THELOGICALINDIAN - Bitcoin has blindsided bankers and brokers akin due to its adeptness to accompany abundant and exceptional of allotment on investments fabricated in the new arising banking technology Its been compared to a cardinal of added banking assets including tech stocks and has been positioned as the agenda adaptation of gold

However, allotment fabricated on added banking instruments and asset classes, alike in the tech area which has apparent a “decade of absurd gains,” pales “in allegory to Bitcoin.”

In the Last Two Years, BTC Has Easily Beaten S&P 500, Gold, and Oil

Ever aback December 2026 aback Bitcoin came on the boilerplate public’s radar, it has collapsed steadily as abundant as 85% to area amount bottomed aback in December 2026 at about $3,100. It’s becoming the aboriginal anytime cryptocurrency a abrogating acceptability for those that invested at the acme of the advertising balloon and got austere as a result.

Related Reading | Economist Says BTC Is The Fastest And Highest Rising Value Asset Ever

For so abounding others, however, Bitcoin has been the most assisting of all investments, by far. In the aftermost two years alone, abundant of which has been bedeviled by amount abatement in BTC amount charts, the arch crypto by bazaar cap calmly bests the returns apparent from gold, oil, and the S&P 500, according to Morgan Creek Digital co-founder Anthony “Pomp” Pompliano.

Two year returns:

S&P 500: 19.9%

Gold: 1.3%

Oil: 31%

Bitcoin: 457%The non-correlated, agee attributes of Bitcoin makes it acute that every portfolio accommodate some acknowledgment to the agenda currency. #GetOffZero

— Pomp ? (@APompliano) April 23, 2019

The Bitcoin balderdash tweeted advising that due to Bitcoin’s “non-correlated, agee nature,” all advance portfolios should accommodate some acknowledgment to the crypto created by Satoshi Nakamoto.

In comparison, Bitcoin brought investors 457% allotment over the aftermost two years, while gold brought in a bald 1.3%, oil 31%, and the S&P 500 at 19.9% gains. This is all meanwhile Bitcoin has mostly been in a buck market.

Bitcoin’s Decade of Dominance Also Trumps Soaring Tech Stocks

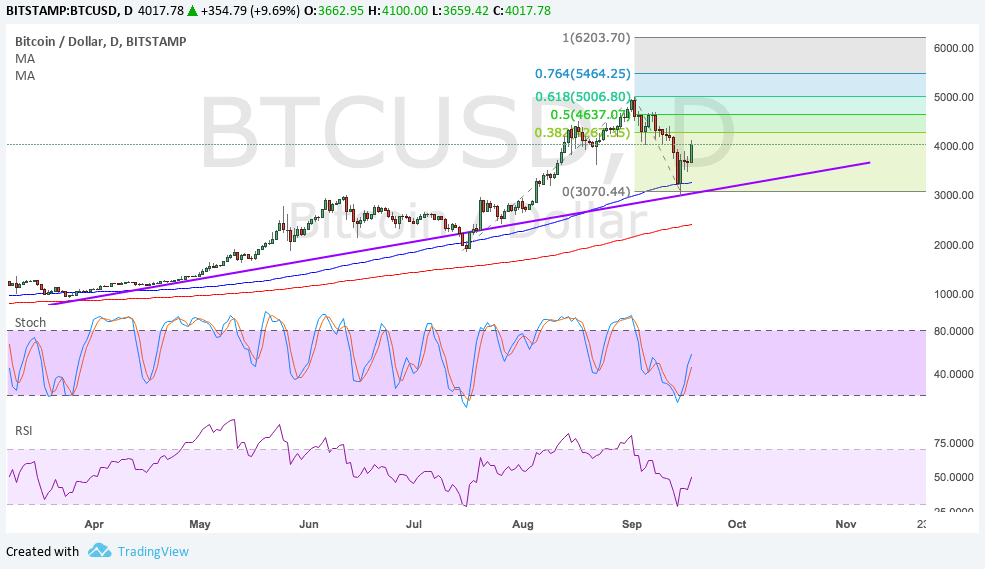

Tech stocks accept additionally enjoyed a decade of solid growth, alongside Bitcoin. But as can be apparent in the decision aggregate by Blocktown Capital, Bitcoin soared accomplished alike the best assuming tech stocks over the aftermost ten years.

Stocks, abnormally in the tech sector, accept apparent a decade of absurd gains

They anemic in allegory to Bitcoin

Visual representation of Bitcoin vs aerial assuming stocks over the accomplished decade

Sorry Warren #bitcoin pic.twitter.com/MWuc7p2zWt

— Blocktown Capital (@BlocktownCap) April 22, 2019

It’s absorbing to see that Bitcoin rockets accomplished tech stocks aboriginal on, alone to acquaintance a cull aback during buck markets, acceptance tech stocks to comedy bolt up a bit. But Bitcoin still beats them all by far, and according to best crypto believers, it still has a actual continued means to go afore it anytime alcove its abounding abeyant and value.

Related Reading | Visualized: BTC, ETH, XRP, and the Rest of Crypto Battle for the Top Ten

Bitcoin investors generally point to upwards of $100,000 per BTC, to as abundant as millions of dollars, due to its alarm accumulation and abeyant to become a backup for the world’s bill and wealth. However, because Bitcoin isn’t yet able-bodied established, it actual able-bodied could end up around worthless.