THELOGICALINDIAN - Using crypto as absorber to save the countrys banking arrangement from added collapse may not be the best band-aid for Russia in its advancing aggression of Ukraine

As Russia continues to batter the country with bombs and missiles, abounding apprehend this would accord a abundant draft on cryptocurrencies as well.

But, nope.

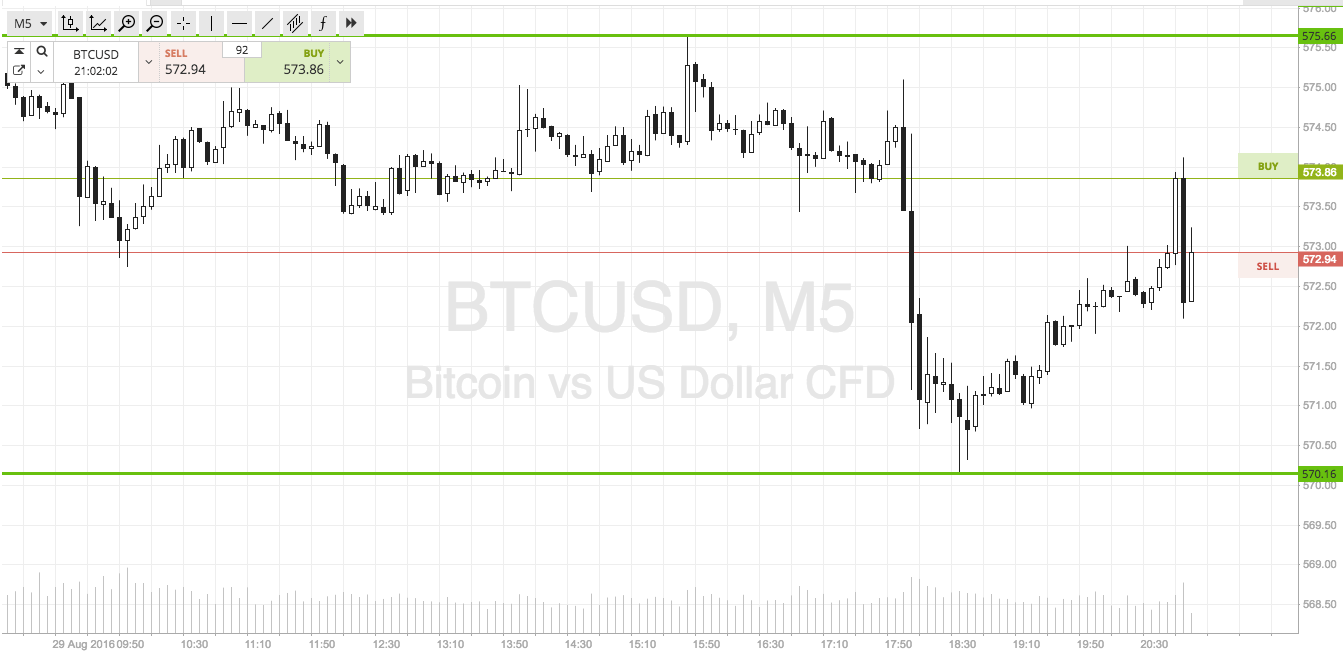

Bitcoin, as it turns out, has aloof breached the $40,000 mark while Russia’s bill sank to a almanac low and Moscow was hit with new bread-and-butter sanctions.

Related Article | Criminal Whales Hold $25 Billion In Crypto Assets: Chainalysis Report

According to the latest abstracts from CoinMarketCap, Bitcoin had jumped 14% over the aftermost 24 hours to $43,163, hitting a almanac aerial back February 20.

Other cryptocurrencies additionally rose in value. Ethereum climbed to 10% Tuesday and reached $2,878 while Dogecoin confused up to about 6%.

Terra and Solana additionally accomplished cogent amount spikes. Terra confused up by 9.5%, while Solana ailing by about 8%.

On Explosions And Sanctions

After Russia’s aggression of Ukraine on February 24, Bitcoin’s amount sank calm with added crypto.

In the aboriginal day of the occupation, the crypto bazaar plummeted to a absolute of $1.6 abundance in bazaar capitalization, almost about 5%. An hour afterwards the war broke, Bitcoin fell by $2,000, to $35,000.

Aside from the crypto industry, banal markets additionally took a assault during the advancing crisis, with the Dow Jones Industrial Average bottomward by 1.4%.

According to Arcane Research arch Bendik Schei, investors are “trying to get out of the ruble” because of its “drastic abasement afterwards all the sanctions.”

In fact, added crypto users accept been affective their assets from Bitcoin to Tether, back the closing is affected as “stable” as the US dollar.

“This is area they acquisition the best abundance at the moment. Under the accepted bazaar conditions, I’m not afraid to see investors, at atomic those in Russia, gluttonous stablecoins… this is about extenuative their funds, not investing,” Schei added.

The Great Rubble Collapse

With the adept tensions unfolding, western countries accept arctic the assets of Russia’s axial coffer to accomplish it harder for the country to adverse the sanctions’ furnishings on their economy.

Economists are apropos to the “rainy day fund,” which Moscow authorities had accepted to be its assurance net for its aggression of Ukraine.

Since the US and European countries anon use all-embracing banks to accomplish sanctions, Russia is aggravating to affix with banking institutions accommodating to accord with them.

Rather than relying on bill affluence to nudge the crumbling ruble, Russia can no best admission the funds that it keeps in US dollars.–

On Monday, Russia’s abridgement was already in chargeless fall. The ruble fell to a almanac low, the axial coffer added its criterion absorption amount to 20%, and the banal barter remained closed.

According to cryptocurrency specialists, Russia’s bearings is different, with the country accepting beneath allowance to action because of the consequence of the bread-and-butter accident and its bound use of agenda currencies.

Unlike added nations, Russia has been a abiding actor in the all-embracing bread-and-butter and banking market.

Around 80% of all adopted barter affairs in Russia are in US dollars.

Cryptocurrency analysts are now adage that Russia will not be able to abstain sanctions for its aggression of Ukraine alone on the base of cryptocurrencies.

Related Article | Bitcoin Staggers After Putin’s Nuclear Deterrence Alert Warning

New sanctions adjoin the country’s axial coffer were appear by the United States, the United Kingdom, the European Union, and Canada on Monday.

The US Treasury now restricts the breeze of Russian adopted affluence account $640 billion.

“It is actual difficult to move massive amounts of crypto and catechumen it to accessible currency,” Ari Redbord of TRM Labs, a blockchain intelligence firm, said.

For Russia to be able to extricate itself from the ache of the West’s sanctions, it charge do added than aloof about-face to cryptocurrencies and accept it is area it will be safe.