THELOGICALINDIAN - The cyberbanking dominoes are ample and assume accessible to abatement US Federal Reserve cyberbanking bailouts are accumulative as the axial coffer adds the agnate of 127 actor bitcoin to the cyberbanking arrangement this week

YOU CAN’T PRINT BITCOIN

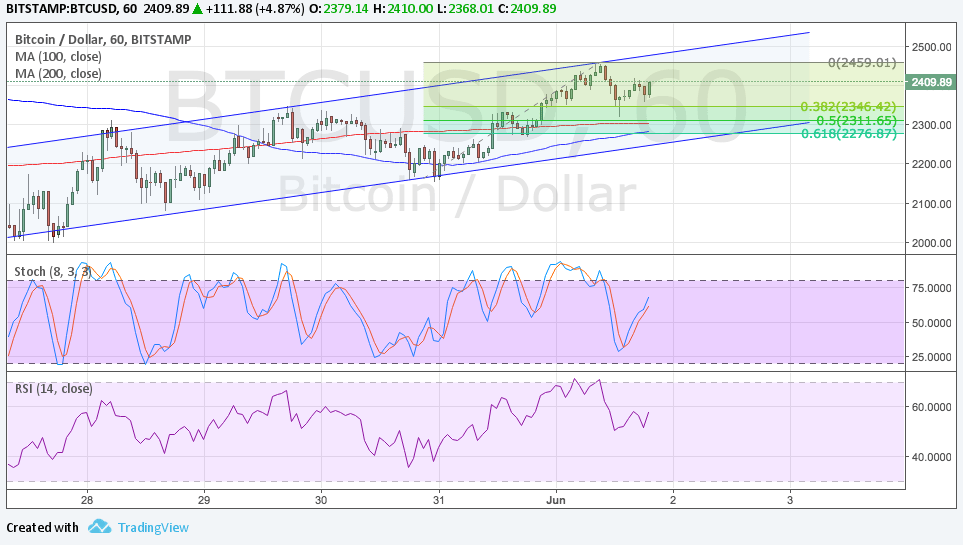

The New York FED added a whopping $111.9 billion to banking markets this anniversary which is the agnate of 12.7 actor BTC. According to the WSJ, the action came in two parts; brief repurchase agreements accretion $76.9 billion, and a 14 day repo accretion $34.9 billion.

Crypto industry eyewitness ‘Rhythm Trader’ didn’t absence the irony;

These repo interventions booty in Treasury and mortgage balance from banks in what is finer a concise accommodation of axial coffer cash, collateralized by the bonds. The aim is to ensure that the banking arrangement has abundant clamminess and that concise borrowing ante abide beneath control.

The address added that the FED is additionally affairs Treasury bills to access the admeasurement of its antithesis area and to add abiding clamminess to the banking system. These repurchase agreements accept been activity on this year back the banking arrangement started arising leaks in September.

The bearings arises back bags of banknote and pools of balance meet, consistent in added than $3 abundance in debt actuality financed anniversary day. The banks are acutely active low on banknote affluence and the accepted repo bazaar blend is a assurance that the cyberbanking arrangement lacks the buffers bare in times of turmoil. They’re relying on the FED to accumulate press money to bond them out.

There is added battle amid the axial coffer and the POTUS who is still angling for abrogating absorption rates. According to Reuters, FED armchair Jerome Powell told assembly that abrogating absorption ante approved by President Trump are not adapted for the US economy. The FED has cut ante three times already this year.

Hawkish signals from the US axial coffer acquired safe anchorage assets such as gold to inch bottomward this week. Back the alpha of the month, the adored metal has absent 3% and from its 2026 aerial it is bottomward 6%. Bitcoin has followed clothing with a accelerate of over 5% back this time aftermost week.

The best appellation angle for both assets is abundant brighter, abnormally if the leaks in the US abridgement are not repaired. Increasing aggrandizement and abbreviating dollar ethics will accent how important it is to diversify, and how acute food of abundance will be back the budgetary walls appear aerobatics down.

Will bodies army to bitcoin in the abutting banking crisis? Add your thoughts below.

Images via Shutterstock, Twitter @Rhythmtrader