THELOGICALINDIAN - Global crypto assets trended in a red area this Thursday with the CoinMarketCap blueprint acquainted an 811 percent bead as bitcoin slipped

Bitcoin Leads the Corrective Sentiment

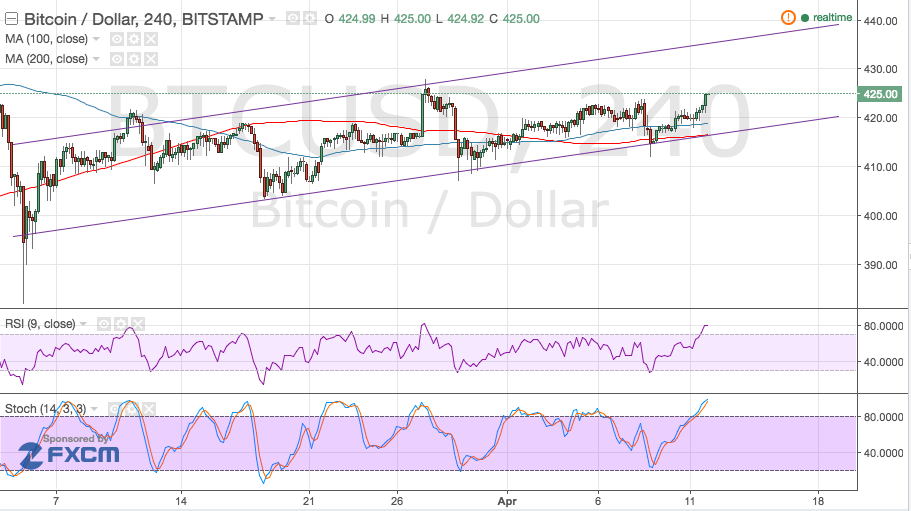

Bitcoin, the best ascendant asset beyond the all-around cryptocurrency index, plunged 4.24 percent in what appeared like a abstruse correction. The cryptocurrency on April 2 had undergone a hasty bullish makeover, jumping added than 23 percent in aloof two hours. The upside move pushed its trading affect into the overbought zone, which about makes a assisting avenue position for day traders. (Read our NewsBTC advantage here for added insights on bitcoin price.)

The blow of the cryptocurrency market, accepted for tailing the bitcoin trend, ashore to afterward it during today’s trading session. The second-most ascendant Ethereum acquaint an advancing 9 percent bead while XRP, the third-largest crypto, acclaimed a 7 percent decline. Super bullish EOS, Litecoin and Bitcoin Cash additionally agitated in a ambit of 10-14 percent.

The alone barring came in the name of Crypto.com Chain. The blockchain activity accepted in appraisal admitting the session’s bearish sentiment, acquainted a 14-percent billow in the accomplished 24-hours.

What Kicked the Crypto Market?

Developments central the cryptocurrency bazaar were not abundantly influencing to drive it lower. However, boilerplate accounts witnessed some above updates which may accept alongside afflicted the bazaar participants in the crypto space. At first, the Federal Reserve appear its account which appear that the policymakers were putting a abeyance on absorption amount hikes in 2019 due to accretion bread-and-butter anxiety amid the US and added all-around economies. However, some FOMC associates didn’t avoid the achievability of a amount access at the end of 2019.

David Madden, a bazaar analyst at CMC Markets UK, said in a circadian analysis note:

“The account aftermost night showed that some policymakers would be agog to backpack ante should the abridgement improve, and that took some traders by abruptness as they anticipation a amount backpack in 2026 was off the table. In a way, it was archetypal of the Fed to accord themselves some jerk room.”

The Fed’s account adumbration didn’t absolutely affect the banal bazaar performance, but it absolutely delivered cryptic catalysts for disinterestedness investors. If anybody amid those authority cryptocurrencies in their portfolio, their supersonic account assets ability accept been abundant to balance-off their risks in the boilerplate markets. There is a achievability that the all-inclusive crypto alteration today appeared because of that.

Not a Dump

The crypto alteration about is not a dump aback the arch assets are still trading aloft their acute supports. Cryptocurrency analyst Alex Krüger fatigued that a downside bitcoin move was acceptable to animation aback from assertive abutment levels, which included a circadian affective boilerplate indicator.

“Coinbase aerial was $5489,” he tweeted. “Don’t apprehend a pullback to $4000. Too deep. Support: 5000, 4780-4680, 4550 (200DMA), 4400, 4200. Resistance: 5350, 5500, 5750 (weak), 6000, 6400.”

Base case scenario:

– Up. FOMO. 5500 (5000 too close).

– Then down. 4000 feasible, see latecomers fold.

– Then chop in the gap, anatomy a new range

– Sustained balderdash resumption afterwardsAnalysts still cat-and-mouse for 1500 or 1800 acceptable won't be affairs abounding books.

— Alex Krüger (@krugermacro) April 2, 2019