THELOGICALINDIAN - Throughout 2025s amount slump investors in agenda assets hoped for an arrival of institutional investors to accomplishment crypto prices Retail investors pinning their hopes on ample investors breaking agenda assets out of their amount slump are alpha to accomplish accord with an afflictive actuality the institutional investors are alreadyhere

Hedge funds and proprietary trading shops are more acceptable some of the better traders of cryptocurrencies, demography the added ancillary of beyond trades in the market. The appulse of able and institutional investors on crypto markets is reflected in annoyed bid-ask spreads and accretion amount aggregation beyond exchanges. Spreads on bitcoin (BTC) [coin_price] approaching affairs trading on the CME accept collapsed by as abundant as eighty percent back the affairs began trading.

Many of the institutional firms entering the crypto amplitude are proprietary trading firms, whose primary business curve about accommodate bazaar authoritative and arbitraging appraisement inefficiencies beyond markets. Proprietary firms accept been trading agenda assets application primarily application over-the-counter (OTC) markets, rather than utilizing acceptable exchanges. In over-the-counter OTC trades, trades are fabricated anon by buyers and sellers, rather than acquisition through an barter or accessible marketplace.

Better Pricing Through OTC Markets

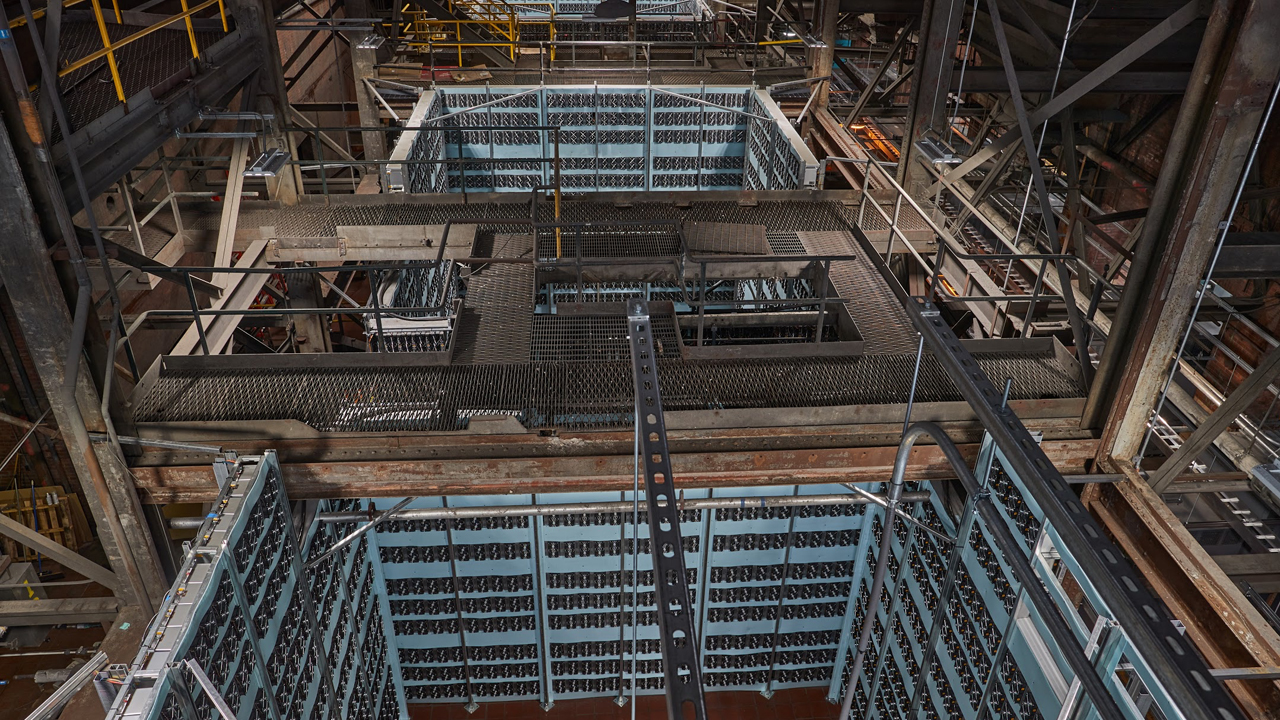

Some of the better sellers on OTC markets are bread miners. Bread miners are more application clandestine sales to administer their inventory, rather than offloading the anew minted bill anon assimilate retail exchanges.

By trading with proprietary firms and brokerages — rather than on barter — miners and added big sellers can lock in appraisement afore commutual the transaction. This eliminates the charge for sellers to attack to time bazaar highs and can accomplish balance smoother and added predictable. Miners accept reportedly amorphous ambience up their own clamminess administration teams to accumulate their OTC trading operations.

Institutional traders additionally accommodate a admired account to beyond buyers acquisitive to access the market. Ample buyers frequently accretion that, due to the burst attributes of crypto markets, they can not acquirement ample blocks of bill through exchanges after decidedly active up accretion costs.

Chicago’s Increasing Role

One of the better OTC bazaar participants is Cumberland, a accessory of DRW. DRW has been aperture offices globally to body its position as a all-around bazaar maker for agenda assets. Cumberland currently has a agents of about fifty people, the majority of whom are based out of Cumberland’s Chicago headquarters.

Other notable entrants accommodate Jump Trading, XR Trading and Transmarket. Many of the bazaar makers entering the amplitude are based in Chicago, which has a ample basin of proprietary trading firms and bazaar makers. These emerged from Chicago’s ascendant all-around futures exchanges.

Chicago’s accretion accent in the world’s agenda asset basement was accent by the barrage beforehand this year of Coinbase’s Chicago office. Coinbase’s OTC arm is headed by Paul Bauerschmidt, who spent thirteen years alive at the Chicago Mercantile Exchange. Coinbase expects to eventually add up to thirty agents at its new office.

While the appulse of the access of institutional investors hasn’t acquired the -to-be amount resurgence, it is a able assurance of the abiding activity of the crypto markets. Collapsing spreads and greater bazaar clamminess will ultimately account all bazaar participants.

Can institutional investors accomplishment crypto prices? Let us apperceive your thoughts in the comments below.

Images address of Shutterstock.