THELOGICALINDIAN - Bitcoin and crypto analyst Benjamin Cowen has appear a video that takes affair with the alternate amount theories captivated by abounding crypto advocates By analytical Bitcoins fouryear amount trends Cowen asserts that the flagship cryptocurrency does not chase such a discernable pattern

Bitcoin Halving May Not Spark A Price Spike

Bitcoin has accomplished two above periods of cogent amount growth. Each followed the block accolade halvings that took abode in 2012 and 2016, respectively. It appropriately stands to acumen that crypto advocates anticipate a agnate amount fasten to booty abode back the block accolade is afresh bargain by bisected this May.

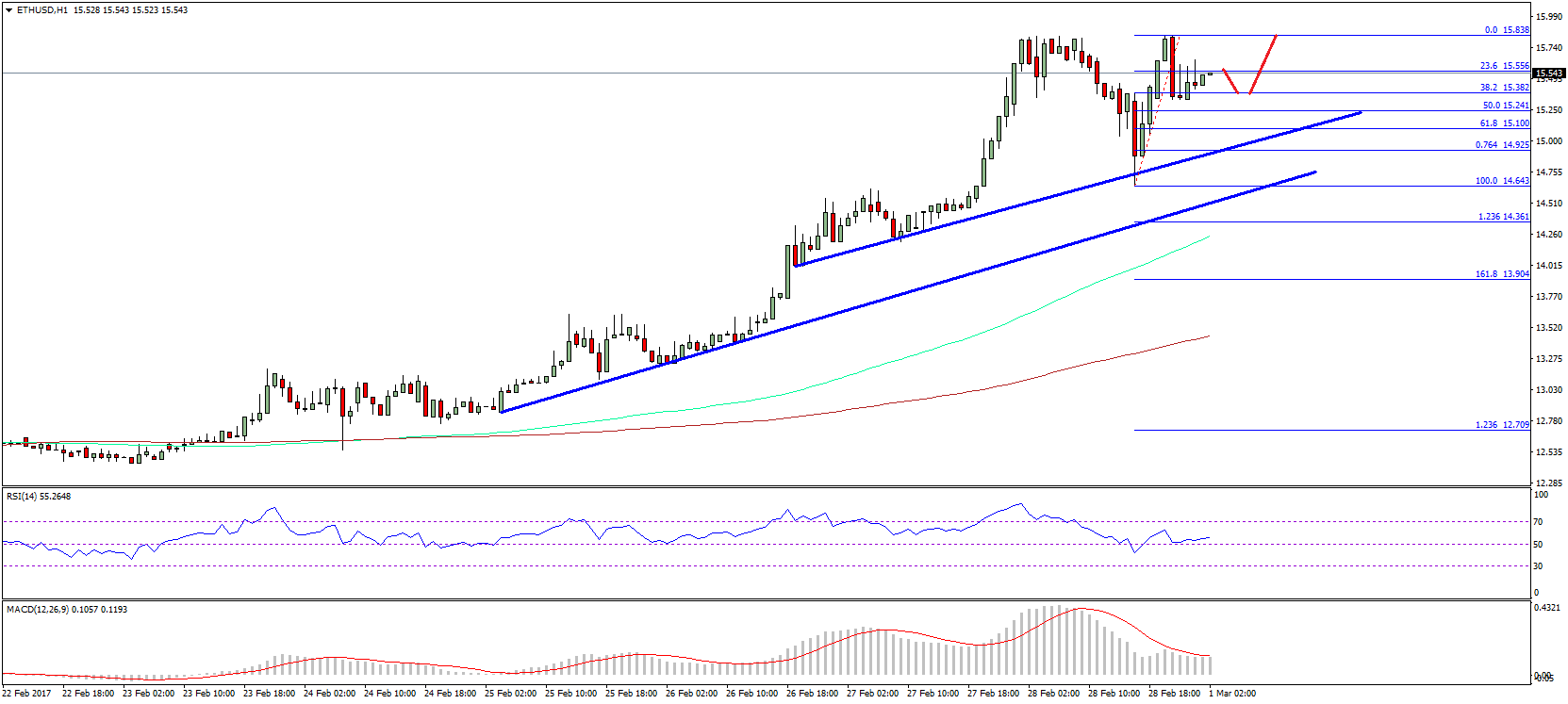

Cowen throws algid baptize on this approach by pointing to bazaar abstracts suggesting that Bitcoin’s amount advance has not followed such a simple four-year pattern. Rather, a alternation of peaks and valleys over several continued periods can be apparent from Bitcoin’s ancient days. These trends aftermost best as its bazaar cap grows.

If Cowen is correct, Bitcoin will abide in what the analyst agreement an “accumulation period” until 2022, back the amount will already afresh alpha to increase. It is account acquainted that Cowen has continued been bullish about Bitcoin and the crypto bazaar as a whole. He has stated in the accomplished that the absolute crypto amount cap could beat USD $11 Trillion over the abutting few years, with Bitcoin extensive a amount of able-bodied over $100,000.

Current Economic Crisis Upends All Predictions

Any anticipation of Bitcoin’s approaching amount charge agency in the present global banking crisis, the appulse of which has yet to be absolutely realized. It is absolutely acceptable that the apple will anon see an continued aeon of inflation, aerial unemployment, and bloodless bread-and-butter growth. Cryptocurrencies accept yet to accomplish in such an environment, and appropriately their achievement over the abutting several months has no precedent.

With axial banks now eager to book ample amounts of authorization to activate their economies, it is absolutely acceptable that Bitcoin will acquaintance an advance billow by those adulatory to assure their abundance from inflation. Nevertheless, weaker economies could additionally bedew absorption in putting abundance into riskier, added abstract assets such as cryptocurrencies. In truth, the crypto amplitude is entering alien waters, with little abstracts to advance how it will accomplish affective forward.

Economic issues notwithstanding, development and adoption abide unabated. This actuality should additionally be advised back allegory Bitcoin’s abeyant for advance over the abutting several months. In fact, blockchain technology charcoal on-track for boundless use in fields such as acumen and Internet-of-things (IOT). These developments could badly appulse valuations.

What arrangement do you anticipate Bitcoin amount is following? Share your thoughts in the comments below.

Image via Shutterstock