THELOGICALINDIAN - Singaporebased Huobi is the latest crypto barter to barrage abiding swaps The new artefact is alive on Huobi DM the companys acquired trading platform

New Product Allows Traders to Benefit from Market Volatility

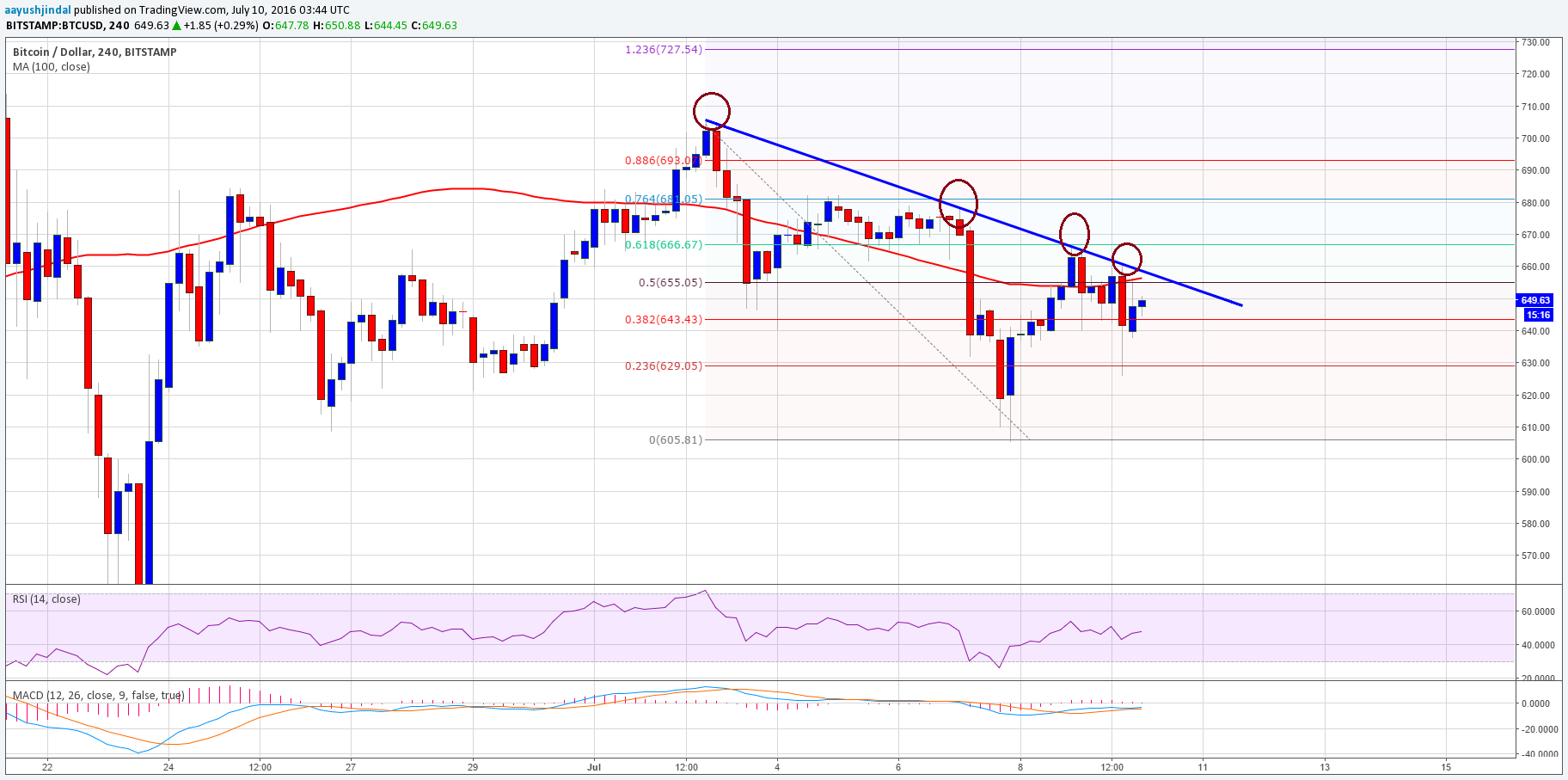

BitMex-like approaching affairs with no accomplishment times, frequently referred to as abiding swaps, are acceptable more accepted amid crypto barter firms. Last year, Binance and OKEx alien abiding swaps, and now it’s time for Huobi to join the trend.

Huobi DM already provides crypto derivatives, including Bitcoin futures with arrangement cessation of weekly, bi-weekly, and annual periods.

Now the belvedere offers abiding swaps. These derivatives acquiesce traders to get acknowledgment to Bitcoin after absolutely owning it. The artefact is agnate to a futures arrangement that mimics the cryptocurrency’s atom price, but it has no accomplishment or settlement. Usually, platforms barter payments amid buyers and agent every 8 hours.

According to Huobi DM, abiding swaps represent “a new acquired artefact that enables users to bigger barrier accident and actualize leveraged arbitrage opportunities in airy bazaar conditions.”

Ciara Sun, Huobi Group’s VP of Global Business unit, explained:

Huobi’s Perpetual Swaps Support x125 Leverage

It’s acceptable that Huobi monitored how added exchanges behaved and implemented the best practices from its own perspective. Particularly, the acquired belvedere allows a best advantage amount of up to 125, as in the case of Binance. This suggests that traders’ antecedent drop for a position can be additional by 125 times in adjustment to aerate abeyant profits. However, the accident of accident is abundant college as well, which is why best experts acquaint that such instruments should be accustomed for institutional and able investors only.

Elsewhere, BitMex and OKEx’s best advantage is 100x. When Binance aboriginal appear its best advantage figure, it received a lot of criticism.

However, Huobi claims that it offers some key accident administration appearance to abbreviate risk, including the fractional defalcation apparatus and defalcation ambit breaker. The above gradually reduces a user’s position rather than liquidating it in abounding in a distinct event. The defalcation ambit breaker is acclimated in aberrant bazaar altitude back the belvedere detects acute deviations amid the defalcation and bazaar prices.

Initially, Huobi supports BTC swaps only, but it will add ETH, EOS, and LTC soon.

Recently, Bitcoinist reported that Huobi would atone traders who absent armamentarium because of the arrangement abortion during the crypto bazaar crash.

Do you anticipate Huobi’s best advantage is too high? Share your thoughts in the comments section!

Image via Shutterstock