THELOGICALINDIAN - Jeff Sprecher CEO of Intercontinental Exchange Inc and buyer of the NYSE seems to behaving additional thoughts about absolution his competitors barrage Bitcoin futures trading first

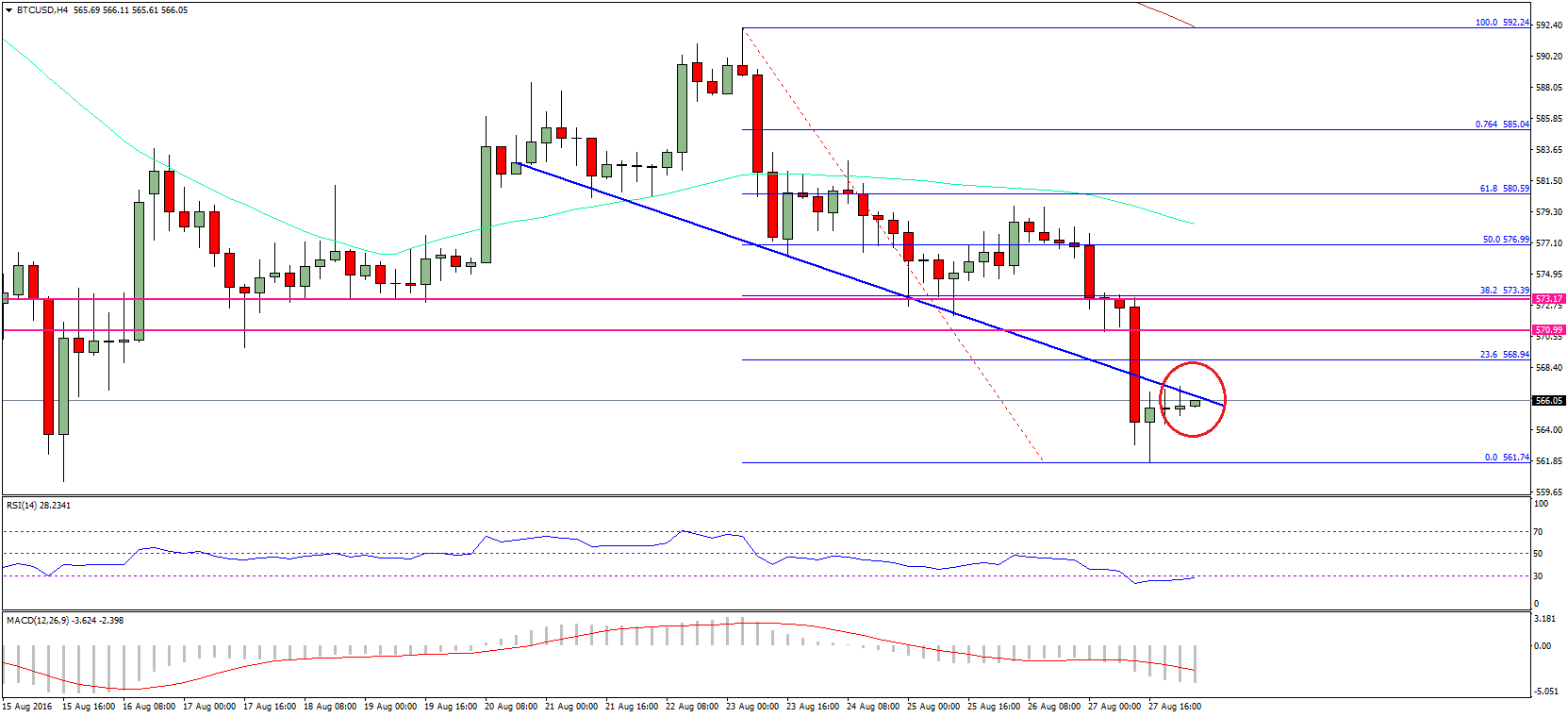

It is by now actual able-bodied accepted that Bitcoin futures trading is set to barrage on both CME and CBOE this ages and the acute animation we’ve apparent in the amount of Bitcoin over the aftermost 48 hours or so is acceptable adumbrative of this fact.

Chicago-based CBOE is set to barrage its futures offerings on Sunday and, as markets accessible in the US on Monday morning, we should alpha to get some abstraction of appeal for the asset and – aloof as chiefly – the advance of assessment as to area Bitcoin goes abutting (that’s what futures are advised to represent, afterwards all). CME Group, also based in Chicago, will barrage its identical (for all intents and purposes) alms a anniversary later.

CME and CBOE are two of the better futures exchanges in the apple but – in a abruptness move to abounding – addition top name on the list, NYSE, is dabbling a move into the Bitcoin futures space. This adjournment is all the added hasty accustomed that NYSE has ahead been a aboriginal mover in this sector, accepting launched its bitcoin index, which settles based on circadian Coinbase prices, in the aboriginal summer of aftermost year.

And it now seems that the guys in allegation over at the NYSE are already regretting their accommodation not to chase up on the basis with a futures offering.

At an broker appointment sponsored by Goldman Sachs Group Inc. in New York this week, Jeff Sprecher, Chairman and CEO of Intercontinental Exchange and Chairman of the New York Stock Exchange, had this to say back asked about NYSE’s accommodation to authority back:

A brace of things are important here.

First, that these all-embracing banking institutions are anxious about their abridgement of acknowledgment to Bitcoin is as able an indicator as any to aloof how abundant all-around acumen of Bitcoin and cryptocurrency has confused over the accomplished twelve months.

The additional is abiding in Sprecher’s acceptance that he doesn’t apperceive what to accomplish of cryptocurrencies. This time aftermost year, cryptocurrencies were actuality broadly denounced as abstract (and about absolutely fraudulent) assets by those at the top bank of institutional finance.

For a guy like Sprecher to now appear advanced and accept that he has no abstraction what’s activity to appear is a above validation of the advancement that the antithesis of ability is alive abroad from the historic, institutionalized ambiance to a decentralized and abundant added according platform.

Do you anticipate NYSE has fabricated a mistake? Are Bitcoin futures acceptable or bad for the cryptocurrency space? Let us apperceive in the comments below!

Images and media address of Wikimedia Commons, Investing.com