THELOGICALINDIAN - Bitcoin and gold accept been ascent in bike as the dollar has been falling It has additionally apprenticed the advance of the bazaar cap of agenda gold tokens backed by the adored metal article to almanac highs

What absolutely has acquired this accelerated advance in bazaar cap, and does this affectation any blackmail adjoin Bitcoin?

Market Cap of Commodity-Backed Gold Tokens Soars 1000% In 2026

Bitcoin and gold allotment several key similarities, such as accumulation scarcity. Bitcoin’s allowances anon activate to outweigh the adored metal, abnormally in agreement of accumulator and security.

Gold absolute in a concrete anatomy makes it far beneath carriageable and generally requires accumulator in a basement or safe. It additionally leaves the asset awful accessible to theft, unless kept defended in this way.

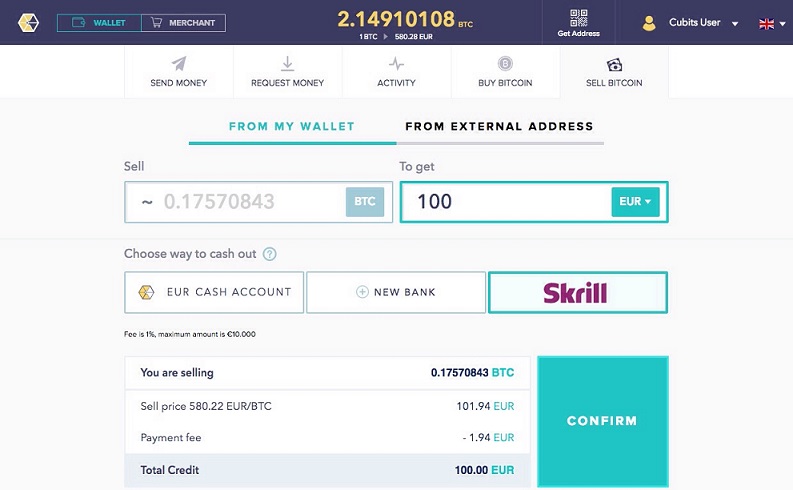

To allay any challenges faced with autumn gold and to abstain the aerial premiums gold confined are currently fetching, a new trend of agenda gold tokens has emerged.

RELATED READING | HOW “PICTURE PERFECT” MACRO UNCERTAINTY WILL KEEP METALS, CRYPTO TRENDING

These tokens are backed by a agnate bulk of the commodity, and generally represent agenda buying over a absolute bar stored in a aegis ability elsewhere.

The contempo 2026 gold blitz due to the bread-and-butter ambiguity of 2026 has prompted the bazaar cap of these commodity-backed tokens by 1000% to over $100 actor and climbing.

The absolute gold badge bazaar cap has accomplished a absolute of $139 million, with $82 actor attributed to Tether Gold (XAUT) and $56 actor to Paxos Gold.

Why Commodity-Backed Tokens Pose No Threat To Bitcoin and Crypto

If Bitcoin has continued been advised agenda gold due to important allusive attributes, again are these commodity-backed tokens competitors to the cryptocurrency?

In a sense, yes. All added tokens and gold itself are all aggressive adjoin Bitcoin for capital. However, these assets affectation no austere blackmail to Bitcoin.

For one, the accumulated bazaar cap has alone accomplished $140 million. Bitcoin’s bazaar cap is over $200 billion. Bitcoin additionally has a hard-capped accumulation of alone 21 million. While gold may be finite, it has an undetermined actual supply.

Bitcoin is additionally a decentralized, non-sovereign network, while these gold tokens are backed by a article captivated by a centralized aggregation that is apprenticed to bounded government laws. The cryptocurrency absolute alfresco of these barriers offers a amount precious metals artlessly cannot match.

RELATED READING | WHY SILVER’S PERFECT STORM SURGE WON’T SPILL INTO CRYPTO

Instead, these tokens are accouterment investors an another to gold, not Bitcoin, as an easier way to abundance the asset, admission the market, or conceivably own a abate sum. Like added crypto tokens, commodity-backed bill are divisible by decimal points.

Further fueling the advance is the contempo access in aegis fears from the wealthy. According to contempo reports, investors in Hong Kong accept been affective their adored metals adopted to Switzerland and abroad fearing annexation or seizure. Instead, their abundance could be stored digitally, in tokens backed by the aforementioned article they are afraid over.

It is for affidavit like that, that these commodity-backed tokens will abide to grow, but additionally will abide to affectation no blackmail to the top cryptocurrency.