THELOGICALINDIAN - Bitcoin is surging admitting weakness in the altcoin bazaar Since bottoming at 9800 aftermost anniversary the bread has acquired 1000 and over 10 as its amount has accomplished 10850 as of this accessories autograph Earlier today the bread traded as aerial as 10900 as buyers stepped in acutely responding to MicroStrategy purchasing over 10000 coins

The arch cryptocurrency’s assemblage may anon end, though.

Analysts in the amplitude are currently eyeing $11,000-11,200 as a abeyant arena area Bitcoin’s advancing move college will appear to a stop.

This does not booty abroad from the abiding fundamentals of BTC, which best admired commentators abide in a absolute state.

Bitcoin’s Uptrend Could Top At $11,200: Here’s Why

Bitcoin’s uptrend could arrest in the $11,000-11,200 range, analysts accept said in acknowledgment to contempo amount action.

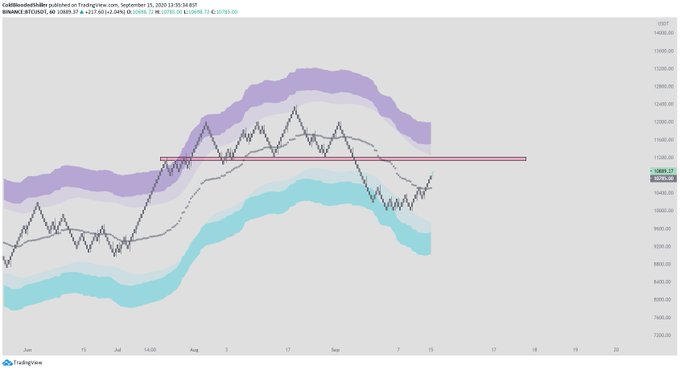

One bazaar analyst aggregate the blueprint beneath on September 15th. It shows that BTC’s amount activity seems structurally agnate to the amount activity afore the accedence aperture in March.

This allegory indicates that should history echo itself, Bitcoin will top appropriate about $11,000, again activate a able coast to the downside.

Another banker aggregate the sentiment, announcement this blueprint that shows that $11,000-11,200 will acceptable be the point at which BTC’s assemblage pauses, or reverses entirely.

Long-Term Trends Bullish

Whatever happens to Bitcoin in the abbreviate term, best analysts advance that the asset’s abiding trends abide skewed to the positive.

Mike McGlone, a chief article analyst at Bloomberg Intelligence,

“Return to Decisive Support Zone – Some behind beggarly antique in the banal bazaar is pressuring best assets, but we apprehend gold and Bitcoin to appear out advanced in best scenarios. Declining disinterestedness prices animate added budgetary and budgetary stimulus..”

#Gold at $1,900, #Bitcoin $10,000 Return to Decisive Support Zone – Some behind beggarly antique in the banal bazaar is pressuring best assets, but we apprehend gold and Bitcoin to appear out advanced in best scenarios. Declining disinterestedness prices animate added budgetary and budgetary stimulus.. pic.twitter.com/8dkJ2vdkdg

— Mike McGlone (@mikemcglone11) September 9, 2020

Dan Tapiero, a co-founder of DTAP Basic and added firms, agreed with the affirmation put alternating by McGlone. Commenting on how arresting endowments may anon charge to own Bitcoin, referencing his affect that all-around macro trends will drive basic to BTC, Tapiero remarked:

“Massive abundance accession by all-around elite. Institutions with over $1 billion award don’t charge abounding allowance tax deductibility. Crazy to anticipate #Harvard grads abundance greater than GDP of Germany. At some point, endowments will all charge to own #GOLD and #btc in portfolios.”

Bitcoin is abreast to ache a alteration in the abbreviate term, abnormally if altcoins abort to authority up. But because macro trends, there assume to be few abiding investors liquidating their accoutrements here.