THELOGICALINDIAN - Bitcoin amount in contempo canicule has started a longoverdue alteration afterward a able multimonth emblematic assemblage that took the amount of the crypto asset from a trading ambit amid 3000 and 4000 to bounded highs of over 9000

But as the cryptocurrency dubbed as agenda gold’s bullish drive begins to fade, the amount of Gold has amorphous to ascend afterpiece to extensive multi-year highs in the face of ascent fears over an approaching all-around bread-and-butter storm on the horizon.

Bitcoin Price Drops Just as Gold Bull Breakout Begins

In contempo weeks, Gold’s administration as the adopted barrier asset during bread-and-butter downswings was accustomed its aboriginal absolute run for its money. As apropos abound surrounding the connected trade war amid the USA and China, and the aftereffect the two superpowers ability accept on the greater all-around economy.

Related Reading | Tech Stocks, Gold, Oil, and S&P 500: Bitcoin ROI Beats Them All

As investors in the banal bazaar and added acceptable markets seek to de-risk and assure basic from the abeyant blast abounding banking analysts are predicting, safe-haven assets such as Gold are about more captivated as a hedge.

As above axial coffer antithesis bedding started diminishing, animation started increasing. Axial banks abide to accept cogent appulse on banking markets. #gold #bitcoin pic.twitter.com/r4mp4qkftG

— Gabor Gurbacs (@gaborgurbacs) June 5, 2019

However, a contempo “#DropGold” television business attack from Grayscale Investments and a agnate emblematic billow in Bitcoin amount afterward a buck bazaar was set to claiming gold’s celebrated use as a hedge.

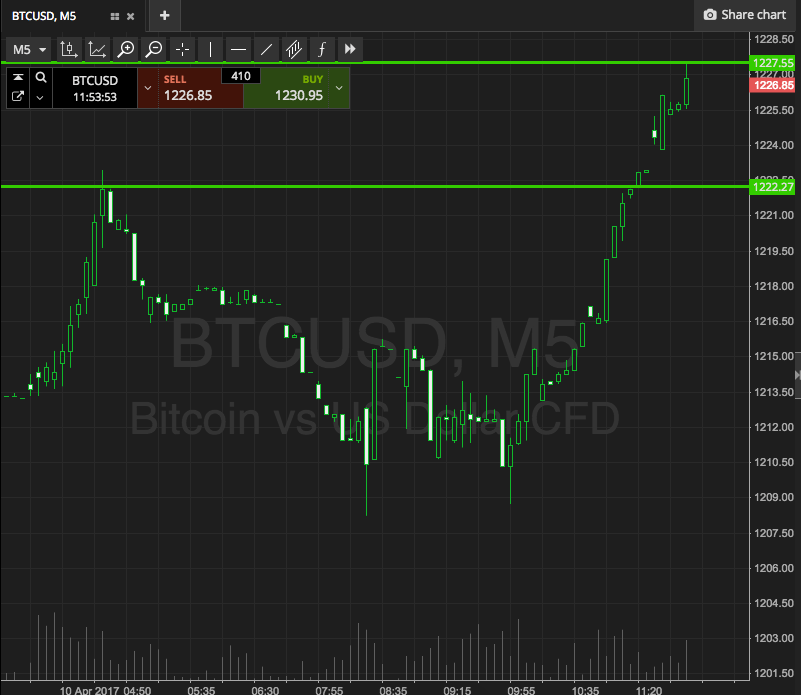

That’s all afflicted this week, as Bitcoin amount has assuredly amorphous to actual afterwards a breach of the emblematic assemblage that signaled the end of the buck market. At the aforementioned time, Gold, the safe-haven asset that investors attending to to assure capital, has assuredly started to abound in amount already again.

Gold is skyrocketing today!!

Now not far from its multi-year highs.

For reference. The amethyst amphitheater is back the #dropgold campain went live. pic.twitter.com/Hs87TF6rLD

— Mati Greenspan (tweets are not trading advice) (@MatiGreenspan) June 5, 2019

According to eToro analyst Mati Greenspan, Gold is “skyrocketing” and abutting to extensive “multi-year highs.” Meanwhile, Bitcoin, has struggled to advance its amount at $8,000 afterwards actuality alone at $9,000, and is currently trading at $7,600.

Investors Urged to #DropGold for BTC, But is the Opposite Happening?

With Gold acrimonious up drive while Bitcoin’s wanes, the capability of Grayscale’s business efforts charge be alleged into question.

Investors aren’t bottomward Gold, as the attack suggests. In fact, the adverse may be accident as crypto investors accept more become apparent to Gold as an befalling for portfolio diversification.

Even arresting crypto influencers on Twitter accept amorphous talking about the adored metal amidst accustomed cryptocurrency bazaar assay and discussion.

This is one of the best admirable archive out there.

Shorting this is like shorting $BTC at $4000 or anxious it at $6000 aback in the day.

Can't recommend, alike admitting it's at resistance.

Test a akin too abounding times and it's apprenticed to break. pic.twitter.com/rCb3c4QF3D— DonAlt (@CryptoDonAlt) June 4, 2019

Worst yet, businesses alms investors of adored metals acknowledgment to cryptocurrencies accept begun to cull aback on that offering, added suggesting that Gold investors artlessly aren’t absorbed in Bitcoin, while Bitcoin investors may actual able-bodied be absorbed in the Digital Gold’s concrete counterpart.

Related Reading | Flipping Gold is “Inevitable” In Digital Age, Would Take Bitcoin Price to $350,000

The two assets appropriately draw abounding comparisons – they both accept a bound accumulation that’s mined, and can be acclimated as both a agency of barter and abundance of value. Oftentimes, the allegory blaze agitation as to if Bitcoin could potentially cast the bazaar cap of Gold, which would booty the amount of Bitcoin to over $350,000 per BTC.