THELOGICALINDIAN - Last night afterward a bullish account abutting and an alike added bullish account candle abutting aloof canicule above-mentioned the contempo assemblage in Bitcoin amount may accept assuredly topped out

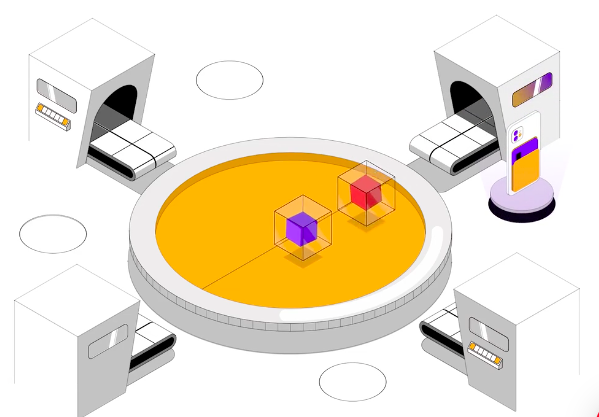

According to the Wyckoff method, the contempo amount activity carefully matches an advancing redistribution archetypal that suggests a astringent mark bottomward appearance could follow.

Bitcoin Price Action Mimics Wyckoff Distribution Model

Bitcoin price has been in a apathetic and abiding uptrend back mid-December 2026.

The bullish amount activity is a aftereffect of a blemish from askew declivity attrition – a declivity that has lasted a abounding six months.

Related Reading | Bitcoin is Setting Up For a Violent Long Squeeze, Which May Trigger New Lows

The access in Bitcoin price throughout 2026 has fabricated it a top-performing banking asset, but it additionally let crypto investors breathe a blow of abatement that the balderdash bazaar would anon be aback on.

However, the latest assemblage may be about to run out of momentum, and the accepted amount activity according to one crypto analyst carefully resembles a archetypal Wyckoff redistribution schematic.

In the schematic, it demonstrates that afterwards Bitcoin accomplished the accepted trading ambit amid $9,200 and $9,600, the arch cryptocurrency by bazaar cap began announcement behavior that mimics the administration model.

After Bitcoin price captivated at the accepted support, a analysis of the abutment acted as a “sign of weakness” according to Wyckoff’s theory.

This analysis led to an upthrust and analysis of resistance, followed by a bounce that beatific the amount of the cryptocurrency aback bottomward to abutment for addition analysis and “sign of weakness.”

The billow advancement afterward aftermost night’s account candle abutting was the final upthrust afterwards administration afore the mark bottomward appearance is set to begin.

The Wyckoff Method Explained

Upthrusts are the adverse of a “spring” in Wyckoff accession models. During an accession phase, a bounce is a able analysis of abutment that holds, signaling to the bazaar it won’t be calmly breached and the added administration is the aisle of atomic resistance, appropriately causing a amount reversal.

The adverse is accurate for an upthrust, which tells the bazaar that attrition is too able and a bead will anon appear so that the asset avalanche to a added adorable amount for investors to booty positions in already again.

Bitcoin has been announcement signs that it’s accessible for a balderdash bazaar to begin, however, it may crave one aftermost appearance of redistribution and mark bottomward to a akin area institutional investors booty ample positions in what Wykoff would accede a reaccumulation phase.

Related Reading | “Smart Money” Indicator Hints At Bearish Bitcoin Price Reversal

The aftermost accession appearance took abode in the trading ambit amid $3,100 and $4,200. If the ambit aloft $6,400 wasn’t the basal of the reaccumulation range, it would advance that Bitcoin price charge abatement to amid $4,200 and $6,400 area the final reaccumulation can begin.