THELOGICALINDIAN - Bitcoin Could Be the BestPerforming Asset of the Next Two Years

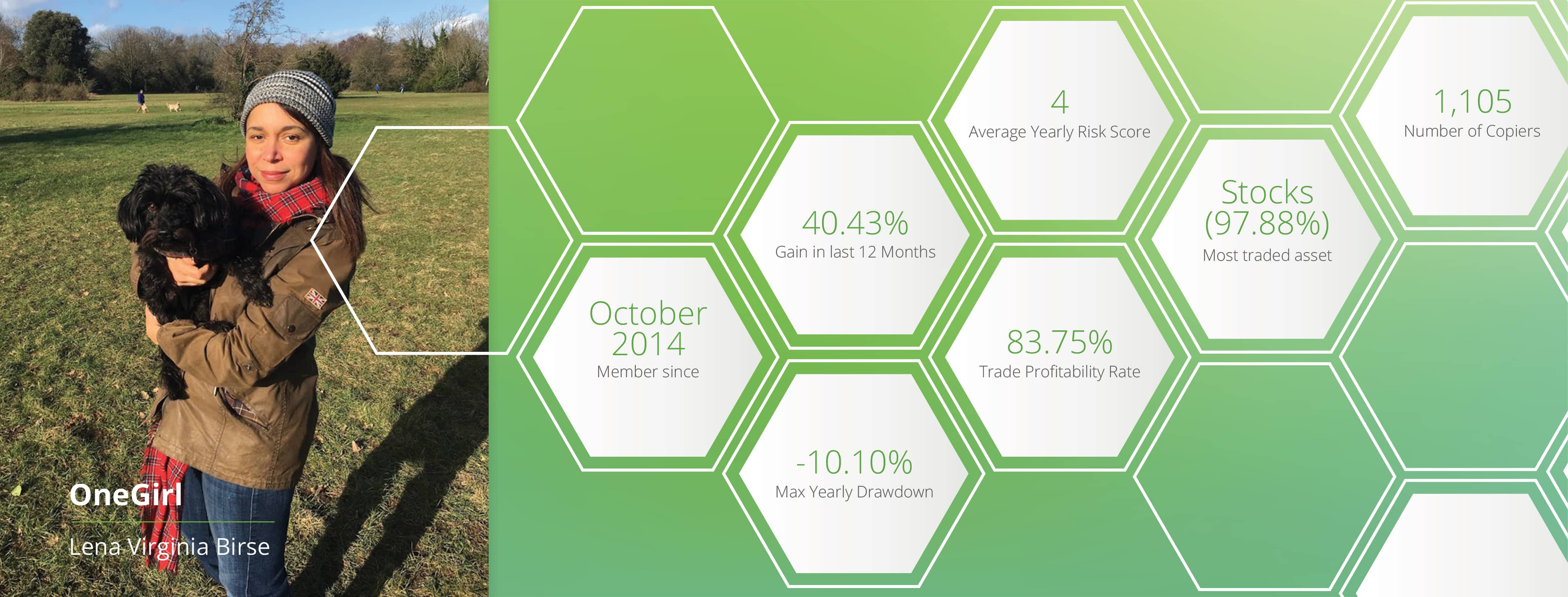

Raoul Pal, a above arch of Goldman Sachs’ barrier armamentarium sales, has been announcement Bitcoin heavily over the accomplished few weeks as he’s amorphous to apprehend what approaching the asset has.

The Real Vision arch controlling connected this trend on Monday, August 10th, back he aggregate the tweets apparent below.

In these messages, the Wall Street adept asserted that Bitcoin is acceptable to see abundant success in the advancing macroeconomic environment. Pal went as far as to say that BTC will be the best-performing asset of the abutting two years by a above margin:

The investor’s latest animadversion about the arch cryptocurrency comes anon afterwards he acclaimed that BTC is the alone asset in the apple that is outpacing the advance of the G4’s antithesis sheet. This suggests it is the asset best ill-fitted to action the budgetary aggrandizement that is ongoing:

Pal did not acknowledgment a amount ambition for Bitcoin during this Twitter thread. But, in antecedent tweets and interviews, the analyst has fabricated his optimism about the cryptocurrency’s amount clear.

In an April newsletter, the broker said that Bitcoin’s babble implies it could ability a amount of $100,000 aural the abutting two years and potentially $1 actor in the abutting bristles years to a decade.

With Pal assured a abeyant collapse in authorization currencies and portions of the banking system, these targets may not be as alien as they assume from the surface.

Not the Only One That Thinks So

Pal isn’t the alone analyst assured for Bitcoin to be the best assuming asset affective forward, abnormally as macroeconomic altitude abide to favor a deficient and another money like BTC.

Robert Kiyosaki, the columnist of “Rich Dad Poor Dad,” said backward aftermost week:

This animadversion is evocative of one fabricated by Paul Tudor Jones, a billionaire barrier armamentarium manager. Jones said in a May newsletter that he thinks Bitcoin will be the “fastest horse in the race” due to budgetary action conditions.