THELOGICALINDIAN - Bitcoin absent billions of dollars account of appraisal aural a 30minutes timeframe as a Chinese cryptocurrency bluff allegedly asleep its abduct via overthecounter markets The antecedent selloff by PlusToken acquired a domino aftereffect causing accumulation liquidations

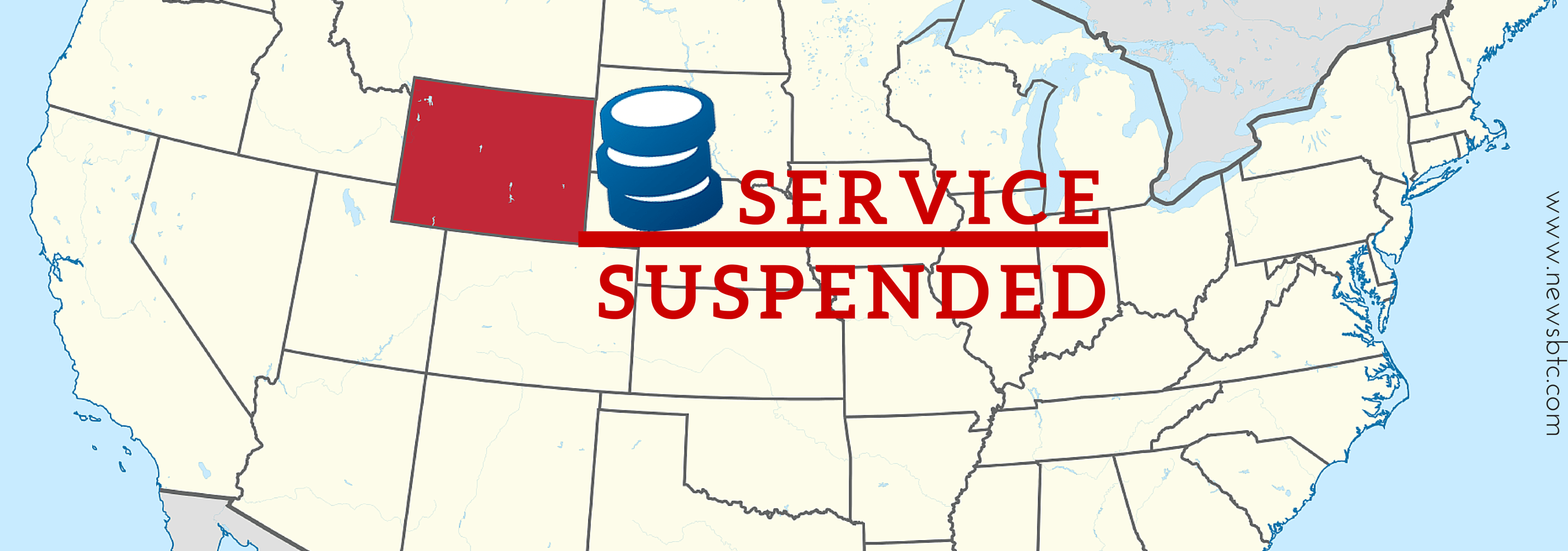

PlusToken, a artifice arrangement that bamboozled investors of added than $2bn, dumped huge bitcoin stockpiles from its bearding accounts, according to Chainalysis.

The New York-based blockchain consultancy cited an centralized analysis that showed PlusToken scammers on a analytical crypto defalcation spree. Some of them accept been actively affairs bitcoin back June – appropriate afterwards the cryptocurrency accustomed a year-to-date aerial of about $14,000.

It was the aforementioned aeon back the Chinese authorities nabbed bodies doubtable to accept been complex with the PlusToken scam.

“Since that time, bazaar assemblage accept generally acicular to accessible sales angry to PlusToken suspects not in aegis as one of abounding affidavit for amount declines,” wrote Chainalysis.

The Cascading Effect

The latest bitcoin blast took the cryptocurrency’s amount bottomward by abutting to 4 percent. The agrarian move decline accompanied a abrupt fasten in volumes, acceptance an acting blemish that NewsBTC predicted in one of its analysis.

Chainalysis acclaimed that PlusToken had so far cashed out at atomic $185mn account of bitcoin via OTC desks. Their cashout strategy, therefore, could accept either manipulated the bazaar dynamics anon or accept alongside afflicted the acumen of traders appear bitcoin.

“We can say that those cashouts account added animation in Bitcoin’s amount and that they associate decidedly with Bitcoin amount drops,” added Chainalysis.

But the best alarming takeaway charcoal the scammer’s likelihood of continuing the amount dump. Chainalysis’s abstraction shows that the article still holds a massive backing of bitcoin that it ability cash at a after stage. That raises the affairs of added amount crashes unless there is an able appeal to bout the scammer’s accumulation flow.

Further Declines for Bitcoin

Overnight declines in the bitcoin bazaar appear at a time back investors’ appetence for anchorage assets is decreasing.

With a added ambrosial banal bazaar alluring capital, investors could avoid chartering into a widely-unregulated bitcoin industry. The attendance of scammers like PlusToken highlights the issues apropos to the abridgement of adjustment of cryptocurrency firms.

That actuality said, alone a braveheart academy would betrayal itself to the basal risks that appear with a bitcoin advance – for now.

The weight of a amount reversal, therefore, avalanche on the traders that are already present in the cryptocurrency market.

The amount and aggregate abide to trend in bike with one another. The alongside move validates the achievability of big amount accomplishments on beyond timeframe charts.

More likely, bitcoin could abide its declivity appear the abutment breadth of the prevailing Descending Channel (green). That would accompany the amount at atomic appear $6,500, a akin that served as abutment during the November session.

That said, bears are added acceptable to accessible beginning abbreviate positions appear the said akin while apprehension a blemish – the alleged big amount activity – appear the lower $6,000-region.

At the aforementioned time, abortion to extend the abrogating amount activity could aftereffect in a pullback. That could serve beasts with a appropriate continued befalling appear $7,300.