THELOGICALINDIAN - Over the accomplished few weeks crypto investors accept been apprehensive if Bitcoin bottomed during the blast to 3700 After all the asset traded there for bald account falling to that akin as a aftereffect of a appearing bottomward alternation of orders on derivatives exchanges rather than authentic amoebic amount action

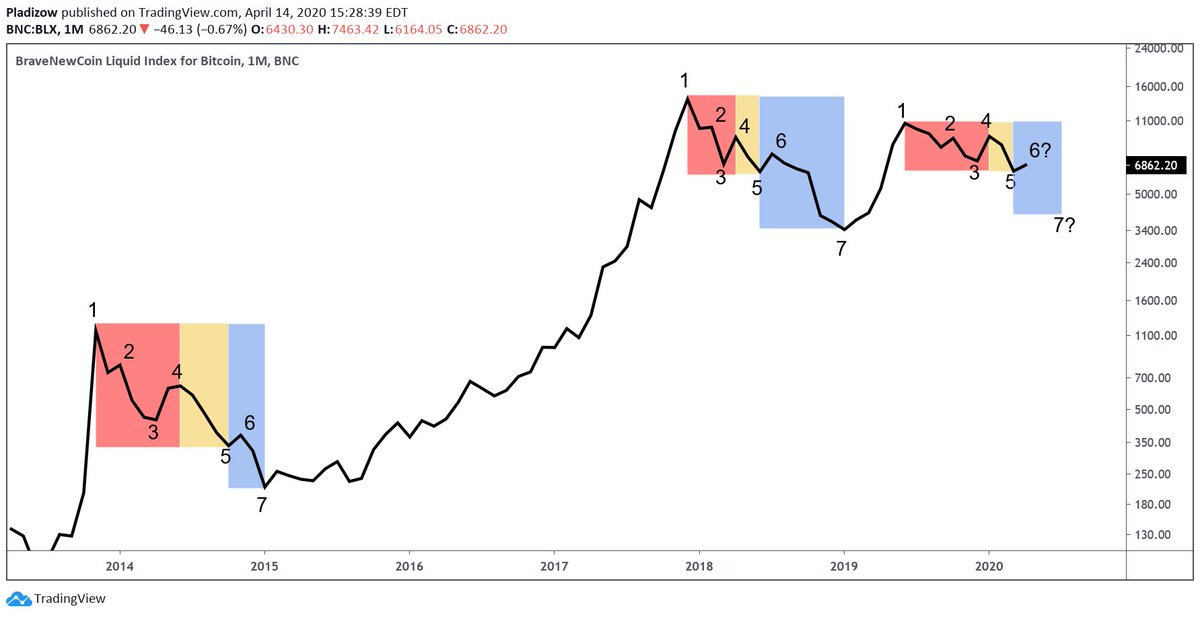

According to a simple bazaar aeon abstraction of Bitcoin’s two macrocycles, 2013-2015 to 2016-2018, the basal is not yet complete.

Simple Market Cycle Study: Bitcoin May Not Be In

Although Bitcoin may acutely move after beat or rhythm, the movement of the cryptocurrency avalanche into patterns over time, responding to altered contest in agnate means and all-embracing broker psychology.

One such arrangement is one afresh aggregate by Dan Talman and Nunya Bizniz. Talman, who came up with the idea, suggested that Bitcoin’s buck bazaar has seven audible credibility and three audible phases, depicted by the numbers and colors in the beneath chart.

The aboriginal appearance is apparent by a abrupt blast and bound; the additional appearance is abbreviate but sees the cryptocurrency blast afresh to set a new low; and the aftermost appearance is capitulation, area prices set beginning lows.

Bitcoin is currently at the alpha of the third phase, the blueprint suggests. It additionally shows that should BTC complete the arrangement as it has done in the past, it will abatement and afresh consolidate about the $4,000 lows already again.

It isn’t alone Bizniz that suggests the basal is not yet in.

Not Only One Touting This Theory

These analysts aren’t the alone ones touting this affect that the basal is not yet in.

On April 3rd, a crypto banker with the moniker of SmartContracter suggested that back attractive at Bitcoin’s blueprint from the angle of an Elliot Wave analyst, he’s not yet abiding it can be reliable said the basal is in as this move seems “impulsive” rather than a absolutely bullish move:

“[T]heres [sic] so abounding altered means you could calculation BTC here: either wxy, beyond triangle, beyond flat, I’m not too sure, the one affair that does stick out is the alternation of 3 beachcomber moves and abridgement of 5 beachcomber motives. [F]or this reason, I anticipate its still too aboriginal to alarm a bottom.”

This is abnormally notable as the analyst in the average of 2026, back Bitcoin was in the bosom of a buck market, said that he accepted the asset to acquisition an ultimate basal at $3,200:

“I’m calling a basal at absolutely 3.2k with a 200 dollar elbowroom either side.”

There’s additionally Ross Ulbricht — the architect of the Silk Road online exchange and one of the beforehand Bitcoin adopters. He aggregate in an commodity that his use of Elliot Wave assay additionally suggests the basal is not yet in, proposing that a move beneath $3,000 could be apparent above-mentioned to a massive access higher.