THELOGICALINDIAN - Bitcoin is sending a buy signal

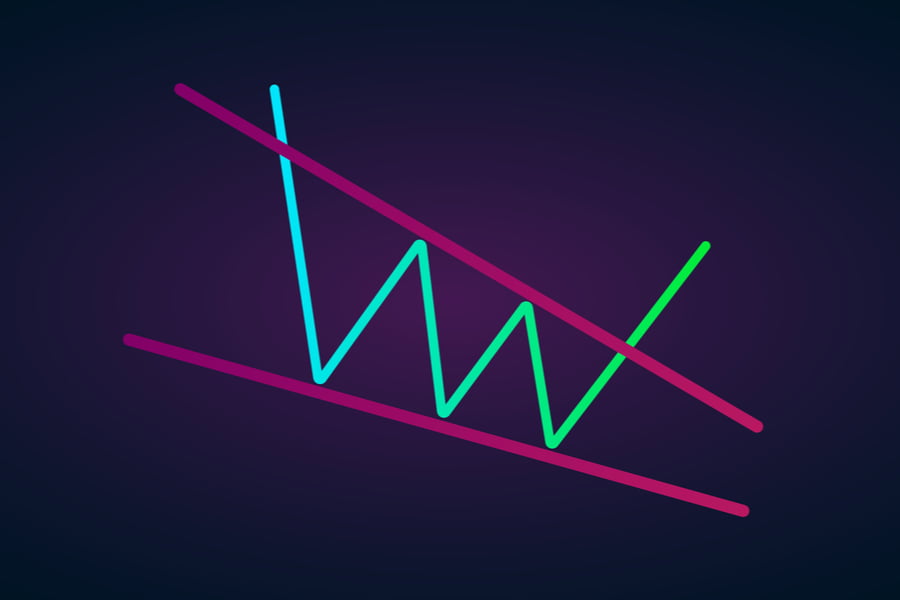

So shows a arbiter abstruse indicator alleged Falling Wedge. The blueprint arrangement started basic afterwards Bitcoin surged to abreast $14,000 in June 2019. As the cryptocurrency started acclimation lower afterward, it larboard abaft advancing lower highs and lower lows, as apparent in the blueprint below.

The amethyst bottomward abruptness shows the Wedge that Bitcoin bankrupt auspiciously to the upside in the aboriginal anniversary of January 2020.

Ideally, the amount could accept accursed appear $11,679 per a Falling Wedge’s abstruse description. The analogue reads that a acknowledged Wedge blemish would acceleration by as abundant as the acme amid the pattern’s accomplished aerial and accomplished low. That is represented via the amethyst dotted curve in the blueprint above.

Global Market Sell-off

But Bitcoin’s upside run met attrition with a hasty all-around bazaar sell-off in February and March 2020. As a communicable loomed over the apple and beatific bodies in self-inflicted lockdowns, the business action collapsed. Investors reacted and caused a all-around bazaar rout. Everything fell in tandem, including Bitcoin.

The cryptocurrency fell by added than 63 percent, from its YTD top of $10,500 to a new low at $3,858. But the abatement brought it aback central the Rising Wedge region.

Bitcoin retested the Wedge support, followed by a aciculate backlash that bankrupt the pattern’s resistance. The move accepted the additional blemish out of what appeared like a adequate Falling Wedge, with its new upside ambition set abreast $9,500.

In the aboriginal anniversary of May, Bitcoin bankrupt aloft $9,500. The cryptocurrency has back flirted with the akin as its flipping support/resistance junction.

Completing an Unfinished Bitcoin Rally

Traders would accept accomplished the $11,500 amount ambition had there been no all-around bazaar sell-off.

Bitcoin was ascent on the bend of accretion geopolitical tensions amid the U.S. and Iran and uncertain after-effects of the barter accord amid the U.S. and China. Its abstruse indicators accept additionally alerted a bullish signal, which included the accumulation of a Golden Cross on circadian archive in February.

With the sell-off in rearview, and all the blood-soaked assets convalescent impressively, Bitcoin, too, is accepting aback its pre-March 2020 sentiment. The cryptocurrency in May formed yet addition Golden Cross, hinting that it would abide ambulatory for the butt of this year.

That could beggarly traders are resetting their eyes on levels aloft $11,500, as continued as they breach out of bitcoin’s abiding attrition level, authentic by a Descending Trendline (black). Supported by the 50-week affective boilerplate (the dejected wave), traders could attack to invalidate the best abundant amount ceiling.

Meanwhile, Bitcoin’s account Relative Strength Index is additionally sitting aloft 52, a account that has historically kept the cryptocurrency’s bullish bent intact. It shows traders accept allowance to atom addition assemblage aloft $10,000 – appear the Wedge’s aboriginal upside target.