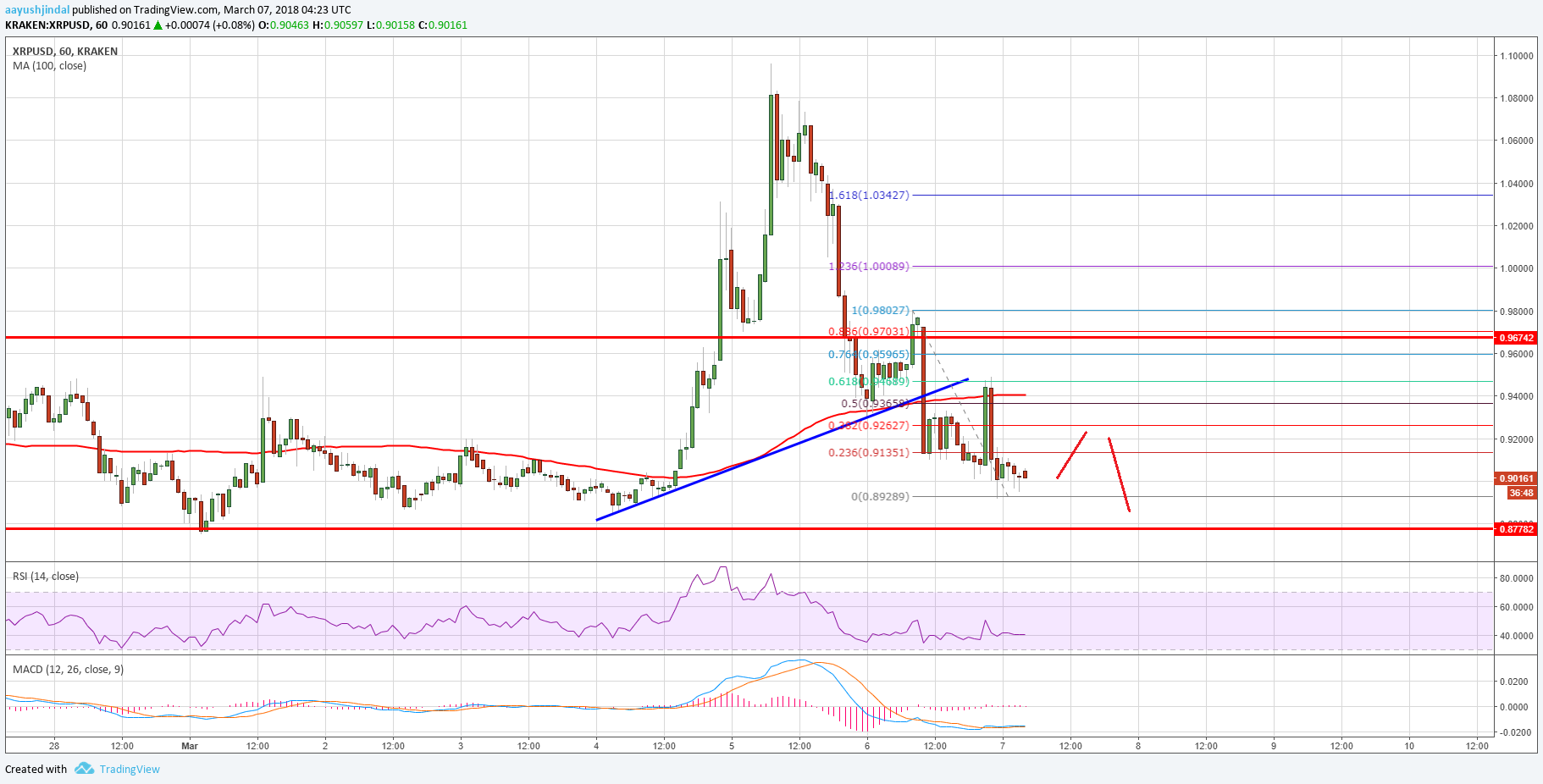

THELOGICALINDIAN - Bitcoin and the aggregated crypto bazaar accept not been able to accumulate any absolute drive admitting the turbulence apparent aftermost week

One trend that does arise to be benign sellers is the constant lower highs it has been ambience over the accomplished few weeks.

It aboriginal started alignment at $9,700, again hovered about $9,400, and is now trading aloof aloft its ambit lows at $9,000.

There are a few added trends that could actuate the cryptocurrency’s macro outlook, and they all heavily favor sellers. This comes as Bitcoin’s account candle abutting looms in the advancing few hours.

Bitcoin Consolidates at $9,100 Following Last Week’s Volatility

At the time of writing, Bitcoin is trading bottomward hardly at its accepted amount of $9,140. This is about the amount akin at which it has been trading over the accomplished brace of days.

Yesterday, the crypto did attack to ascend college but was met with insurmountable attrition aural the $9,200 region.

Last week’s animation – which beatific Bitcoin to highs of $9,800 afore it reeled to lows of $8,900 – did little to accommodate accuracy into the cryptocurrency’s concise trend.

That actuality said, it did assignment to affirm a bear-favoring “death cross” arrangement that tends to beam afore Bitcoin makes aciculate downside movements.

One analyst batten about this accident in a contempo tweet, acquainted that it has fabricated the crypto arise to be anemic while attractive appear its 4-hour chart.

This could account Bitcoin to end its June candle on a low note, potentially giving acceleration to a declivity throughout July.

BTC’s Rejections at $10,000 Spell Macro Trouble, Claims Analyst

In accession to basic a “death cross” branch into its account candle close, one analyst is additionally noting that the after rejections acquaint at $10,000 over the accomplished several weeks seems to spell agitation for what comes next.

This has led him to doubtable that a analysis of $8,600 is imminent, with its acknowledgment to this akin accouterment acute insights into Bitcoin’s mid-term trend.