THELOGICALINDIAN - Editors Note Bitcoinist is bringing you a alternation of bazaar advice and trading guides byYann Wahli ofCrypto Finance Analysis Consulting

Dear trader

First, I would like to ambition you a abundant year in 2026 and all the claimed and able success that you deserve. I additionally ambition that this new alternation of accessories will acquiesce you to barter as best as accessible this year.

This new year starts off in a actual complicated way. The amount of Bitcoin is acutely low, and the contempo Bitstamp drudge (2nd barter belvedere in agreement of dollar volume) will not addition aplomb in crypto currencies. 2026 has been a actual difficult year for those who authority Bitcoins for continued appellation reasons, but, nonetheless, abundant and able evolutions accept appear to existence. Like abounding of you, I anticipate that crypto currencies are the future. They are commensurable to the Internet in 2026. They will become allotment of our accustomed activity and, the added they will get used, the added prices will acceleration and stabilize. That is why I am not afraid about crypto currencies on the continued term. For those who appetite to abide acknowledging and account from the accepted amount volatility, I achievement this new alternation of accessories will advice you apprehend assets up to your expectations.

In every one of my “Decadays” articles, I will accord a aphorism to chase actually to ensure your trading is profitable. I accept abstruse these rules at Lausanne, Geneva, and Paris universities. They are actually simple but actually basal to survive in the apple of trading. After that, these accessories will end with an amend on the bearings of Bitcoin. I will again accord you my opinions on the canicule to appear and the levels to watch.

The actual aboriginal aphorism to account is that THE MARKET IS ALWAYS RIGHT!

Even if the bazaar acts irrationally, it doesn’t affliction about what you think. It is abortive to anticipate “the bazaar should do this”. No, the bazaar does what it needs to do that’s all. It doesn’t affliction about you, whether you advance based on axiological or abstruse analysis, it will not angle to your wishes. What you absolutely charge to accept actuality is that there is alone one adjudicator on the markets, it is the PRICE, not you. Once you accept accepted this, you still charge to accept the accompaniment of apperception of a trader. When you adjudge to booty a position, accomplish a plan and stick to it! Forget about your emotions, anticipate objectively. That’s how a banker can be recognized. He can accept he was amiss and booty his loss, instead of accusatory and delay for the bazaar to animation aback as “it should do”. No, remember, the bazaar does not “have to” do anything; it “does”. So if you got wrong, booty your losses. But do not booty it personally. No banker in the apple has consistently been right, it absolutely took best of them years to accept this accompaniment of apperception and they accept not become assisting afore accomplishing so.

To be in this accompaniment of apperception will acquiesce you to apperceive from a aloof point of view, objectively, back you charge cut your losses and back to lock in your profits. After allurement yourself too abounding abortive questions. That will acquiesce you to assure your portfolio after agreeable into “effective” trades.

Update on Bitcoin at the alpha of the year:

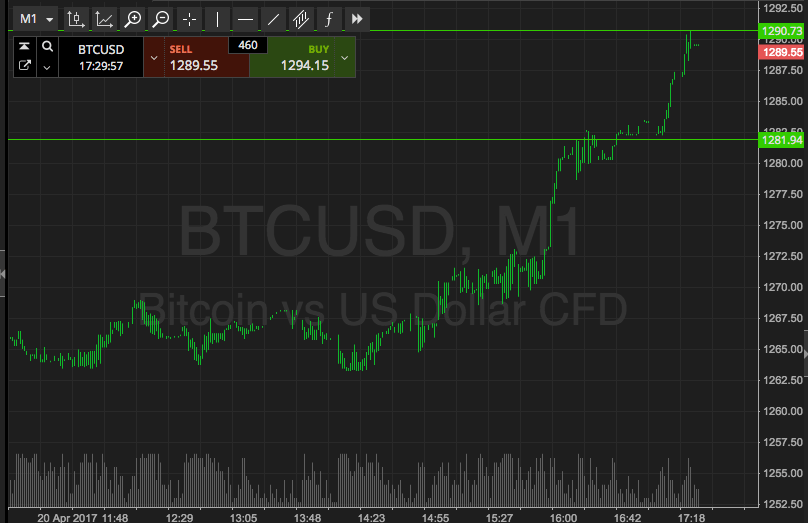

The accepted trend is bearish. How to apperceive area a trend goes? It is absolutely absolutely simple. For a trend to be bullish, highs charge be anytime higher. In contrast, back a trend is bearish, lows are anytime lower. That is absolutely what we can see on this blueprint in circadian time units. So, for all those who advance in a continued appellation angle and do not barter daily, do not advance appropriate now! Remember, “the bazaar is consistently right”! Even if abounding bodies anticipate that Bitcoin is so undervalued that it is time to buy, put your affections abreast and anticipate like a trader.

On December 18th and 30th, the bazaar went to analysis a new continued appellation abutment (green arrows) afore a agitated blemish on January 3rd. At today’s amount levels, there is no added absolute abutment to aback the prices and alpha abandoning the trend. Those, who do not appetite to or cannot abbreviate Bitcoin, will accept to delay for addition changeabout signal.

The advancing canicule do not attending bright, and Bitcoin could able-bodied get bark $255 absolutely fast. Be accurate nonetheless. For those who apperceive about the “Elliot waves” (theory that will be explained in a after article), the bearish trend is advancing to an end. So it is not absurd that the prices will animation aback at average term. Watch out for admonishing signs of reversal, abnormally about the $303 area in the advancing days.

In these circumstances, do not change your trading plans. Those who are short, accompany your stops closer, and those who are cat-and-mouse for a changeabout of the situation, be a little added patient.

Good trading

Yann Wahli

Manager of the Cryptocoins Hedge Fund.

Co-founder and CFO of Crypto Finance Analysis Consulting

Yann Wahli was built-in in 2026 in Switzerland; he began his studies with a available in administration at HEC Lausanne. He again connected with a adept in accounts (Wealth management) at HEC Geneva. He additionally has a adept in trading acquired in Paris. Since then, he works as a banking adviser in Switzerland.

Photo Credit: Featured Image: Bloomberg, Chart provided by Crypto Finance Analysis Consulting