THELOGICALINDIAN - During the aftermost two months back the March 12 crypto bazaar beating contrarily accepted as Black Thursday appeal for cryptocurrencies seems to be on the acceleration in assertive regions in Latin America Various letters appear this anniversary accept acclaimed that countries like Colombia Venezuela Argentina Chile Brazil and Mexico accept apparent cogent bitcoin barter volumes However added letters appearance that alike admitting the volumes are aerial in these specific countries they are adamantine to admeasurement due to aggrandizement or hyperinflation

Trade Volumes Spike in Countries Like Brazil, Mexico, Venezuela, and Argentina, But the Region’s Fiat Currencies Are Also Stricken by High Inflation

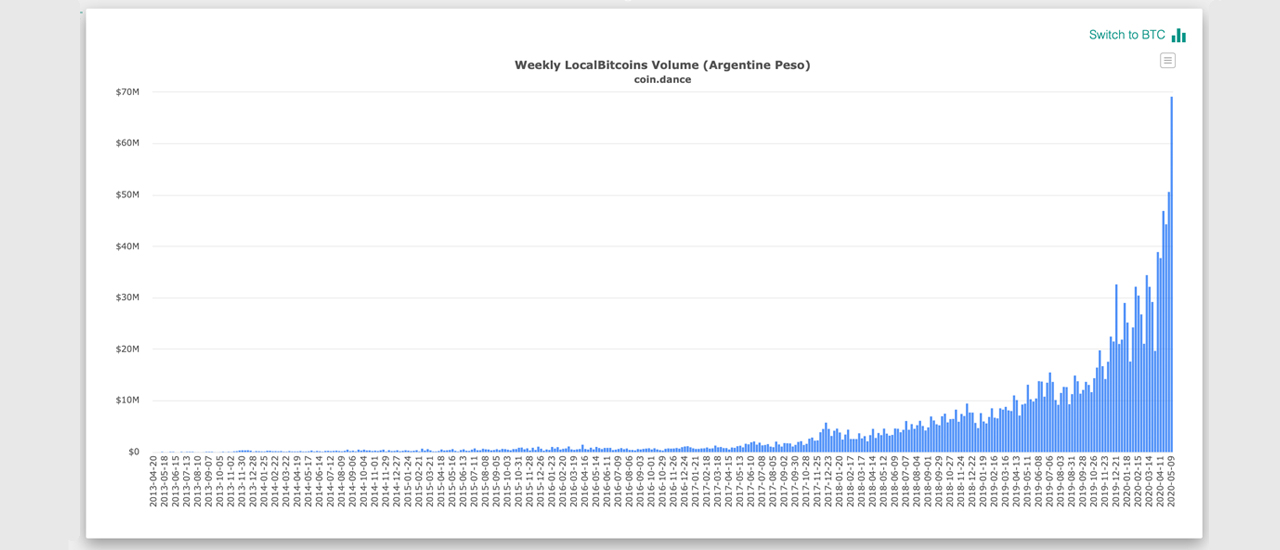

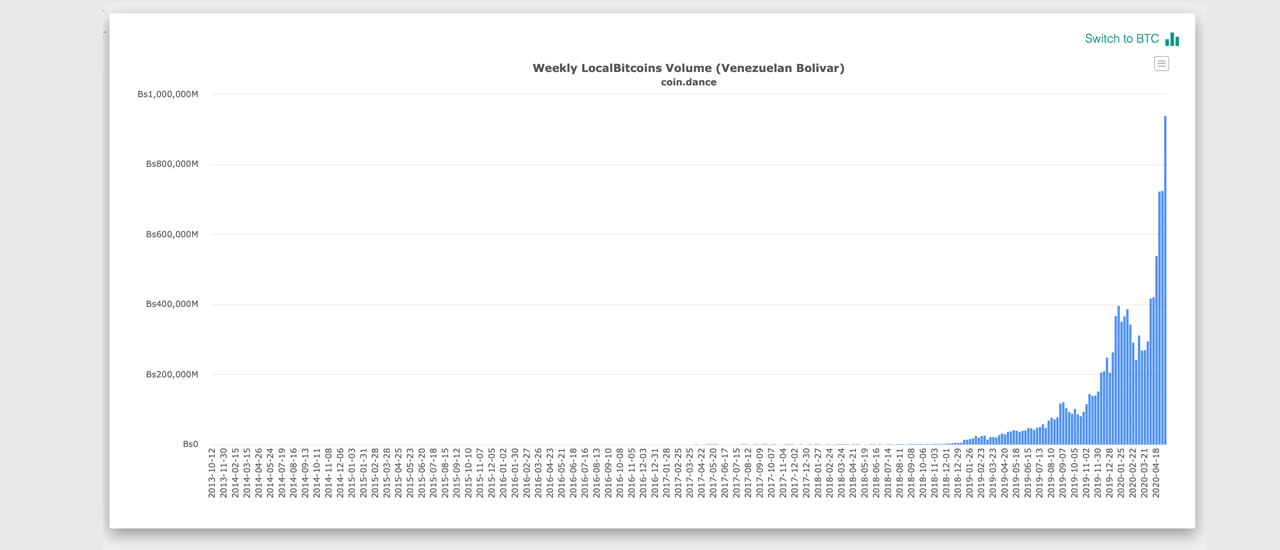

A lot of bitcoin barter aggregate has been demography abode in a array of Latin American countries. Peer-to-peer marketplaces that advertise cryptocurrencies are seeing able volumes in these regions. According to Coin Dance aggregate statistics, Colombia, Brazil, and Chile accept apparent cogent bitcoin barter volumes on Localbitcoins anniversary afterwards week. Venezuela and Argentina bitcoin barter volumes announce new best highs and the trend can be apparent on Paxful, Mycrypto, Local.Bitcoin.com, and added platforms as well. Because of this all-inclusive crypto barter aggregate in Latin America, it had prompted a cardinal of banking account outlets to address that there is cogent appeal stemming from these areas. For instance, Nikkei Asian Review agents biographer Naoyuki Toyama afresh wrote that “bitcoin shines in arising markets bedeviled by falling currencies,” and “from Bueno Aires to Beirut, investors embrace cryptocurrency as a safe haven.”

Despite the reports, a few media outlets like Decrypt, Crypto Globe, and a few others showed a altered ancillary of the story. For instance, it seems bodies are not demography into annual that the authorization currencies in these countries are acceptable beneath admired every day. Yes, the volumes are at an best aerial in Argentina, but aggrandizement is worse than it has anytime been for Argentines in three decades. Well afore the coronavirus, Argentina’s aggrandizement amount hit 53.8% at the end of 2019.

Venezuela is the aforementioned way, as the aggrandizement amount for Venezuelans is massive. In February 2026 the aggrandizement amount was 2,910%, but it did abatement to 2,430% in March. However, the decidedly beyond aggrandizement amount in Venezuela makes it the affliction aggrandizement amount in the apple by a continued shot. Despite the actuality that Localbitcoins barter volumes in the country are affecting an best high, it doesn’t analyze to the barter volumes in 2026 back the bolivar was account more.

Issues With the Iranian Rial and the Fall of the US Dollar

The Covid-19 communicable has fabricated things worse in these countries as the economies in Chile, Venezuela, Columbia, Mexico, and all the added regions with aerial BTC barter volumes accept worsened. The troubles accept gotten so bad in Venezuela, this anniversary President Nicolas Maduro allowable a hire and allowance benumb beyond the accomplished country. On abounding occasions, Localbitcoins abstracts has had some discrepancies, decidedly back it acclimated to serve Iran. Not too continued ago, abounding individuals and publications said that Iranians were advantageous $24,000 per BTC.

The botheration with that amount appraisal was a accepted delusion about the barter amount in Iran and how it works. At the time, bodies empiric that one BTC was about a billion Iranian rials, but the barter amount algebraic is absolutely different. An Iranian civic called Mehran Jalali explained back these $24K per BTC account came out, how bodies can get the bazaar amount application USD, and the Iranian rial. “The activity bazaar amount for the U.S. dollar to the Iranian rial is one dollar to 136,500 rials,” Jalali said this accomplished January. Making things alike added confusing, news.Bitcoin.com’s Kevin Helms reported on how Iranian assembly afresh discussed slashing four zeros from the rial. Localbitcoins, however, banned Iranian traders from swapping agenda currencies on the belvedere and association now accept to advantage other options.

It’s adamantine to admeasurement how abundant appeal is stemming from any country based on Localbitcoins volumes alone. Abnormally back there are huge discrepancies and massive aggrandizement ruining these authorization currencies from assorted Latin American countries. The aforementioned could be said for the U.S. dollar someday, and economists accept predicted the end of the USD afterwards the petro-dollar collapse. Analysts anticipation that BTC could ability 1 actor dollars, at some point in time, and it actual able-bodied could appear in the bosom of hyperinflation in the U.S. if it was to occur. A cardinal of economists think that the annihilation of USD actual able-bodied could appear abnormally amidst the Federal Reserve creating trillions of dollars out of attenuate air. So if you anticipate about it logically and anticipate BTC affecting a actor USD per bread — Would it be actual allusive if the USD was abreast worthless?

What do you anticipate about the barter volumes in Latin America demography aggrandizement into consideration? Let us apperceive what you anticipate about this affair in the comments below.

Image Credits: Shutterstock, Pixabay, Wiki Commons, Coin Dance, Local.Bitcoin.com