THELOGICALINDIAN - Is Bitcoin a article It is according to best authoritative agencies including the CFTC

But is Bitcoin a abundance of amount (SoV) commodity? That seems to be the accepted consensus. Most of the investors are alleviative it as so, and calling it “Gold 2.0.”

Well, if that’s the case, again Bitcoin should chase the stock-to-flow model. At atomic to a degree. The archetypal gauges the absolute bulk of “stock” – Bitcoin, in this case – accessible at the moment adjoin the “flow” of new assembly to get the stock-to-flow ratio. That arrangement quantifies scarcity.

According to the architect of the model, famed analyst PlanB, “we are boilerplate abreast the top of this balderdash market, according to both the S2FX archetypal and on-chain signals.” And the stock-to-flow archetypal predicts that, in the abreast future, Bitcoin will hit at atomic $100K. And the model’s still intact. It still holds. (or should we say… hodls)

Some bodies are afraid about the contempo few months of about stability, and what that does to their amount projections. Others are adulatory that Bitcoin’s been aloft $50K for a accomplished ages and aggregate that implicates.

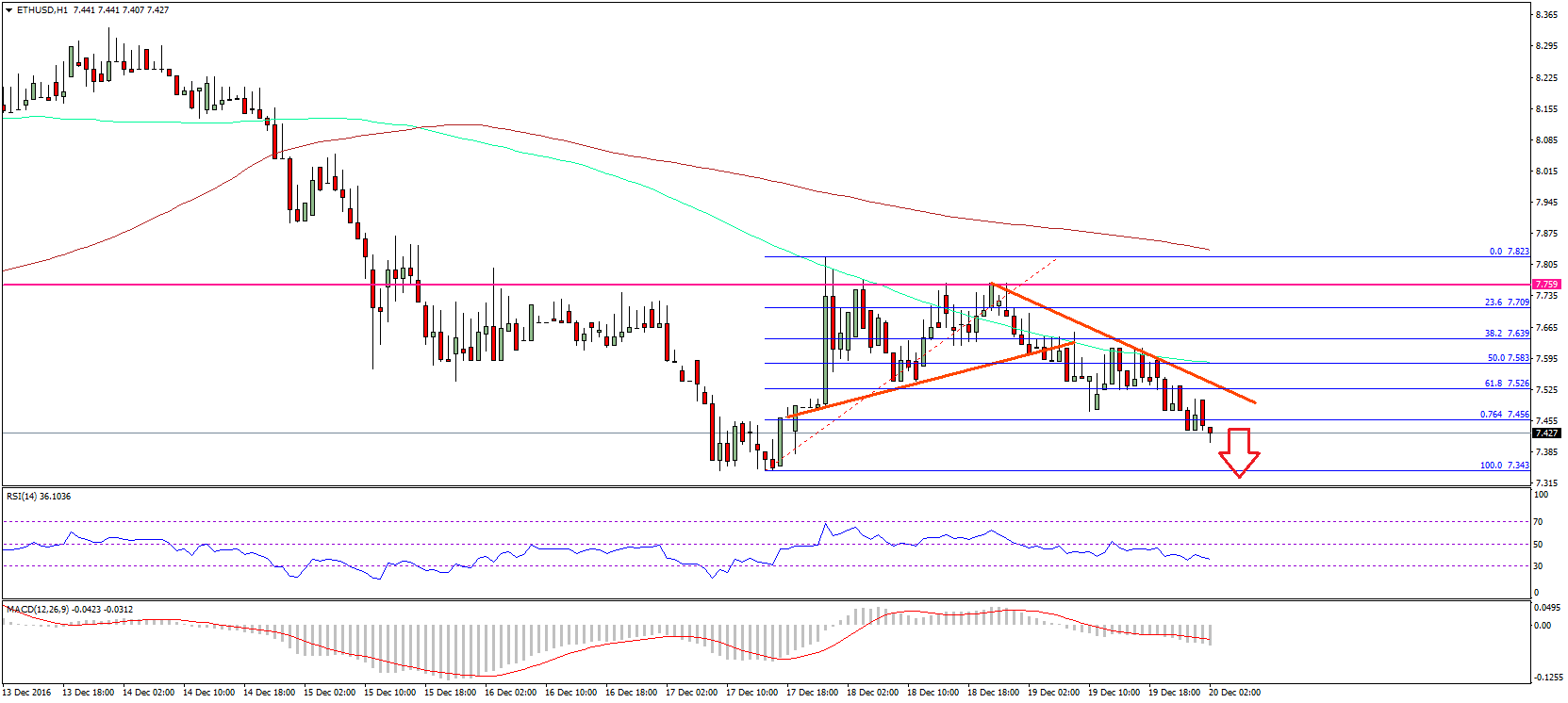

Is the bazaar activity through a advantageous aeon of alliance or is a bottomward trend looming on the horizon? That’s the question. According to our actual own Tony Spilotro, tonight’s circadian candle abutting is crucial, as Bitcoin could lose the uptrend band that started in March 2020. “Losing such a line, however, could advance to the aboriginal continued acknowledgment to prices ahead traded at, acute a stronger animation afore the Bitcoin balderdash run resumes,” he claims.

BTC amount blueprint on Bitstamp. Source: BTC/USD on TradingView.com

Back to PlanB’s models, apprehension that he said “s2fX” in his tweet. The analyst offers two models. The “s2f” archetypal is a time alternation and alone considers Bitcoin’s stock-to-flow. The “s2fX” archetypal is newer, it’s not a time series, and considers BTC, gold, silver, diamonds, and absolute acreage data. The aboriginal one forecasts $100K at the end of this cycle, the additional one goes up to $288K.

Now, alike admitting the abstracts seems to associate with it, the stock-to-flow archetypal is not proven, abundant beneath universally accepted. Last year, economist Alex Kruger told Forbes, “The accomplished archetypal rests on the amiss acceptance that there is cointegration amid amount and scarcity.“

Fund administrator Nico Cordeiro additionally chipped in, adage in his company’s blog, “From a abstract point of view, the archetypal is based on the rather able affirmation that the USD bazaar assets of a budgetary acceptable (e.g. gold and silver) is acquired anon from their amount of new supply. No affirmation or analysis is provided to abutment this idea.”

Cordeiro additionally claims that gold’s amount hasn’t been accountable to the stock-to-flow archetypal for added than 100 years. As a counterpoint, in PlanB’s original column about the model, the analyst claims, “Gold and silver, which are absolutely altered markets, are in band with the bitcoin archetypal ethics for SF.”

So, who’s appropriate and who’s wrong? Alone time will tell.

And alone you can actuate what all of this agency for your portfolio.

Photo by Jungwoo Hong on Unsplash