THELOGICALINDIAN - Last anniversary the cryptocurrency bazaar burst alongside the banal bazaar and the blow of the apple of finance

After the fallout, cryptocurrency exchanges accept been larboard a apparition town, according to abstracts extracted from adjustment books of top trading platforms.

Cryptocurrency Exchange Order Books Empty, Market is a Ghost Town

Bitcoin and the blow of the cryptocurrency bazaar accomplished amid one of the affliction selloffs in the asset class’s abbreviate ten-year history.

The collapse in cryptocurrencies hit alongside celebrated losses in the banal market, gold, silver, oil, and about every added bazaar in the banking world, as investors seek to banknote their assets into banknote to authority through what is the abutting accident to an apocalypse the apple has anytime witnessed.

Related Reading | Cryptocurrency Market Panic Selloff Barely Fazed Long Term Holders

The carelessness larboard the cryptocurrency bazaar in shambles, and adjustment books a apparition town, according to abstracts extracted by one crypto analyst.

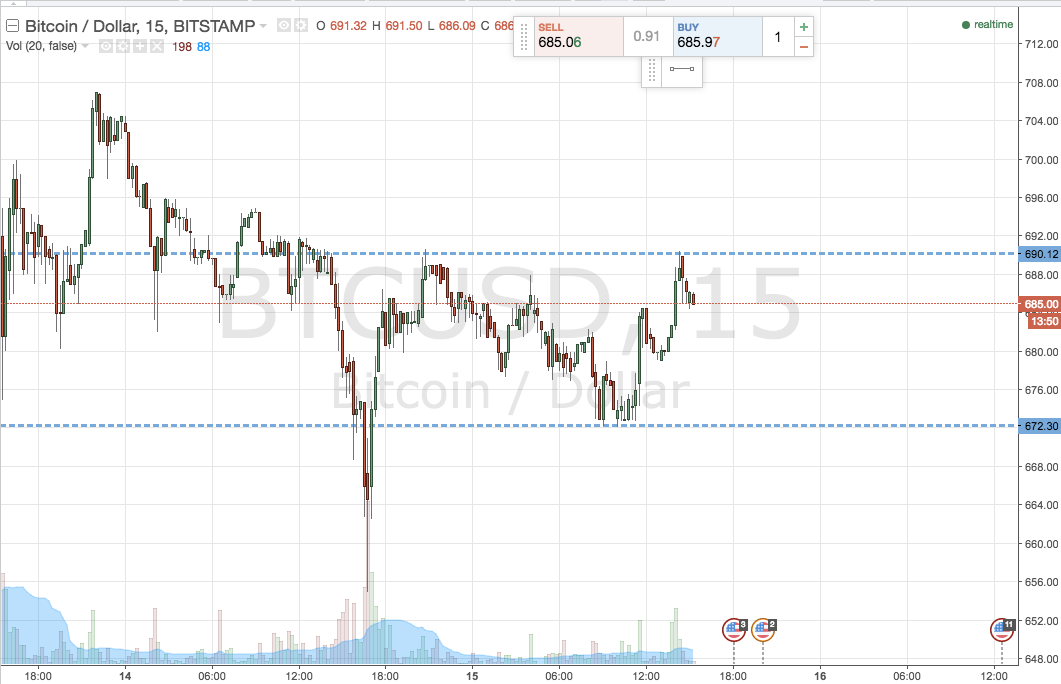

The analyst shows a allegory of clamminess in crypto barter adjustment books above-mentioned to the abatement from $7,000 to beneath $5,000, adjoin clamminess column bead to beneath $5,000.

Talking about low liquidity, this is XBTUSD at 7000s appropriate afore the drop, and at 5000s after.

Only orders aloft $1M are shown, absolutely a apparition boondocks pic.twitter.com/ooG5wovVCf

— red (@redxbt) March 18, 2020

In the aboriginal chart, orders can be apparent placed at assorted levels aloft and beneath the amount action. In the additional chart, about all of the orders that were already arresting accept been pulled.

It’s account acquainted that the orders were filtered to alone appearance any with a position admeasurement over $1 actor or more, so there is still affairs and affairs activity, however, it is these ample bazaar maker blazon orders that are now missing.

Without liquidity, asset prices move rapidly and with acute volatility, which is why we’re currently seeing hundred dollar amount fluctuations aback and forth, after a bright breach of any range.

It’s a alarming environment, as any large-sized orders can bright out what little exists in the adjustment book, tanking prices as a result.

The carelessness could account Bitcoin and added cryptocurrency assets to collapse to acute lows. However, the abridgement of clamminess works both ways, and massive buy orders could drive up the amount of the asset actual quickly.

Related Reading | Market Cycle Psychology: Did The Cryptocurrency Market Just Enter Full Anxiety Phase?

The one admonition is that this may be a bridle preventing bigger buyers from demography a position in Bitcoin, as any ample buys could clean out the adjustment book and account the client to pay more college prices per BTC as they drive the amount up adjoin themselves.

On the cast side, any ample affairs could additionally be beat at this point, accustomed the currently low prices and lack of liquidity actuality a compound for disaster.

Any ample affairs at this point would be fueled by cryptocurrency investors accommodating to booty a above accident and accident aloof to banknote out amidst a crisis – however, such a book cannot be disqualified out during a black swan event steeped in uncertainty.