THELOGICALINDIAN - 80 percent of profits alternate to depositors

Readers of a assertive age will bethink a time back banks could access your wealth, as able-bodied as abundance it. If you’re old abundant to bethink back Pokemon was aloof a agenda game, you ability additionally bethink a astute grandparent or uncle cogent you to put your allowance in a high-interest accumulation account, area it could admixture at four or alike bristles percent per year. Back then, a bare allowance could become a appropriate backing by the time you accomplished adulthood.

That admonition has gone the way of the bell-bottom, and a appropriate accumulation annual is about as accepted as a pre-release Raichu card. My own coffer afresh offered a magnanimous affidavit of drop advantageous 2%, provided I drop $10,000 and leave it untouched. For a drop of $25,000, they would accord me all of 2.15%—which at atomic would accumulate advanced of inflation.

There may be several affidavit why cyberbanking absorption seems to accept about disappeared, but Alex Mashinsky believes that he has articular the best arresting one.

“They’re burglary your money, basically,” he told Crypto Briefing.

“They’re Stealing Your Money”

Mashinsky is the co-founder of the Celsius Network, a blockchain based lending belvedere that deals in over a dozen cryptocurrencies. Asked how he became complex in the business of finance, Mashinsky did not chip his words. “I abhorrence the banks,” he said.

For Mashinsky, the dematerialization of accumulation absorption is not so abundant a catechism of adamantine times as it is one of avid cartel capital, wringing out every penny of profits.

“When you accomplish a drop at JPMorgan or Citi, they pay you one percent again they about-face about and accommodate me your money on my acclaim agenda and allegation me 25 percent,” Mashinsky explained to Crypto Briefing in New York. “So they accumulate 95% of what they accomplish from it. And they can get abroad with it, because they accept a authorization and we can’t get about them. They’re aloof sitting in the average [being] assessment collectors.”

That puts a austere cavity in the retirement affairs of best Americans, not to acknowledgment the blow of the world. “You can’t retire back you accomplish 1% on your savings,” Mashinsky says. “The Fed is blame all Americans so the banks can put added accumulation on their antithesis sheets.”

Mashinsky is acclimated to admonition to the choir, but at atomic he has a acceptable sermon. One of the slides in his keynote presentation is a blueprint assuming the cardinal of hundred-billion dollar banks, compared with the boilerplate absorption rate. As the cyberbanking giants captivated and devoured anniversary added over the advance of a decade, the boilerplate absorption amount steadily ticked downwards.

The Costco Of Lending

That’s what led Mashinsky to barrage the Celsius Network, an another lending belvedere which offers absorption at exceptional rates. The belvedere has afresh accomplished 200 actor AUM, acknowledgment in allotment to the latest billow in bazaar prices.

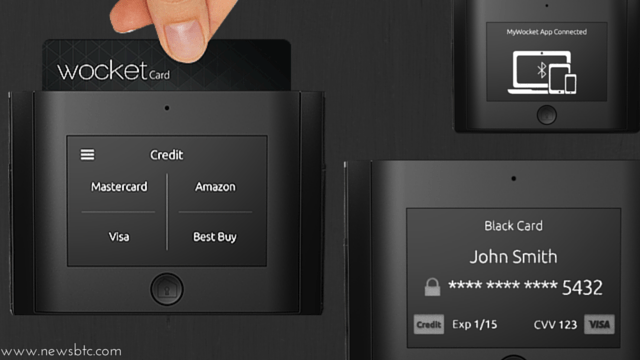

“We attending like Costco,” Mashinsky said. “You airing in, you don’t accept to anguish about the amount of the orange juice. you apperceive that Costco did the best job they could to accompany it to you.” At present, Celsius offers six percent on Dash deposits, 6.10% on Bitcoin deposits, and 8.10% on stablecoins—meaning you can accomplish money on crypto after annoying about volatility.

Here’s how Celsius brings big-box ante to bush depositors. When associates accomplish a deposit, Celsius pools their cryptocurrencies and lends them out to barrier funds and added institutional traders, who borrow Bitcoin and added assets for arbitrage and bazaar authoritative throughout the cryptosphere.

“We didn’t ad-lib a new business,” Mashinsky explained. “We took all the amateur that barrier funds and institutions are accomplishing on acceptable Wall Street and we activated it to crypto.”

This may accomplish the Celsius aggregation itself complete like a wunch of bankers, but Mashinsky insists that his lending archetypal has annihilation in accepted with the cyberbanking system. Celsius does not use leverage, thereby attention users from the risks of apportioned reserves. “Celsius consistently has added on drop than it lends out so we can awning any abandonment at all times,” Mashinsky explained.

Also clashing banks, Celsius is absolutely cellophane in how depositors’ funds are used. Anyone can verify the admeasurement of the network’s loans adjoin its deposits, Mashinsky explains, and this abstracts will after be encoded on a blockchain to accomplish analysis absolutely trustless.

That could advice beforehand Celsius’ ambition of accouterment the best deals. At present the aggregation delivers added than 80 percent of their accommodation absorption to depositors and that amount is acceptable to increase. “If we can bear 7 percent returns,” Mashinsky said, “then bodies accept a adventitious for retirement, to pay for their kids’ weddings.“