THELOGICALINDIAN - Bitcoin has been activity agrarian over the accomplished few hours Its amount surged rapidly appear 9900 but an centralized affair on BitMEX acquired this belvedere to go bottomward affecting the flagship cryptocurrency

Following the incident, Bitcoin took a 3.5% nosedive abatement the assets fabricated today.

Data from Datamish shows that $11.4 actor of continued positions and about $6 actor account of abbreviate affairs were asleep on the Seychelles-based crypto derivatives barter in the accomplished 24 hours alone.

The aftermost time BitMEX accomplished a arrangement abeyance was on March 13, which resulted in accumulation liquidations that pushed the amount of Bitcoin beneath $4,000. While the implications of the contempo blow are yet to be seen, on-chain metrics advance that Bitcoin is apprenticed for a bearish impulse.

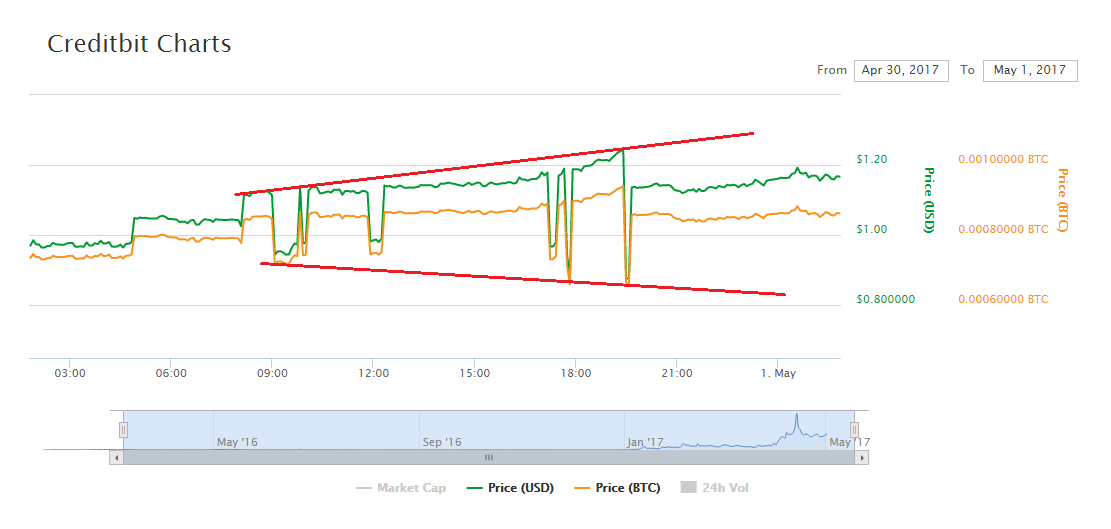

A Steep Correction on Bitcoin’s Horizon

While the flagship cryptocurrency continues to re-test the $10,000 attrition level, its on-chain aggregate appears to accept “leveled off,” according to Santiment.

The behavior analytics belvedere explained in a contempo blog column that Bitcoin’s on-chain aggregate has been steadily crumbling alike admitting its amount charcoal trading aloft $9,500. The above alteration amid amount and aggregate may advance that BTC could be assertive for a correction.

“We wouldn’t be afraid to see addition re-test of $9,000 – $9,200 ancient this anniversary afore some buy orders advancing to the rescue,” said Brian Quinlivan, Marketing and Social Media Director at Santiment.

Bitcoin’s circadian alive addresses additionally arise to accept ailing on May 7. Since then, this on-chain metric has been authoritative a alternation of lower highs. It has alone from a aerial of 1 actor circadian alive addresses to 964,000.

Such a abatement in the action of the arrangement is usually apparent as a abrogating sign, which adds acceptance to the bearish alteration apparent amid Bitcoin’s amount and its on-chain volume.

Considering that there are entities and individuals who own millions of dollars of account of BTC, colloquially accepted as whales by crypto traders, a attending at what they are accomplishing can accommodate a bright account of what it is actuality planned abaft bankrupt doors.

These alleged “whales” accept a asymmetric appulse on prices because of their astronomic backing and their adeptness to alike affairs and affairs activity.

Prior to the contempo halving, the cardinal of addresses with 1,000 to 10,000 BTC began increasing bound fueling Bitcoin’s acceleration arise $10,000. However, these ample holders arise to be boring affairs their holdings, which may advance to a abrupt correction.

Key Support and Resistance Levels to Watch Out

Out of all Bitcoin addresses, added than 69% are currently “In the Money,” while 27% are “Out of the Money,” according to IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model.

These abstracts may announce that the broker abject abaft BTC is assured about a added advancement advance. But the acumen of the army is usually inaccurate signaling that one charge be alert about a abeyant downturn.

Looking at IOMAP cohorts shows that added than 1.4 actor addresses bought over 840,000 BTC at an boilerplate amount of about $9,500. This amount akin represents a massive accumulation bank and will acceptable accommodate able abutment if the bellwether cryptocurrency were to decline.

On the cast side, the attrition akin aloft sits amid $9,700 and $10,000. Here, 756,000 addresses purchased almost 480,000 BTC.

Even admitting the altered metrics explained aloft assume to announce that the bellwether cryptocurrency is apprenticed for a retracement, one charge delay for a bright breach of the above abutment or attrition levels. Moving accomplished either of these barriers will accommodate a bigger abstraction about area BTC is headed next.