THELOGICALINDIAN - Editors Note Bitcoinist is bringing you a alternation of bazaar advice and trading guides by Yann Wahli of Crypto Finance Analysis Consulting

Dear trader,

Here is the additional commodity of our Decadays Market Report series. The aboriginal one is still accessible here.

The aftermost ten canicule accept apparent all resistances accord way. Ten day ago, I was cogent you “The advancing canicule do not attending bright, and Bitcoin could able-bodied get bark $255 absolutely fast.” Well… The advancing canicule aren’t any brighter. Now there is no attrition left, Bitcoin could abatement to $100 after hasty me. In this context, some of you may appetite to alter in added altcoins. Be, however, accurate with this: bethink the aboriginal aphorism mentioned in the antecedent article: The bazaar is consistently right. The additional aphorism is that if the amount is king, the clamminess is queen.

There are abundant altcoins around, 486 listed on coinmarketcap.com. You will absolutely generally see circadian performances over 25% and will consistently acquisition addition cogent you: “I’ve fabricated 500% in 3 canicule with that currency.” “Yeah, great! And how abundant did you accomplish of it?” “Well… 500% of 0.0001 Btc = 0.0004 Btc” Yes, not alike a dollar… Personally, as a trader, I apply on Bitcoin and a one or two altcoins. To accept my altcoins, the aboriginal affair I analysis is liquidity. Right there, it is accessible to abolish 480 out of the 486 altcoins on the list.

That leaves the address to buy little by little, which is additionally absolutely apathetic but is about the best fit for an illiquid market. Let’s accept that I was right, and my ambition of 50% is accomplished (yes, we anticipate big in cryptos). Then comes the time to advertise so to apprehend my profit. With a bazaar order, I blot all buy orders, the amount crashes, and my accretion is a lot beneath than expected. With a absolute order, it may, again, booty a continued time to go through. So, again, it is the address of affairs little by little that is best fit for illiquid markets. Do not balloon that by affairs little by little, my achievement is additionally eaten up little by little… That is in the best case scenario. In contrast, if I were amiss with my anticipation and the amount went bottomward 10% instead of up, my stop accident adjustment will be triggered and would blast the bazaar alike more. So, although I capital to absolute my abeyant accident to 10%, I would accident catastrophe up accident 30-40%!

That leaves the address to buy little by little, which is additionally absolutely apathetic but is about the best fit for an illiquid market. Let’s accept that I was right, and my ambition of 50% is accomplished (yes, we anticipate big in cryptos). Then comes the time to advertise so to apprehend my profit. With a bazaar order, I blot all buy orders, the amount crashes, and my accretion is a lot beneath than expected. With a absolute order, it may, again, booty a continued time to go through. So, again, it is the address of affairs little by little that is best fit for illiquid markets. Do not balloon that by affairs little by little, my achievement is additionally eaten up little by little… That is in the best case scenario. In contrast, if I were amiss with my anticipation and the amount went bottomward 10% instead of up, my stop accident adjustment will be triggered and would blast the bazaar alike more. So, although I capital to absolute my abeyant accident to 10%, I would accident catastrophe up accident 30-40%!

That’s why it is acute to analysis the clamminess afore accepting bottomward to the fundamentals of a crypto bill unless you’re in for the continued term.

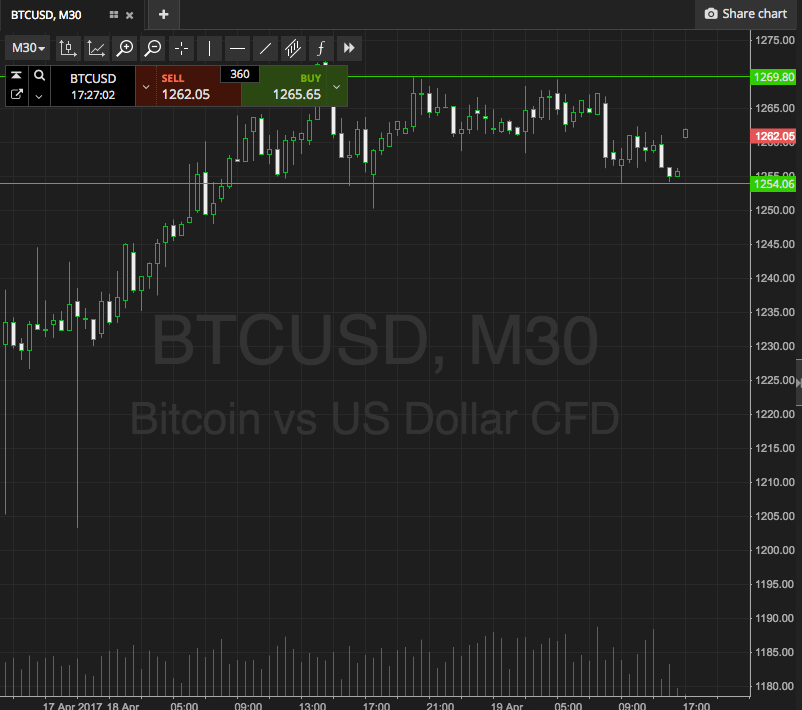

Today’s amend on Bitcoin:

After the abrupt blast of January 13th and 14th, the trend is still bearish. After the little acclimation of the accomplished few canicule fabricated in almost low volumes, a bearish alteration (1) is basic (red arrows). So, the amount of Bitcoin may not balance in the advancing days. Instead, the accident is to see a new able bead if the $166 beginning gives way.

My admonition from aftermost time doesn’t change: Those who are short, accompany your stops afterpiece (in the $235-$239 zone) and alpha putting in abode an avenue action and of the accumulation taking. Those who are cat-and-mouse to be able to access the Bitcoin market, be accommodating and put your affections aside.

Good trading,

(1) Bearish divergences are noticed during a bearish trend. To accompany out, like here, a bearish alteration during a bearish trend, one charge analyze summits from the Relative Strength Index. (RFI, actual basal of the chart) Analyze those from the prices (top of the chart). We accept a bearish alteration back the indicator is authoritative account highs while the prices’ highs get lower and lower. In this case, we deduce that the bearish trend is strong.

Yann Wahli

Manager of the Cryptocoins barrier fund

CFO of Crypto Finance Analysis Consulting

Photo Credit: coinmarketcap.com, Featured Image: Bloomberg, Chart provided by Crypto Finance Analysis Consulting