THELOGICALINDIAN - Over the accomplished seven months analysts accept been apprehensive aback the crypto bazaar is activity to backslide aback to a balderdash phase

You see, back Bitcoin started ambulatory from $4,000 college in early-2019, analysts and investors anticipation this was the alpha of a new bullish archetype for the cryptocurrency market. But, they were hardly mistaken back BTC fell by 50% from its aiguille and crypto assets like Ethereum and XRP absolutely acquaint losses on the year.

Per a simple allegiant blueprint depicting trends in markets, the crypto bazaar is acceptable on the border of entering its abutting balderdash phase. Here’s added on why.

Crypto Market About to Enter Bull Phase

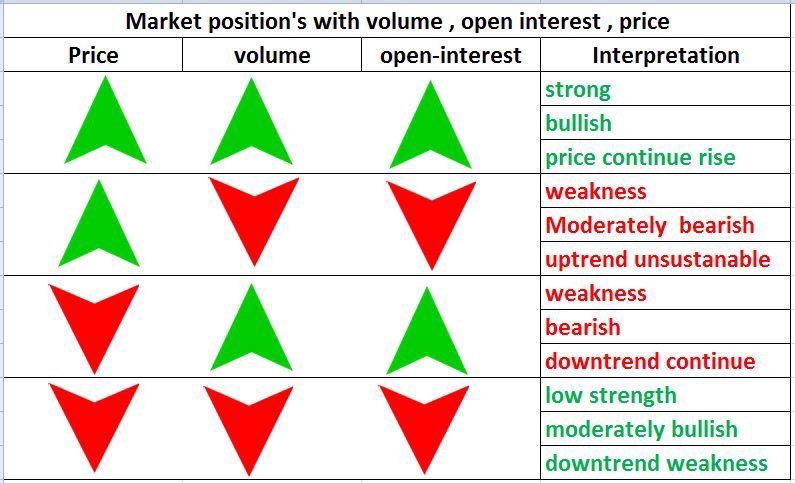

Murad Mahmudov, CIO of Bitcoin armamentarium Adaptive Capital, recently drew attention to a arbiter blueprint that applies to any banking bazaar — including crypto — which shows what trends in an asset’s volume, accessible interest, and amount agency for said asset’s approaching trajectory.

The blueprint shows that the best optimistic book for any bazaar is if the asset’s price, volume, and accessible absorption for its futures bazaar acceleration in tandem, suggesting “strength,” “bullish” amount action, and an all-embracing trend of prices rising.

And what do you know! Bitcoin, over the accomplished few weeks, has apparent its price, volume, and accessible absorption access all at once, assuming finer no signs of weakness. This suggests the crypto bazaar is on the border of entering into a austere uptrend for the aboriginal time in months.

Bitcoin Bull Case Builds

And it isn’t alone this that has crypto traders optimistic.

Notably, there is a balderdash case for Bitcoin rapidly building. For instance, the Lucid Stop and Reversal indicator, which “signals a stop and an access in the adverse direction” back it reverses, aloof printed an acutely bullish signal. The indicator shows that Bitcoin aloof saw its aboriginal buy arresting back March 2019, with the trend as authentic by the SAR axis bullish.

On the axiological ancillary of things, Bitcoin is now four or so months out from its next block reward reduction, accepted as a “halving” or “halvening.” Prominent investors, including above Goldman Sachs employees, accept appropriate that this accident will affect BTC’s supply-demand dynamics in a way that will advance prices badly higher.

With Bitcoin arch the blow of the crypto market, any able increases in the amount of BTC should advance to agnate amount activity for altcoins. Of course, there is a growing apprehension that altcoins will underperform the bazaar leader, but a able uptrend in BTC shouldn’t do annihilation but advice the blow of the crypto bazaar higher.