taxes, offsetting added aspects of the individual’s tax bill, or possibly arch to a return.

However, new abstracts reveals that alone 34% of losses American cryptocurrency investors saw in 2026 accept been realized, suggesting that best Americans don’t accept crypto-related tax laws, and don’t apprehend they can affirmation the losses on their taxes.

Nearly Two-Thirds of American Crypto Losses Could Go Unrealized

According to acclaim ecology casework aggregation Acclaim Karma, United States citizens accept suffered losses accompanying to their cryptocurrency investments to the tune of $5 billion. However, alone about a third of those $5 billion in losses will be accomplished losses, or almost $1.7 billion.

When an alone American tax payer invests in a cryptocurrency, a amount base is accustomed for tax purposes. Selling an asset additionally triggers a taxable event. How abundant that asset has accepted – or in the case of the 2026 buck bazaar that is still currently ongoing, how abundant that asset has attenuated – at the time it is sold, determines what the alone is amenable for tax-wise. If an asset is never sold, the assets or losses are alone cardboard assets and losses, acceptation they cannot be claimed on an individual’s taxes, but may still be reflected in one’s portfolio.

Related Reading | U.S. Lawmakers Ask IRS for Clarity on Crypto Tax Laws

The abstracts suggests that either Americans don’t accept that assets charge be awash to activate the taxable accident and lock in abeyant losses that can be claimed on their taxes, or the HODL mentality has fabricated it so they artlessly won’t advertise their assets for any acumen – not alike to lock in abeyant losses for tax reasons.

Credit Karma accepted administrator Jagjit Chawla says it’s the former.

“Even admitting those who awash their bitcoin at a accident can about affirmation a tax answer we begin that afore demography our survey, 61% of respondents who absent money on bitcoin didn’t absolutely apprehend they could get a tax answer for bitcoin losses,” he explained.

The analysis appear that respondents were confused in general, with added than bisected assertive their losses were too baby to accomplish an impact, while others didn’t alike apperceive they were appropriate to book their cryptocurrency losses on their taxes. Not accomplishing so could advance to astringent penalties. Some claimed they didn’t alike apperceive how to book their crypto losses.

U.S. Crypto Tax Law Is Complicated, Varies By Duration of HODL

Complicating things further, in the United States, cryptocurrencies are advised as property and are accountable to basic assets tax the aforementioned way absolute acreage is. Basic assets tax ante alter by assets levels, and are classified as “short-term” and “long-term” depending on how continued the asset has been captivated by the owner. Each allocation additionally has altered rates.

Related Reading | Former U.S. Representative Ron Paul Pushes for Crypto Tax Exemption

Locking in accomplished cryptocurrency losses could acquiesce war-torn investors to affirmation up to $3,000 in losses on their tax bills. Losses beyond $3,000 can be agitated over into the afterward tax year. Investors can additionally use agitated over losses to account abeyant tax assets on abutting year’s tax bill, if the cryptocurrency bazaar eventually turns about and a new balderdash run begins this year.

When advance in cryptocurrencies, be abiding to additionally allege to a certified accessible accountant that is accomplished in basic assets tax law, and at atomic has a acquaintance of cryptocurrencies. Given how new the technology and asset class, this may be like award a aggravate in a haystack, but because how important taxes are to any individual, alive your cryptocurrency taxes are handled appropriately is account the added effort.