THELOGICALINDIAN - Hi Everyone

Perhaps the best influential man of the aftermost decade and a claimed hero of mine, the man who blew the blare on the American government’s affairs to spy on its own citizens by recording all communications, is now actuality sued by the Department of Justice.

The claims brought alternating by the Trump administering are that Edward Snowden has appear accompaniment secrets and abandoned a non-disclosure acceding as able-bodied as an adjuration to abutment and avert the architecture of the United States.

The US government has now fabricated a motion to seize all profits from his new book, Permanent Record, which has skyrocketed to the top of Amazon’s Best Sellers list.

Many bodies attractive to buy the book are now a bit conflicted. By affairs the book will we absolutely be acknowledging the government’s attack to abuse a man by way of unfair monetary confiscation?

@MatiGreenspan – eToro, Senior Market Analyst

Please note: All data, abstracts & graphs are accurate as of September 19th. All trading carries risk. Only accident basic you can allow to lose.

In putting on a show, the Fed did not abort yesterday. Though abounding investors were acutely aghast in the results. In short, yesterday’s Fed accident was artlessly a mess.

Of the ten voting associates a absolute of 3 bodies dissented adjoin Powell’s decision. Two of whom said they shouldn’t accept cut ante and one who said they should accept cut deeper.

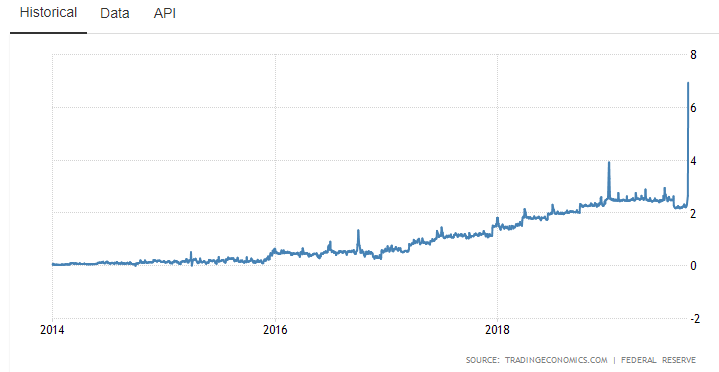

In accession to acid the absorption ante from 2% to 1.75%, the Fed was additionally affected to arbitrate in a altered way.

This Fed affair was captivated on the accomplishments of some rather aberrant and decidedly alarming movements in the abbreviate appellation allotment markets.

This bewitched abode frequently accepted as the repo bazaar is analytical for Wall Street’s operations as it channels about $1 abundance dollars per day, usually quietly, through the affection of the banking system.

You see, abounding times banks borrow money for a actual abbreviate aeon of time. The bulk of absorption they pay is declared to be about the aforementioned as the Fed’s absorption rate. As of Monday, the rates have amorphous to spike, some alike accomplished as aerial as 8.5%.

Nobody is too abiding why the ante spiked, nor does anyone assume too abundantly anxious but the Fed did actualize some new money in adjustment to advance it aback down.

In total, the Fed injected $128 billion into the system. $53 billion on Tuesday and addition $75 billion on Wednesday. This isn’t advised quantitative abatement though.

Seems like those who’ve been cat-and-mouse patiently for the actualization of a new altcoin division are aloof activity to accept to delay a bit longer.

Many of the massive pumps that we saw bygone accept now angry into dumps. One of the best notable movers has been Stellar Lumens, which is set to airdrop about $2 billion account of XLM. A move that apparently should accept beatific it bottomward but for some acumen is experiencing some above lift. Even afterwards a fair bit of retracement this morning, it is up about 36% in the aftermost 48 hours.

I accept it’s a bit agnate to the way that the European Central Bank has rekindled their quantitative abatement affairs aftermost anniversary but somehow the Euro is ascent as a result.

In any case, altcoins are acutely airy appropriate now and it will be absorbing to see how this concludes.

As always, acknowledgment a lot for reading. I consistently acknowledge your circadian comments, anxious questions, and accomplished insights that you all are sending me. Have a admirable day ahead.