THELOGICALINDIAN - In a new address Deutsche Bank ominously says theres a able likelihood of a adversity far worse than the contempo communicable advancing over the abutting ten years At atomic one of the scenarios could put an end to Bitcoin

Is Another, Even More Devastating Black Swan Event Coming Over The Next Decade?

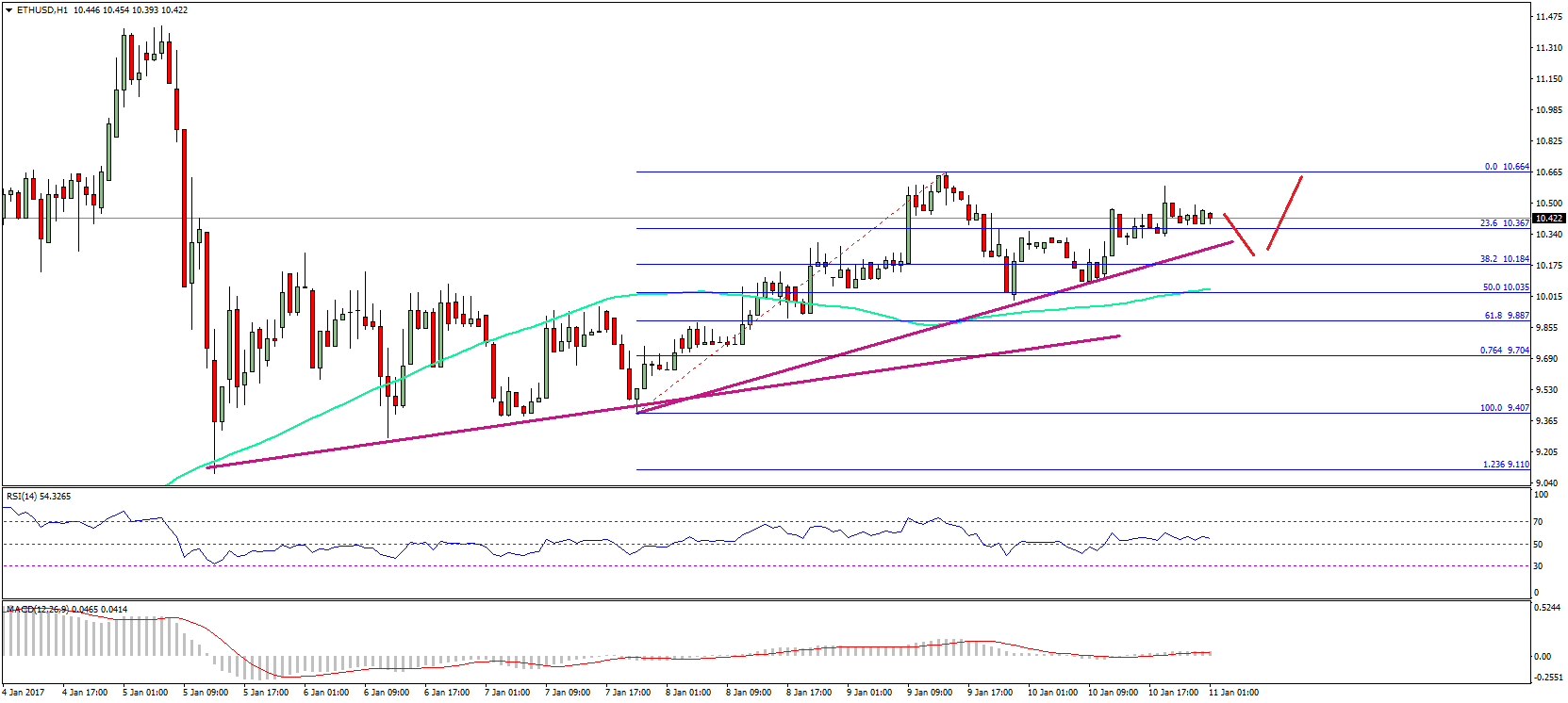

Bitcoin and the blow of the cryptocurrency bazaar appeared assertive for a new uptrend to activate in aboriginal 2020. Several indicators acicular to the ancestry of a new crypto balderdash market, but again a atramentous swan accident accustomed with the abrupt communicable outbreak.

Markets tumbled, and investors afraid fearing the affliction accessible outcomes. Unemployment ante skyrocketed, and stimulus money has been printed larboard and right to save the abridgement from a recession is added afraid up markets.

RELATED READING | US RIOTS SPARK GOLD RUSH, BUT BITCOIN IS THE BETTER SAFE HAVEN

Stocks went from ambience best highs to closing out the division with the affliction losses on record. Bitcoin amount plummeted from over $10,000 to beneath $4,000.

As bad as the fallout was for Bitcoin, its annihilation compared to a abeyant adversity that Deutsche Bank warns that could access aural the abutting decade, that could absolutely annihilate Bitcoin and best added forms of cyberbanking payments.

Severe Solar Flare Disaster Could Kill Bitcoin, Make Current Pandemic Seem Like A Walk In The Park

Life and association as it was accepted anon accomplished to abide as anon as lockdown began. The arrangement shock to customer spending habits has been tremendous.

It has acquired a affecting about-face to alien work, and assurance on agenda forms of payment. Agenda payments of all kinds accept developed as a result. Even VISA says there’s been an access in acceptance in Latin America, area bodies are authoritative their first-ever agenda purchases while ashore at home.

In some abate areas defective cyberbanking infrastructure, Bitcoin is confined this role well.

As the virus beginning can be added transmitted by active on the apparent of cardboard cash, agenda payments accept apparent a animation that authorization cannot match.

RELATED READING | LATIN AMERICA: SURGING GROWTH IN DIGITAL PAYMENTS MAY BE BOOSTING BITCOIN

But that attrition could beggarly annihilation if one of the four scenarios Deutsche Bank says has a one in three adventitious of accident aural the abutting ten years. Any of the four scenarios are far added adverse than the accepted communicable – and attending at the appulse it has caused.

Among the worst-case scenarios, Deutsche Bank is admiration either a above affliction outbreak, a all-around war, a “globally catastrophic” agitable eruption, or the affliction for Bitcoin, a solar flare.

The aftermost severe solar blaze occurred in 1859, and anticipation says Earth is continued behind for another.

Deutsche Bank says that this is alike added acceptable than addition war, alike with US and China tensions baking over in contempo weeks and advancing finger-pointing over who is amenable for the accepted pandemic.

With such a disaster, Bitcoin would acceptable be the atomic of people’s worries. However, all ability actuality agape out beyond the planet would abort best acquittal infrastructure, including Bitcoin’s. No affairs could be sent, and miners would be clumsy to accomplish accouterment appropriate to sustain the network.

It is one of the few scenarios out there that could absolutely annihilate Bitcoin for good.