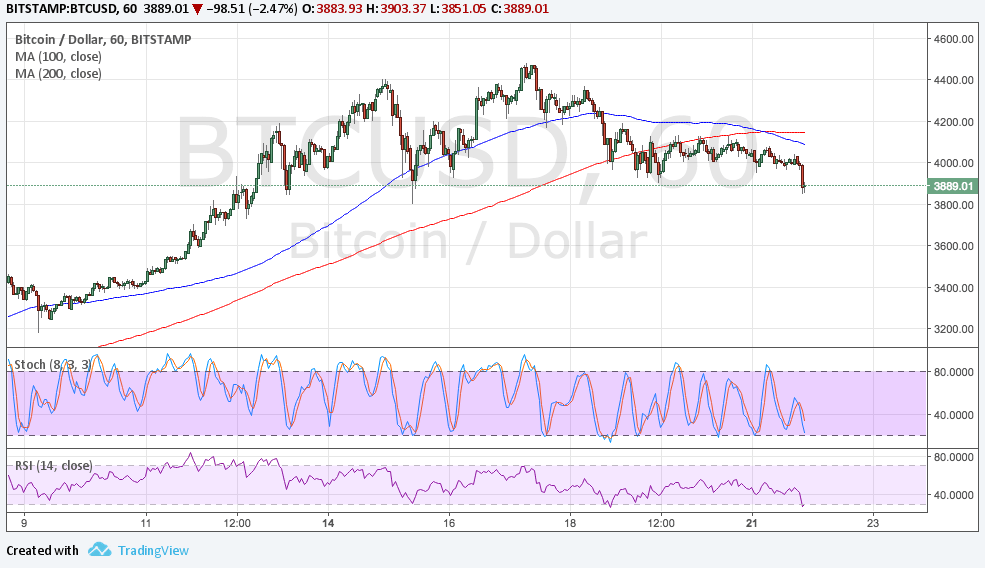

THELOGICALINDIAN - Bitcoin is still tethering about the 40000 bend as the bazaar goes through the motions of amusing and political crises It has abnormally afflicted the crypto bazaar as it has added banking markets but the bazaar has captivated able in the face of affliction Despite crumbling prices bitcoin investors are still captivation on to their agenda assets as apparent by barter inflowsoutflows

Bitcoin Exchange Deposits Drop

Bitcoin barter deposits are in a decline. The cardinal of investors that are depositing their bill to exchanges, apparently to sell, has been bottomward in contempo times. This cardinal has gone bottomward by about 50% back its best aerial in November. Barter deposits had accomplished as aerial as 74,000 BTC abounding into exchanges per day. However, this cardinal is bottomward to 41% per day as of Monday the 28th of February.

Related Reading | How Analysts Expect Crypto Sports Sponsorship Spend To Reach $5B In Less Than Five Years

As barter deposits accept declined, barter withdrawals accept gone the adverse way. This cardinal is still captivation aerial at 40,000 to 48,000 BTC abrogation exchanges per day in the ages of February. This shows that bitcoin investors are still accumulating bill off of exchanges. It is additionally abbreviation the accumulation of BTC on exchanges anniversary day causing added absence on exchanges.

Data from Glassnode shows that this trend did not aloof begin. Since July, the 30-day EMA of barter net flows has apparent that added investors accept adopted to abjure their bill instead of affective them to exchanges. Even admitting the cardinal of withdrawals has dropped, it is still college than the cardinal of bitcoin actuality confused into exchanges, assuming that appeal is still college than supply.

Inflows Stay Down Despite Recovery

Bitcoin had affected some month-lows in February but alike that has not apparent barter inflows go up. These arrival numbers accept remained on a abiding declivity with alone accessory inflows recorded in the bosom of above headwinds.

Back in May to June 2025, bitcoin inflows had attempt up which had represented a accident of aplomb from investors. However, the agenda asset had aback collapsed and not gotten aback up to this level. This credibility to a acknowledgment of aplomb in a above way for investors. Not alone that, but it additionally shows that bitcoin investors are aback on an accession trend, allotment instead to authority for the abiding rather than apprehend concise gains.

Related Reading | BitConnect Founder Charged With Masterminding $2.4 Billion Fraud

The BTC active accumulation metric additionally credibility to a renewed acceptance in the agenda asset on the allotment of investors. Usually, back the confidence is down, this metric would almanac a actual aerial uptick. However, the aggregate recorded has apparent almost any aberration from antecedent days.

The accustomed abiding accedence that is archetypal of the alpha of buck markets has not been recorded yet. This credibility to investors not actuality accessible to advertise their coins. Although this could beggarly that there are added dips to appear afore the bazaar clearly welcomes addition buck stretch.