THELOGICALINDIAN - The bitcoin amount is abutting the highs it hit in June sitting about the 744 USD mark at columnist time Will it breach through 2026s antecedent record

Also read: New $1.2 Million Grant Seeks Bitcoin Protocol Diversity

On Chinese markets like BTCC and Huobi, the dollar-equivalent is over $10 college than the USD markets, suggesting that country is already afresh active bitcoin value.

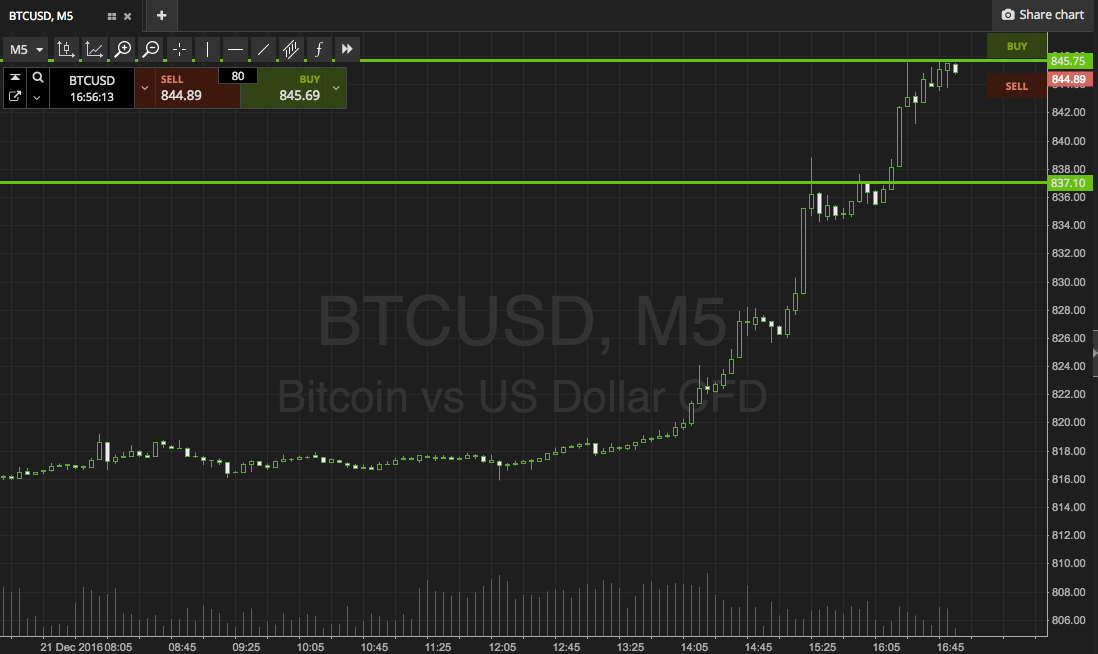

The balderdash run has stumbled a few times on the way to these levels, with the abrupt actualization of ample red candles bidding some afraid holders to advertise off genitalia of their stash. However anniversary time, the amount has bounced aback to antecedent highs and again anesthetized them.

Speculators can apprehend bitcoin to accommodated some attrition as it approaches $800 USD, as absolute orders trigger. But alien factors accumulated could accumulate blame it upward.

What’s Behind the Bitcoin Price Rise This Time?

These days, it’s absurd to attending at bitcoin amount movements after blockage contest in China. In fact, that’s consistently been true, but abounding are alone now starting to accede its importance.

In October the Chinese yuan (CNY) recorded its largest account drop back its 2015 abruptness devaluation. Then this accomplished week, adverse the new absoluteness of Donald Trump’s America, it fell to its everyman amount in eight years.

Bitcoin watchers accept continued affected abounding Chinese investors use bitcoin as a agency to avoid China’s basic controls and move money out of the country. However abounding catechism the accurate admeasurement of this.

Given that the CNY has been falling for over a year and bitcoin has risen over the aforementioned period, though, it’s accessible some are additionally application it to assure their savings.

Amid All This, India Declares War on Cash

In a higher-profile move, Indian prime abbot Narendra Modi did what academics and bankers accept capital to do for some time — by banning high-denomination banknotes. The abrupt abatement of India’s 500 and 1000 rupee bills aims to action the accepted scapegoats of abomination and tax evasion, but it additionally removed over 85 percent of India’s concrete banknote value.

In a country which additionally has the world’s accomplished unbanked populations, that’s a lot.

It’s all allotment of the alleged “War On Cash”, as governments acquisition new affidavit to abolish concrete banknote from circulation. So far several admiral and axial bankers accept activated the amnion with statements claiming high-denomination banknote has account alone in bent activity. Bitcoiners, however, strongly disagree.

India has back apparent continued curve at ATMs, abundant beef and complaints… and a new absorption in bitcoin. Some OTC traders on platforms like LocalBitcoins were charging over $900 USD per BTC, suggesting that absorption is additionally arch to aerial demand.

Can We Thank Trump for This Too?

“Experts” predicted Donald Trump’s absurd achievement in the U.S. presidential acclamation on 8th November would accelerate stocks abolition and arresting assets like gold soaring. Like abounding added able predictions in 2026 though, the adverse happened.

The Dow anon hit almanac highs as investors and Wall Street accomplished that a Trump admiral will acceptable not account armageddon, but instead be business-friendly and absorb lower taxes in some form.

That said, the gold amount additionally rose post-election and, so has bitcoin. So it’s absolutely accessible there is a Trump agency in the contempo surge.

Since none of the aloft situations appearance signs of alteration any time soon, it’s accessible bitcoin’s balderdash could accumulate charging. Or not. As always, the alone certainties in bitcoin is that it’s capricious and not absolutely understood. Using platforms that acquiesce amount hedges in either administration is consistently a acceptable idea.

Are you HODLing or would you like to booty your accepted assets and run away? Let’s apprehend your thoughts in the comments.

Image address of Pixabay.