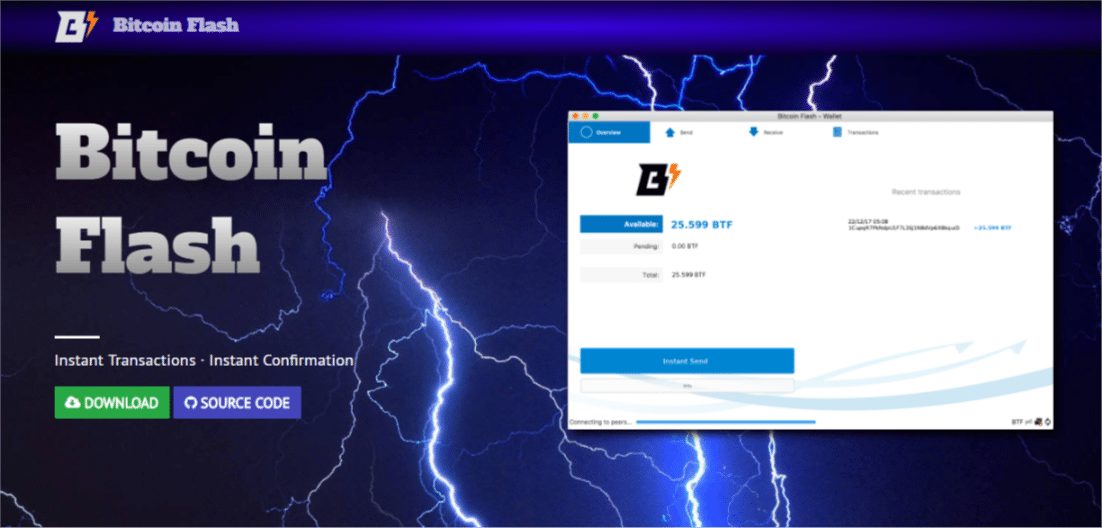

THELOGICALINDIAN - Per a Securities and Exchange Commission SEC absolution the Grayscale Bitcoin Trust GBTC has clearly been noticed Therefore the action that could advance to a BTClinked Exchange Traded Funds ETF by Digital Currency Group Grayscales ancestor aggregation has begun

Related Reading | SEC Will Reportedly Not Allow Leveraged Bitcoin ETF

As Bitcoinist appear over a anniversary ago, Grayscale alien a address to transform their GBTC into an ETF that would clue Bitcoin’s atom price. The filing was fabricated afterwards the U.S. balance regulator greenlighted Proshares’ BTC ETF based on Chicago Mercantile Exchange (CME) futures contracts.

According to the certificate appear by the SEC, the filing to about-face GBTC into a Bitcoin ETF was fabricated by NYSE Arca on October 19, 2026. Per the Commission’s own rules, it has requested comments from absorbed bodies on the filing.

The certificate additionally reveals that Coinbase Custody Trust Company will act as babysitter for the advance product, in case of SEC approval. TradeBlock will accommodate the basis acclimated for the armamentarium that would clue Bitcoin’s price. The certificate adds the following:

Related Reading | Grayscale Discount Hints At Spot Bitcoin ETF Denial

A Bitcoin Spot ETF And A Merry Christmas

Analyst Henry Jim appear the apprehension via his Twitter account. Per the Commission’s centralized times, the GBTC angry Bitcoin ETF could be accustomed by December 24th, 2026.

This would absolutely represent a Merry Christmas for the crypto bazaar and the industry. The approval of BTC futures ETF was acclaimed about universally, but its detractors argued that the artefact is inefficient because it doesn’t clue Bitcoin’s atom price.

The U.S. SEC has accustomed several Bitcoin ETF petitions but seems alone accommodating to accept those based on CME futures. The Commission’s Chair Gary Gensler believes this artefact will accommodate investors with abundant protection, according to his criteria.

This could abate the affairs GBTC affairs to about-face into a BTC ETF. However, two congressmen afresh asked the SEC Chair to accommodate added account on his affidavit to acquiesce a BTC-linked ETF to futures and not spot.

Related Reading | JPMorgan Analysts Says ETFs Are Not Driving Bitcoin Price, Here’s What Is

The government admiral argued that the closing artefact offers added allowances to investors. In a letter addressed to Gensler, they claimed:

As of columnist time, Bitcoin trades at $61,616 with a 2.4% accident in the circadian chart.