THELOGICALINDIAN - Bitcoin and the aggregated crypto bazaar accept fared absolutely able-bodied in animosity of the weakness apparent beyond the all-around markets

The criterion cryptocurrency’s contempo uptrend has accustomed it to be one of the best assuming assets in the apple in 2026, with its uptrend partially actuality apprenticed by account of allegorical investors like Paul Tudor Jones abacus it to their portfolios.

He isn’t the alone acceptable broker who is demography to Bitcoin to barrier his portfolio adjoin aggrandizement accident either.

Recent comments from the managing administrator of Grayscale Investments annotate that ancestors offices, RIAs, barrier funds, and others are calamity into crypto at a accelerated rate.

Grayscale Managing Director: Inbound Interest in Crypto from “Smart Money” is Immense

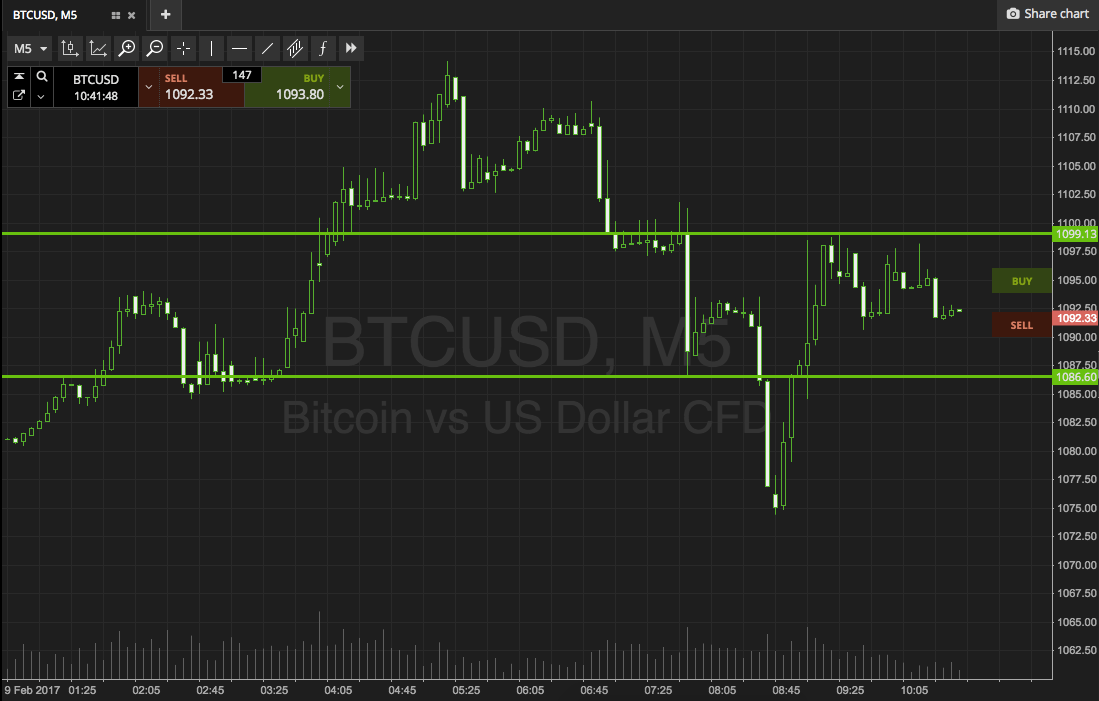

Many investors as of backward accept been pointing to the growing accessible absorption apparent while attractive appear the CME’s Bitcoin futures as a assurance of added action amidst institutions aural the market.

The band of acumen is absolutely simple: because there is a alteration amid accessible absorption and trading volume, the majority of these investors are demography a acquiescent access to BTC futures, employing them to accretion acknowledgment to the crypto’s amount action.

This trend can be acutely apparent while attractive appear the abstracts on the beneath chart:

Recent comments from Grayscale Investment’s managing administrator Michael Sonnenshein assume to added affirm the acute action apparent amidst institutions and added forms of alleged “smart money” aural the beginning crypto market.

He explained that his aggregation has apparent a massive arrival in absorption from these parties in the time afterward the Coronavirus pandemic.

Institutional Interest Was Here Before the Pandemic as Well

The advancing all-around communicable isn’t the alone agency that has apprenticed institutional adoption.

Per Grayscale’s aboriginal division report, it appears that the crypto market was notable seeing institutional acceptance above-mentioned to the advance of COVID-19.

They noted that throughout Q1, their advance articles saw a absolute arrival of $503.7 million. Investors were, on average, cloudburst $38.7 actor into their crypto funds anniversary week.

Although it still charcoal alien as to what their inflows looked like in Q2 – it is awful acceptable that it will dwarf the record-breaking advance their articles saw aftermost quarter.