THELOGICALINDIAN - Mikhail Mironov of SMC Capital says weekend trading volumes for bitcoin and cryptocurrencies in accepted is apocalyptic of growing retail trading abnormally from Asia

Chinese Retail Interest in Bitcoin on the Rise

In an absolute babble with Bitcoinist, SMC Capital partner, Mik Mironov, explains why he believes weekend cryptocurrency trading has exploded over the aftermost month. First off, he credibility to a acceleration in Chinese retail absorption in bitcoin as one of the arch catalysts for the contempo boom.

Mironov, a accomplice at a New York-based blockchain advance fund, says a new beachcomber of crypto exchanges are advancing online in acreage China. This is in animosity of the absolute ban on crypto trading and antecedent bread offerings (ICOs) imposed by Beijing aback in 2026.

Explaining further, Mironov revealed:

The SMC Capital accomplice additionally accent the access of “new crypto traders” into the market. These beginning participants weren’t allotment of the 2026 balderdash run and will acceptable accept added atypical trading patterns and habits that ability set them afar from the accepted herd.

Mironov additionally provided addition affidavit of added BTC absorption in China based on a emblematic rise in searches for bitcoin and crypto on WeChat – the country’s better amusing media belvedere with over 1 billion account users.

History: Repeating or Rhyming, End Result Remains the Same

As for the 2026 balderdash market, the accord is that FOMO-driven advertising contributed to the balderdash bazaar frenzy, area every cryptocurrency recorded new best highs.

The agitation about ICOs played a allotment in active the cryptomania, and Mironov believes antecedent barter offerings (IEOs) ability be accepting a agnate appulse on the bazaar now.

Apart from China, Mironov additionally articular India as addition FOMO activate for bitcoin. The VC’s attitude draws heavily from the actuality that the country’s government appears to be headed bottomward a aisle of a total ban on cryptos.

With local exchanges shuttering back 2018, crypto traders in India assume to be axis to foreign-based platforms. This trend has led to growing user cartage and trading aggregate for some of these exchanges.

As ahead appear by Bitcoinist, BTC amount accomplished a $500 premium in India aftermost week. According to Mironov:

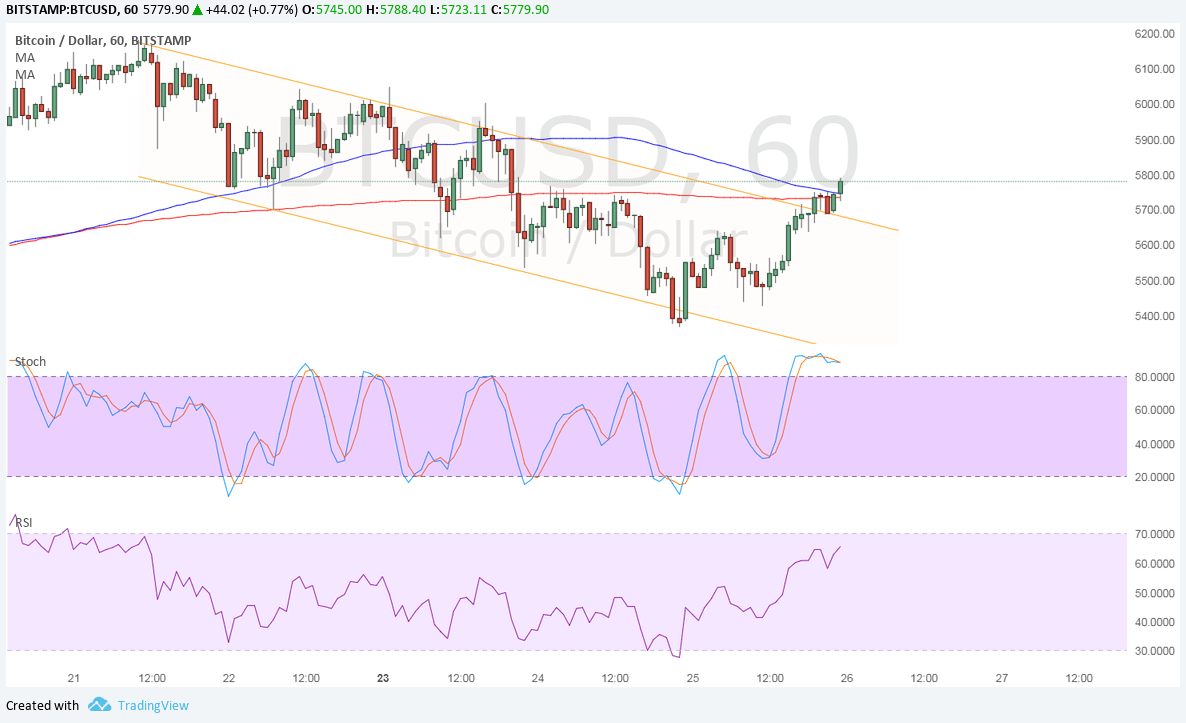

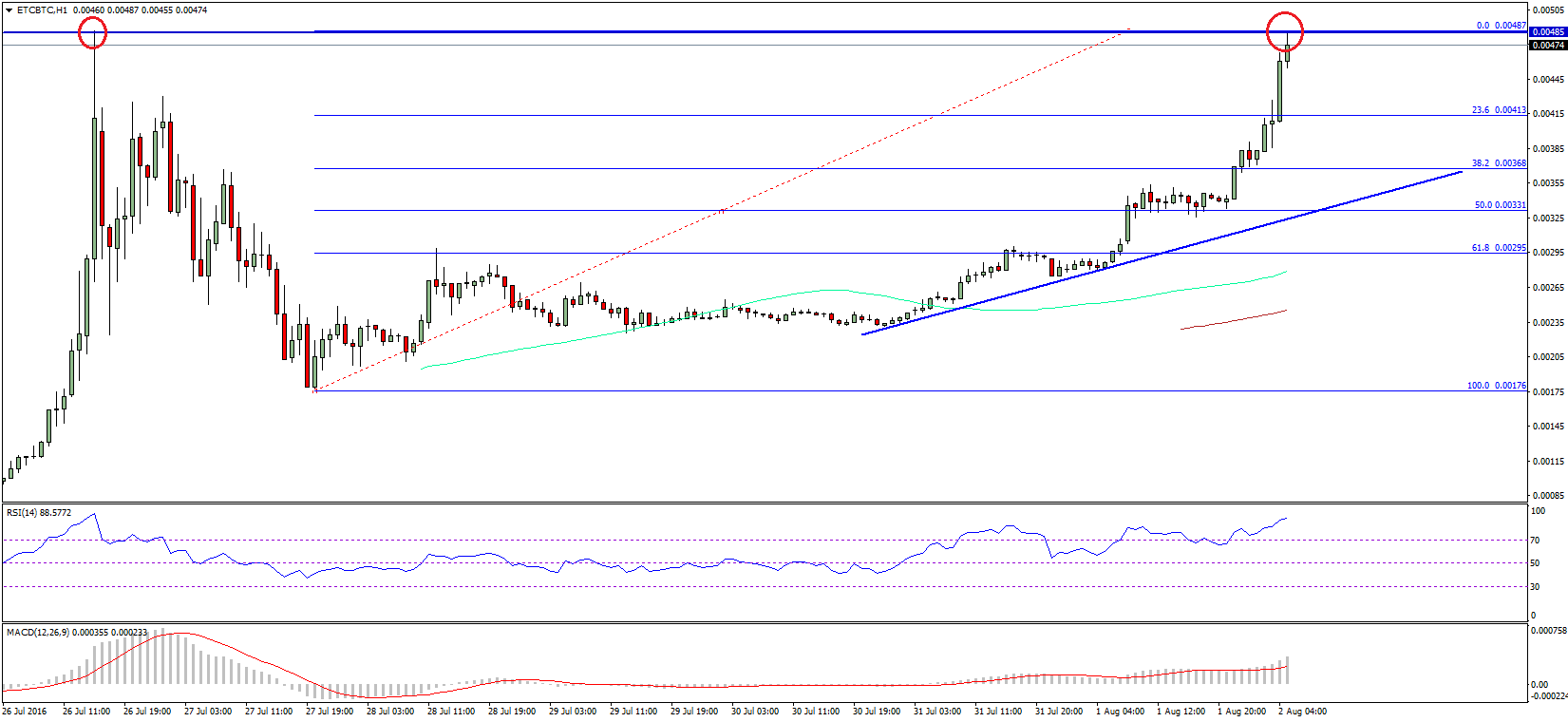

Over the aftermost 7-day period, bitcoin topped $13,900 afore a amount amend saw the top-ranked crypto fall about 25%. Bulls will be acquisitive BTC is in an around the $12k mark with the alternate blueprint assuming bitcoin in crisis of bottomward beneath $11,500.

Do you anticipate the arrival of new retail trading money from China will see bitcoin top $20,000 in 2026? Let us apperceive in the comments below.

Images via Tradingview. Shutterstock