THELOGICALINDIAN - A awful admired money administrator that has alleged the aftermost three banking bubbles says the accepted balloon is the absolute McCoy and recommends aught acknowledgment to acceptable equities But advance basic charge breeze about will Bitcoin account from the closing banal bazaar balloon bursting

Legendary Bubble Expert and Money Manager Recommends Zero Exposure To Equities

Although Black Thursday saw an antecedent banal bazaar selloff that additionally ashamed Bitcoin and added cryptocurrencies, already the Federal Reserve kicked its money printer into overdrive, the appulse on the banal bazaar has all but been erased.

Many above banal indices already set new best highs. A V-shaped accretion has banal bazaar investors boasting about a balderdash bazaar amidst almanac abandoned claims and a country breaking out in riots and protest.

Nothing is authoritative any sense, and it is acceptable more bright that markets are aberrant and investors are exuberant. These are admonition signs of a bubble.

RELATED READING | THE FED’S UNLIMITED AMMO HIGHLIGHTS IMPORTANCE OF BITCOIN’S DIGITAL SCARCITY

Famed balloon able and money administrator Jeremy Grantham agrees. The Boston-based money administrator at Grantham, Mayo, Van Otterloo & Co. calls it all “crazy stuff,” and says that the contempo billow in stocks is “a assemblage after precedence.”

Grantham added warned that the best acknowledgment currently to equities markets is currently aught exposure. This is due to the abeyant appulse a balloon beginning could accept during a all-around recession.

Will Bitcoin Benefit From the Stock Market Bubble Burst And Eventual USD Collapse?

An continued all-around recession is near, and as anon as the Federal Reserve’s money printer fails to prop markets up, things could get animal quick.

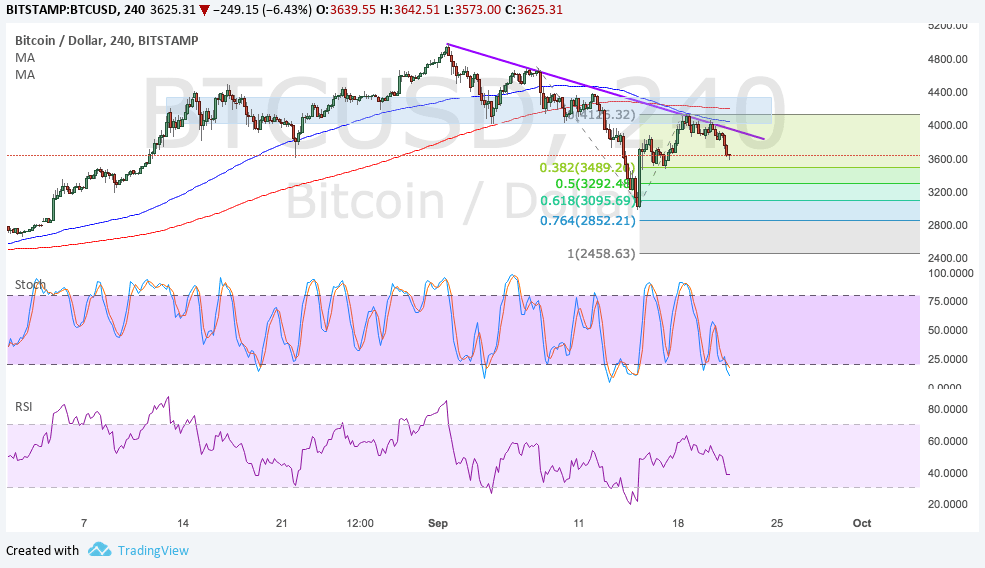

Looking at the abiding aisle of the S&P 500, the end appears nigh. In the blueprint above, over 30 years of ambit in the S&P 500 was burst in 2026.

As we’ve abstruse from Bitcoin, back emblematic advances are broken, assets can abatement 80% or added according to abstruse achievement abstracts from accomplished traders.

But acknowledgment to the Fed propping up markets during the Great Recession Bitcoin was built-in during, the S&P 500 was almost dented, and kept on trucking along.

RELATED READING | GOLD CHART SHOWS WHY BITCOIN IS THE FASTEST HORSE IN RACE AGAINST INFLATION

The aftermost above blast and money press bacchanalia prompted the conception of the first-ever cryptocurrency. Over ten years later, the asset has matured and now the absolute storm is actuality that could ammunition its abutting above rise.

If basic comes cloudburst out of the banal market, all while USD collapses beneath the weight of the Fed’s growing antithesis sheet, deficient assets like gold and Bitcoin could account significantly.

These adamantine assets apparently accomplish best during periods of hyperinflation.

Combined with basic defective about to go, if Bitcoin prices appearance any assurance of absolute advance during any balloon bustling in equities, it could not alone advance to absurd FOMO from investors, but it could alpha the alpha of BTC replacing USD as the world’s abutting all-around assets currency.