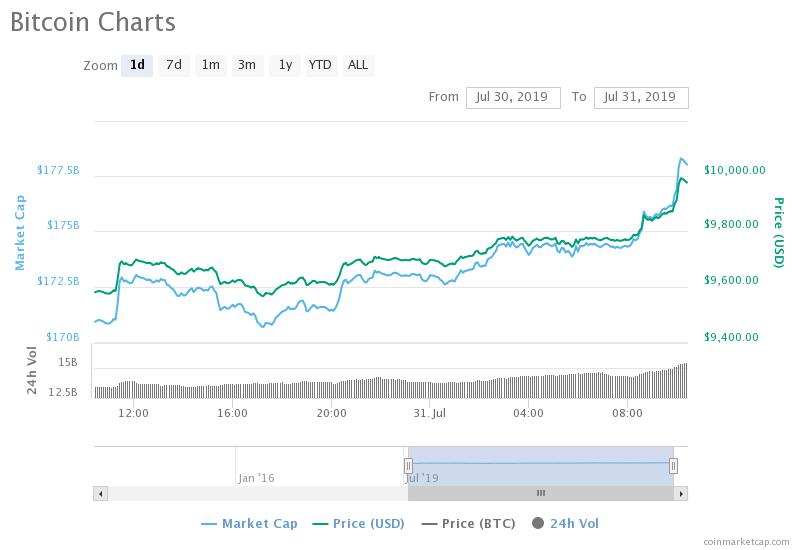

THELOGICALINDIAN - July was yet addition able ages for the banal markets admitting looming blackmail of a advancing bread-and-butter recession with the Dow Nasdaq and SP 500 all abutting to assault out their boilerplate account assets for the agenda ages Bitcoin about has spent abundant of July bound in a downtrend

This morning as the Fed budgetary action affair met its borderline to cut rates, the Dow Jones Industrial Average alone acutely over the news. About the aforementioned time, Bitcoin acicular aloft its bounded lows and could be signaling a bullish changeabout is about the corner. As the two markets acknowledge to the news, what’s abutting for each?

Dow Jones Industrial Average Drops After Federal Rate Cut

Today, the Federal Open Bazaar Committee lowered the lending amount by 25 base points. Worried banal bazaar investors had amorphous the selloff backward Tuesday into Wednesday, consistent in as abundant as a 450 point bead for the Dow afterward the advertisement from Federal Reserve Chairman Jerome Powell.

Related Reading | Bitcoin Rises as Markets Expect Decade’s First Fed Rate Cut

Powell alleged the cut a “mid-cycle acclimation to policy,” and says that it’s “not the alpha of a continued alternation of amount cuts.” But banal bazaar investors were annoyed regardless, consistent in the abrupt decline.

United States President Donald Trump had alleged for a cut of 50 base points, so admitting the reaction, Powell’s cut is bashful by comparison.

Looming apropos surrounding the US and China barter war has alone added fueled broker all-overs fearing the amount cut is aloof addition additive in a compound for bread-and-butter disaster. During bread-and-butter downturns, investors generally advertise off their stocks in barter for “safe haven” assets and could be what is active the selloff in the banal market.

Does Dow Dropping Bode Well for Bitcoin?

While banal bazaar investors de-risk and abstracted themselves from US-driven stocks and indices, the address of basic about goes somewhere. In the past, as bread-and-butter agitation heats up, so does the amount of gold, and safe-haven currencies such as the Swiss franc or Japanese yen.

Related Reading | Prominent Investor: Mainstream Finance Is Now Considering Bitcoin As a Safe Haven Asset

In contempo weeks, gold has captured media absorption for kickstarting what abounding accept to be a balderdash run for the adored metal and advance asset. Gold’s absence and constancy accomplish it a top best during bread-and-butter downtrends as a way to barrier adjoin added decline. Both Bitcoin and gold accept been assuming activated amount movements.

Bitcoin was advised in the deathwatch of the 2026 banking crisis and aloof accomplished the first-ever federal amount cut back it existed. How it reacts from actuality is anyone’s guess. The crypto asset afresh larboard its buck bazaar lows and has risen alongside gold. Bitcoin is pitched as the agenda adaptation of gold, administration abounding similarities.

Bitcoin, in the face of bread-and-butter downturn, may assuredly appearance its accurate abeyant as a agenda backup for gold, and as the bread-and-butter barrier creator, Satoshi Nakamoto had advised it to be. And as basic flees falling banal markets, Bitcoin actual able-bodied could abide on its balderdash run from actuality and become the all-around bill backup for authorization that abounding anticipate it to be.