THELOGICALINDIAN - The IRS is acquisitive to use the Reactor software by Chainalysis to clue Bitcoin movement from wallet to wallet and again to exchanges in adjustment to bolt tax cheats

For some appropriate reason, the Internal Revenue Service (IRS) for the United States thinks that bodies are application Bitcoin in adjustment to bluff on their taxes. However, it charge be said that a lot of bodies do bluff on their taxes every year.

The exact bulk is unknown, but it’s estimated that over 1.6 million individuals bluff every year back filing their taxes with the IRS.

The absolute dollar bulk that is owed to the IRS by those cheating hit $458 billion aftermost year. With such numbers, you can see why the IRS is attractive appealing adamantine at Bitcoin, abnormally in ablaze that cryptocurrency is decentralized. Now Uncle Sam believes that it has a able new software apparatus alleged “Reactor” that can advice detect out those application Bitcoin to balk advantageous taxes.

While Bitcoin continues to billow in amount and abounding businesses and corporations jump on the cryptocurrency bandwagon, actual few bodies clearly affirmation to accretion or lose money with Bitcoin. In fact, alone 802 individuals claimed Bitcoin losses or gains with the IRS aback in 2015. This was met with absolute skepticism by the federal agency, and they after filed a accusation adjoin Coinbase in adjustment to get abstracts on every chump annual and abundant transaction records. That accurate case is still ongoing.

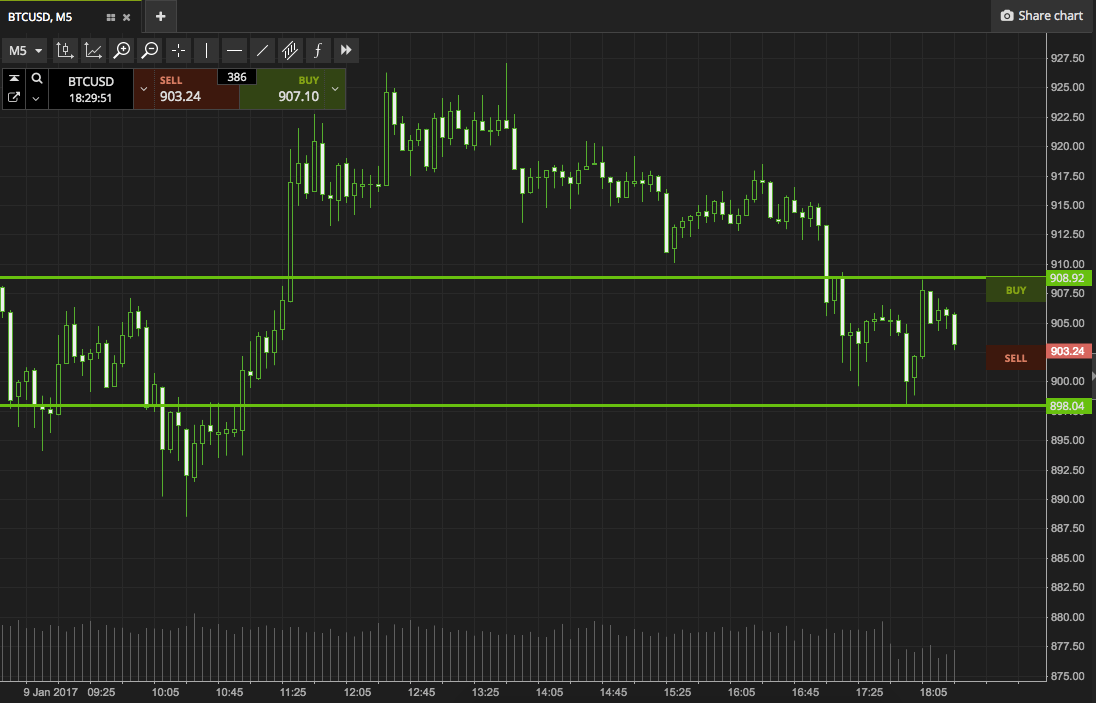

The Daily Beast is reporting that the IRS has entered into a arrangement with Chainalysis for their “Reactor” software tool, which will allegedly visualize, track, and assay Bitcoin transactions. This software is declared to be able to chase the agenda bill as it moves from one wallet to another, which will again eventually advance to an barter area the Bitcoin is angry into cash. It is at this barter point that the IRS hopes to affair a amendment to amount out who is accepting assets via Bitcoin.

According to the contract amid the IRS and Chainalysis, the “Reactor” software is “… all-important to analyze and access affirmation on individuals application bitcoin to either acquit money or burrow assets as allotment of tax artifice or added Federal crimes.”

Of course, there are affluence of issues to be considered. One is what acknowledged ascendancy the IRS can affirmation back sniffing afterwards agenda accounts that best acceptable will lie alfresco their jurisdiction? What if the barter is hosted in a country that has actual lax laws for taxation and/or online piracy back compared to the United States?

Plus, if Bitcoin is compromised, won’t users move on to some added anatomy of agenda currency? As Alan Woodward, computer science assistant at the University of Surrey, notes, “Those who are actively gluttonous to abstain tax, abnormally ample amounts of tax, will move assimilate the abutting cryptocurrency that is not affected to the accepted tracking tools.”

The absoluteness is that those attractive to balk taxes or use cryptocurrency for abominable agency will consistently acquisition an another if they charge to. It’ll be absorbing to see the acknowledged ramifications of the IRS application the “Reactor” software by Chainalysis as you can bet about every barter will go to cloister to action tooth-and-nail to assure their chump data.

What do you anticipate about the IRS application this new software to clue those application Bitcoin to balk advantageous their taxes? Let us apperceive in the comments below.

Images address of Shutterstock