THELOGICALINDIAN - Semiconductor dent architect Intel could be jumping into the crypto amplitude The aggregation has purchased about 800000 in barter Coinbase COIN stocks on June 26th 2026 per a address filed with the US Securities and Barter Commission SEC banking account website Barrons published

According to Form 13F filing with the U.S. regulator, Intel holds 3,014 accepted chic A shares from the crypto aggregation Coinbase Global Inc. The address highlights added banal investments fabricated by the dent architect in companies such as Maxlinear Inc. (MXL), Shift4 Payments Inc. (FOUR), and McAfee Corp (MCFE).

Intel owns over $100 actor in about traded investments, Barrons claimed. Therefore, the aggregation had to acknowledge those investments to the Commission. The report speculates on the achievability that Intel could accept pre-purchased the stocks, afore Coinbase debuted in the U.S. accessible bazaar in April 2021.

Although this constitutes Intel’s aboriginal above advance in a crypto-related company, the dent architect has been absorbed in Bitcoin, cryptocurrencies, and blockchain technology for years. In 2026, the aggregation filed for a apparent on Bitcoin mining.

The certificate presented to the U.S. Apparent and Trademark Office declared a “system-on-a-chip (SOC)” that optimizes BTC miners’ ability consumption. The aggregation was awarded the patent.

In accession to that, an official blog column on their website describes the basal technology that supports Bitcoin. In the post, Intel attempts to call how this technology can be activated to abounding business sectors:

Crypto Exchange Coinbase Stocks Make A Comeback After Debute

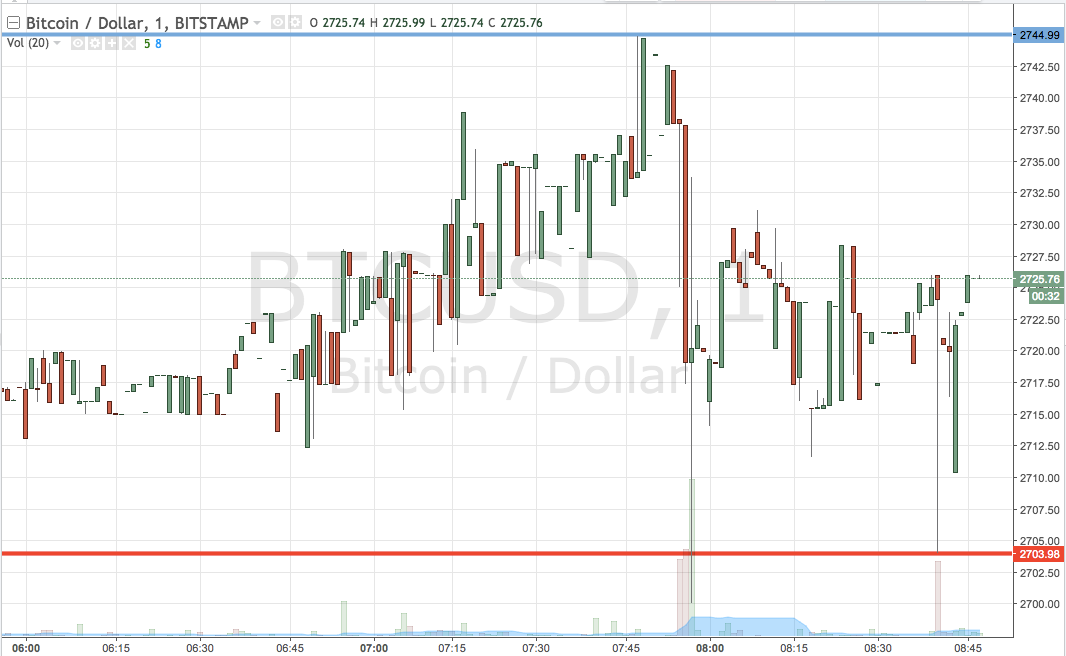

As Bitcoinist reported, Coinbase appear its annual balance report. The belvedere surpassed everyone’s expectations by accomplishing $462 billion in trading volume. As a result, the amount of COIN rallied from the lows at $200 to about $300.

The balance address additionally showed an access in institutional appeal for cryptocurrencies, primarily Bitcoin (BTC) and Ethereum (ETH). The closing outperformed BTC in agreement of trading aggregate for the aboriginal time on the platform.

At the time of writing, BTC trades at $47,582 with a 7.3% accumulation in the circadian chart.